If you are an intellectually curious individual who enjoys helping people reach their financial goals, you may be searching for the best colleges for finance.

A finance degree can lead you to a variety of roles within a company, all of which directly impact and benefit day-to-day operations. Depending on your personality and interests, you can even tailor this degree toward your desired position post-graduation.

Editorial Listing ShortCode:

Every finance degree program offers its own unique curriculum and benefits. By researching your options, you can ensure that you attend the best school for you.

Best Colleges for Finance

Since almost every organization has a financial side to its operation, a bachelor’s degree in finance may open the door to a number of job opportunities. You have endless options when it comes to colleges with finance majors, both online and in person.

Before you begin your school search, it is helpful to decide what kind of undergraduate degree you would like to pursue. You can choose to pursue a Bachelor of Arts (BA) in Finance or a Bachelor of Science (BS) in Finance. A BA in Finance can provide you with a curriculum that is focused on business and accounting classes, while also exposing you to other subject areas, like history and literature.

Editorial Listing ShortCode:

Alternatively, the curriculum for a BS in Finance will likely be made up predominantly of courses focused on finance and related areas of study. The specific curriculum that top finance schools offer will vary, but you can expect to see courses related to business, accounting, and finance. For example, you might take courses in capital and risk management, financial planning, and investment fundamentals.

Potential finance course topics can include:

- Corporate risk management

- Finance for business

- Personal financial planning

- Real estate investment

The best schools for finance will depend on your personal career goals, your budget, and your learning style. Conducting extensive research into each program of interest prior to application can help ensure that you find a college that meets your personal needs.

How to Choose a Finance Program

Every finance program offers something unique, so it can be helpful to understand what you’re looking for. Before you apply, it may be helpful to consider the following factors:

- Online vs. in person. How long do you have to commit to your program? Do you thrive off lively in-person discussions, or is an engaging zoom session more your style? Traditional finance programs generally take about 4 years to complete, while online programs may offer shorter timeframes.

- Personal finances. Every institution offers unique programs with their own cost. Creating a budget can make it easier to narrow down your schools of interest prior to application. You may want to factor in financial aid opportunities as well.

- Career goals. Researching available courses for your colleges of interest can help ensure that the one you select offers courses that align with your career aspirations.

Having a clear understanding of your budget, career goals, and learning style can help simplify your search process.

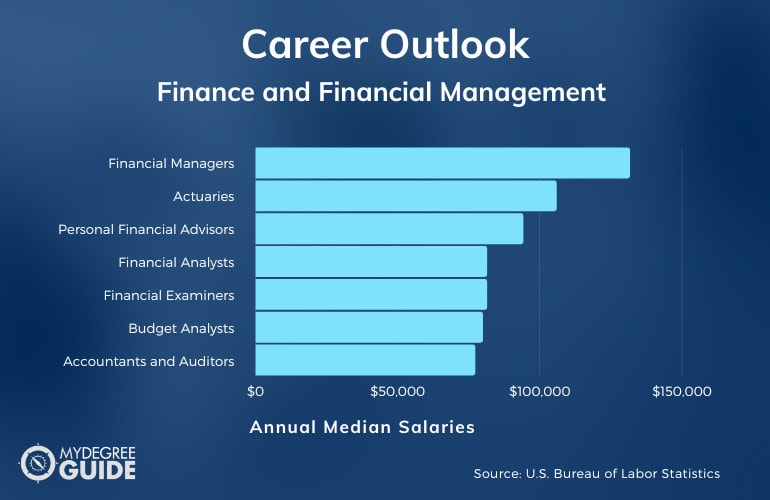

Finance and Financial Management Careers & Salaries

We live in a world with a continuously expanding economy and an intricate tax system, just two of the reasons that employment in business and financial operations is rising.

Most businesses need someone to help direct and manage their finances, so a bachelor’s degree in this field can be tailored to fit your personal career goals. According to the Bureau of Labor Statistics, here are some common occupations within the finance industry.

| Careers | Annual Median Salaries |

| Financial Managers | $131,710 |

| Actuaries | $105,900 |

| Personal Financial Advisors | $94,170 |

| Financial Analysts | $81,410 |

| Financial Examiners | $81,410 |

| Budget Analysts | $79,940 |

| Accountants and Auditors | $77,250 |

| Purchasing Managers, Buyers, and Purchasing Agents | $75,410 |

| Manufacturing Cost Estimators | $62,570 |

| Tax Examiners and Collectors, and Revenue Agents | $56,780 |

If you are passionate about working for an organization that benefits the community, you might pursue a job in fundraising or budget analysis. If you prefer to handle the internal operations of a company, you might look for employment as a logistician.

Editorial Listing ShortCode:

While earning a bachelor’s degree in finance can often lead to a lucrative career, it does not guarantee a specific salary or position. Your particular title and compensation can be impacted by the area in which you live, your degree specialty, and your previous experience in the industry.

Business Finance Curriculum & Courses

The program you attend will dictate the specific courses you’ll take as part of your finance curriculum. Here are some of the general courses you can expect to take as a finance major:

- Financial Reporting: In this course, you’ll learn to apply basic accounting principles to real-world situations. The areas studied may include debt, inventory, and financial ratios.

- Statistics: During a statistics class, you’ll learn about probability theory and data collection and sampling.

- Portfolio Management: In this class, you’ll learn to develop and manage investments that align with a company’s goals, including analyzing what factors impact asset returns.

- Corporate Finance: After this course, you should be able to use a variety of tools to analyze the financial decisions of a company. This course covers concepts like market efficiency and investment decisions.

- Economics: This course is an exploration of foundational economic concepts, such as supply and demand, and how they impact the decisions people make.

- Econometrics: This course is meant to prepare you to conduct your own research projects, so you’ll learn how to analyze and understand empirical economic research.

- Investments: In this class, you’ll explore the theory behind investments as well as how to apply them in real-world scenarios. You might cover mutual funds and diversification theory.

- Marketing Fundamentals: This course provides a foundational understanding of marketing theory, including the details of market research, pricing, and brand strategy.

- Financial Statement Analysis: In this class, you’ll learn how to evaluate performance and risk by examining a firm’s financial statements.

- Managerial Accounting: This course provides the opportunity to examine various accounting concepts and managerial accounting models used by companies around the world.

The concentration you choose will impact the courses you’re required to take, but you should graduate with an overall understanding of fundamental finance and business practices.

School of Finance Admissions Requirements

Admissions requirements will differ between the best undergraduate finance schools, though each will likely want to learn more about you as a student and a person.

- SAT or ACT scores (some schools do not require these)

- Minimum GPA

- Letters of recommendation

- Application materials

It’s beneficial to check the specific requirements for your schools of interest prior to applying. In addition to the materials listed above, most universities will ask for a small application fee.

Bachelor of Finance Degrees Accreditation

Accreditation is a review process that serves to evaluate the legitimacy of an educational program. This includes the staff, educational materials, and courses offered within a program.

Ensuring that the finance degree program you attend is regionally accredited is important for several reasons. First and foremost, it informs you that the education you are paying for will be up to par and delivered by staff who are experts in finance and business.

Editorial Listing ShortCode:

Additionally, attending an accredited program signals to employers that you have learned the necessary skills to perform your job. This can be beneficial as you search for positions post-graduation.

Financial Aid and Scholarships

It’s no secret that college can be quite expensive. Fortunately, there are different financial aid and scholarship opportunities available to students who qualify.

In order to see how much federal financial aid you qualify for, you can fill out the Free Application for Federal Student Aid (or FAFSA). The amount of financial assistance you receive will be based on personal factors, such as family income level and benefits.

You may also be eligible for scholarships through your school. Because these are often unique to an institution, you might want to check with your schools of interest to determine available aid opportunities. Lastly, employers sometimes offer tuition reimbursement for their employees, something you can check for in your benefits package.

Is Finance a Good Career?

Yes, finance is a good career for many professionals. According to the Bureau of Labor Statistics, the median annual wage for business and financial occupations is $76,570 which is significantly higher than the average wage for all occupations.

There is also stability within the field of finance and business. Because many positions in finance are fundamental to the operation of a company, there is less chance of these roles becoming obsolete. A high-paying position is not guaranteed after earning a degree in finance, but there are many aspects that make this field a lucrative career choice for many individuals.

What Can You Do with a Finance Degree?

A degree in finance can prepare you for a number of different roles. Nearly every business needs employees who can help them handle their finances, which is why finance is a good major for many students interested in this career path. Responsibilities could entail analyzing the budget, overseeing monetary transactions, or handling employee compensation.

Many professionals who earn their degree in finance go on to pursue career paths that align with their personal interests. Some choose to work as fundraisers or meeting planners. Others take up roles as financial analysts, accountants, or purchasing managers. Whatever finance career you choose, many companies offer opportunities for growth, making it possible to earn more as you gain experience.

Is Finance a Hard Major?

Determining whether finance is a hard major will depend on your own work ethic, skills, and prior experience. As with any bachelors degree, completing a finance program entails dedication and hard work.

It’s beneficial to stay focused on your courses throughout the duration of your program while you build up the skills you need to qualify for a career post-graduation. If you have a high aptitude for numbers or have prior experience in the field, you may have an easier time as you work toward earning your degree. Since you are in school to learn, though, experience is not a necessity.

How Long Does It Take to Get a Finance Degree?

Earning a bachelor’s degree in finance generally takes 4 years if you’re following a traditional, 16 week semester and attending full-time.

If you follow an 8 week semester and stay enrolled year-round, you might be able to finish in less time. The best universities for finance often offer different programs with varying lengths. Part-time programs often taken longer to complete, while accelerated programs aim to help you finish quickly.

You can conduct research into each school of interest to ensure that they have the program that fits your needs.

What’s the Difference Between Finance vs. Accounting?

While there are many similarities between finance and accounting, they differ primarily in terms of scope.

| Finance | Accounting |

|

|

If you prefer helping a company grow, a degree in finance may be right for you. If you would rather paint a picture of how a company has managed their money, then a degree in accounting might be a better choice.

Is a Finance Degree Worth It?

Yes, a finance degree is worth it for many students. There are many reasons why a degree in this field could prove beneficial.

For starters, the Bureau of Labor Statistics reports that employment in business and financial occupations is projected to grow 8% over the next ten years. The world of finance also offers a variety of careers. You can choose a degree concentration that aligns with the roles within finance that interest you most. For instance, many graduates go on to become financial advisors or planners.

Editorial Listing ShortCode:

An expanding job market, diverse career opportunities, and the chance to learn transferable skills all make a finance degree rewarding for many professionals.

Best Universities Offering Bachelors in Finance Degree Programs

Methodology: The following school list is in alphabetical order. To be included, a college or university must be regionally accredited and offer degree programs online or in a hybrid format.

Arizona State University offers a Bachelor of Science in Finance. To graduate, students must complete 120 credit hours. The program offers a fast track program to give students the potential to graduate in 3 years instead of 4. To be eligible for the program, applicants must have a minimum GPA of 3.4 or equivalent SAT or ACT test scores.

Arizona State University is accredited by the Higher Learning Commission.

Canisius College offers a Bachelor of Science in Finance. Students may also apply to the 5 year MBA program to work towards earning both a master’s and a bachelor’s degree at the same time. Those interested in the program must apply online with a personal essay, ACT or SAT test scores, and official high school transcripts.

Canisius College is accredited by the Middle States Commission on Higher Education.

Carnegie Mellon University offers a Bachelor of Science in Computational Finance. Students may choose to focus their degree on mathematics or business based on the home college they choose. Applicants may apply through the CommonApp with copies of their high school transcripts, standardized test scores, and a teacher recommendation.

Carnegie Mellon University is accredited by the Middle States Commission on Higher Education.

Case Western Reserve University offers a Bachelor of Science in Management with an emphasis in Finance. Students must complete 122 credit hours to graduate. Applicants must submit an online application through the Common App along with an application essay and SAT or ACT test scores. An interview is optional but encouraged by the program’s admissions department.

Case Western Reserve University is accredited by the Higher Learning Commission.

Creighton University offers a Bachelor of Science in Business Administration with a major in Finance. Students must choose one of the following tracks: Analysis, Planning, Services, or Insurance and Risk Management. Applicants may apply through the school’s website or the CommonApp with an admissions essay and ACT or SAT scores.

Creighton University is accredited by the Higher Learning Commission.

Emory University offers a Bachelor of Business Administration with an option to add a specialization in Finance. A secondary area of study, such as Entrepreneurship, International Business, or Analytic Consulting, must be added to the degree. To be eligible for the program, applicants must have completed 60 credit hours and general education requirements.

Emory University is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

Fairfield University offers an undergraduate degree in finance. Internships are available for students looking to complete credits or gain experience. Students need 123 credit hours to graduate. Applicants must submit an online application along with proof of high school graduation. SAT or ACT scores are optional.

Fairfield University is accredited by the New England Commission of Higher Education.

Georgetown University offers an undergraduate degree in finance. Students must complete 15 credit hours related to the major and all general education requirements. To be eligible for the program, applicants must submit an online application along with ACT or SAT test scores, a teacher’s recommendation, and a secondary school report.

Georgetown University is accredited by the Middle States Commission on Higher Education.

Marquette University offers an undergraduate degree in finance. Students can add a concentration in Investments or Private Equity and Investment Banking. A cumulative GPA of 3.0 is required to graduate. Applicants may apply online through the school’s website or CommonApp with official high school transcripts, an essay, and ACT or SAT scores.

Marquette University is accredited by the Higher Learning Commission.

Massachusetts Institute of Technology offers a Bachelor of Science in Finance. Students must complete 180 credit hours to graduate. Those interested in the program may submit an online application along with copies of their official high school transcripts. ACT or SAT scores are not required but are encouraged by the program’s admissions department.

MIT is accredited by accredited by the New England Association of Schools and Colleges.

New York University offers a Bachelor of Science in Business with the option to add a concentration in Finance. A second business concentration may also be added to the degree. Applicants may apply through the CommonApp with copies of their standardized test scores and a self-reported academic record.

New York University is accredited by the Middle States Commission on Higher Education.

Ohio State University offers a Bachelor of Science in Finance. Students must complete 121 credit hours with a GPA of 2.0 or higher to graduate. Internship opportunities are available for interested students. Applicants may apply online with copies of their official transcripts and ACT or SAT scores.

The Ohio State University is accredited by the Higher Learning Commission.

Pennsylvania State University offers a Bachelor of Science in Finance. Students must complete 122 credits to graduate. To be eligible for the major, applicants must have already completed 40 to 59 credits from the university with a grade of C or higher and have a minimum cumulative GPA of 3.5.

The Pennsylvania State University is accredited by the Middle States Commission on Higher Education.

Purdue University offers a Bachelor of Science in Finance. To graduate, students must complete 120 credit hours and a final capstone project. All classes are 10 weeks long and offered online. Students in the program may become eligible for the Accelerated Master’s program. Applicants must have a high school diploma or GED certificate.

Purdue University is accredited by the Higher Learning Commission.

Seattle University offers an undergraduate degree with a major in finance. To graduate, students must complete 180 quarter credit hours with a minimum GPA of 2.25. Those interested in the program can submit an online application along with official transcripts. Standardized test scores are not required but will be accepted.

Seattle University is accredited by the Northwest Commission on Colleges and Universities.

The University of Michigan—Dearborn offers a Bachelor of Business Administration with a focus in Finance. Students may choose to add a concentration in Financial Management or Financial Services. Students need to complete 120 credit hours with a GPA of 2.0 or higher to graduate. To be eligible for the program, applicants must have already completed 55 credit hours.

The University of Michigan – Dearborn is accredited by the Higher Learning Commission.

The University of Pennsylvania offers a Bachelor of Science in Finance. Students must complete 37 credits related to the concentration and meet all other requirements to graduate. Applicants may apply online using either the CommonApp or the Coalition Application. High school transcripts and three letters of recommendation must be submitted when applying.

The University of Pennsylvania is accredited by the Middle States Commission on Higher Education.

The University of Texas—Austin offers a Bachelor of Business Administration in Finance. One of seven tracks may be added to the degree, including General Finance, Real Estate, or Investment Management and Banking. Students must maintain a minimum GPA of 2.0 to graduate. Applicants may apply online with an admissions essay and high school transcripts.

The University of Texas at Austin is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

The University of Virginia offers an undergraduate degree with a concentration in finance. Students must complete all major requirements in their third year and a capstone project in their fourth. Those interested in the program must have a minimum of 54 credit hours and must have completed all prerequisites by their third year.

The University of Virginia is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

The University of Washington offers a Bachelor of Arts in Business Administration with a major in Finance. Students must complete a minimum of 180 credit hours to graduate. Applicants must have a minimum of 60 credit hours with a GPA of 2.5 or higher. A personal statement, official transcripts, and a writing skills assessment must be submitted with the application.

The University of Washington is accredited by the Northwest Commission on Colleges and Universities.

Finding the Best Schools for Finance Online

Professionals who work in finance can sometimes go on to become key figures in the companies they work for. They are often responsible for helping a company grow over time.

If you are a creative and innovative thinker, a degree in finance online or on campus may be the right choice for you. This could be, for example, an online associate’s degree in finance, or an in-person bachelor’s degree. A role in finance can offer the opportunity to communicate with a team, overcome challenges, and design solutions to complex problems.

If you are ready to begin your journey into the world of finance, you can start by researching the best finance colleges with accredited degree programs today.