An online accounting certificate program can help you gain essential training for a job in business or finance. If your goal is to work in accounting, you may be able to quickly launch your career with a certificate program.

These programs focus on the necessary knowledge and skills required for entry-level accounting professionals.

Editorial Listing ShortCode:

If numbers, financial records, and bookkeeping appeal to you, then you may want to consider how a certificate program could help you get your start in accounting.

Accounting Certificate Programs Online

Do you have to enroll in school for 4 years before you’ll be able to start a career in the accounting field? Not necessarily. Accounting certificate programs offer undergraduate courses that can get you started on this job path without a long-term commitment to going to school.

Certificate programs focus on essential topics for professionals entering the accounting field. The lessons may cover:

- Business math

- Cost accounting

- Finance

- Financial accounting

- Managerial accounting

- Office software

- Taxation

Undergraduate accounting certificate programs are available for students at two different levels. Some are for students who don’t yet have degrees in any field. These programs provide entry-level training for the workforce.

If you get an online certificate in accounting from an accredited college, those credits may later transfer into a bachelor’s program.

Editorial Listing ShortCode:

Other undergraduate certificate programs are intended for students who have earned bachelor’s degrees in different fields. Getting a post-baccalaureate certificate could help you make the switch to a new career path.

Some schools expressly design their programs to fit one of these molds or the other. In other cases, a certificate program may be flexible enough to work for either group of students.

If you pursue a certificate program in accounting, the courses could help you qualify for entry-level jobs in this field. Examples of entry-level accounting roles include bookkeeper, accounting clerk, and billing clerk. In some settings, a certificate may also qualify professionals to work as accountants, auditors, or loan officers.

Accounting Careers and Salaries

How can you get your start in the accounting field? Many start out as clerks. There are a variety of clerking roles that may be a good fit for people with accounting certificates.

For example, some people with this certificate work as payroll, timekeeping, billing, or financial clerks in offices. Others become accounting clerks or bookkeepers who maintain records of businesses’ transactions. Accounting assistants may do similar tasks.

Working as a tax preparer is another job that doesn’t necessarily require an on campus or online accounting degree. Tax preparers may assist individuals or businesses with their taxation obligations. In some cases, government taxation agencies hire people with certificates.

A bachelor’s degree in accounting isn’t always needed for becoming a tax collector or examiner.

According to the Bureau of Labor Statistics, the business and financial sector, which employs many accounting professionals, is expected to have an 8% growth rate over the next decade.

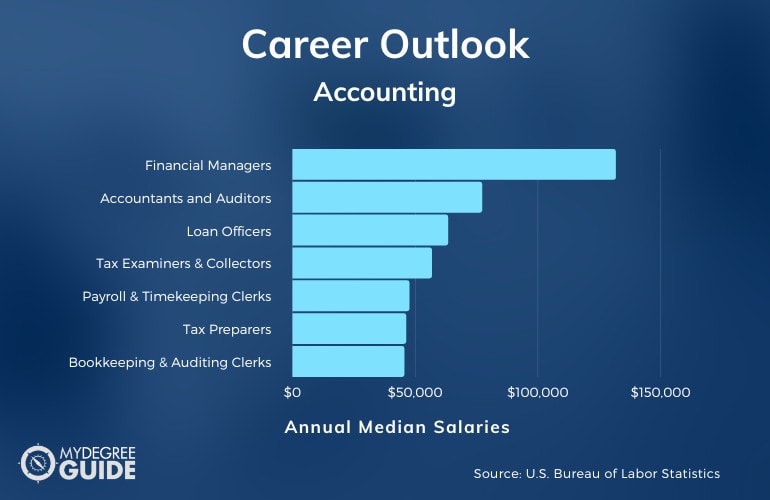

| Careers | Annual Median Salaries |

| Financial Managers | $131,710 |

| Accountants and Auditors | $77,250 |

| Loan Officers | $63,380 |

| Tax Examiners and Collectors, and Revenue Agents | $56,780 |

| Payroll and Timekeeping Clerks | $47,610 |

| Tax Preparers | $46,290 |

| Bookkeeping, Accounting, and Auditing Clerks | $45,560 |

| Financial Clerks | $44,760 |

| Billing and Posting Clerks | $38,330 |

| Bill and Account Collectors | $37,700 |

Hiring qualifications for jobs like these vary among employers.

Becoming an accountant is a popular career path for professionals in this field. It’s common for accountants to have at least a bachelor’s degree, but it’s not always necessary. Some companies will hire people with less training, especially if they already have related work experience.

It’s a similar story for loan officers. A degree in a relevant field, such as accounting, may help you qualify for such a position. If you have banking or other financial experience, you might be hired even if you don’t have a bachelor’s degree.

Editorial Listing ShortCode:

Not all accounting-related jobs are available without formal college training, though. Most states require people to have at least a bachelor’s degree before taking the certified public accountant (CPA) exam. Some states require a master’s degree. In most states, though, there is often not a difference holding a degree in accounting vs finance as far as meeting requirements is concerned.

Some accounting jobs are open only to CPAs. That may be particularly true of jobs with high responsibility levels, such as working as a department manager.

Accounting Certificate Curriculum & Courses

Accounting certificate programs are comprised of courses on the fundamentals of accounting principles and practices. Online certificate programs vary in course requirements, but they often include 12 to 30 credit hours worth of classes.

Here are some common courses you may take:

- Algebra: This math course may not be a specific program requirement, but you may need to add it to your course lineup if you haven’t taken it at the college level before.

- Corporate Finance: While the focus of the certificate is on accounting, learning basic finance principles for the business world can serve you well in your career.

- Cost Accounting: To prepare you for work in many different business settings, this course teaches skills related to budgeting and pricing.

- Federal Taxation: This class explores federal tax laws, provides practice in calculating tax payments, and gives an overview of various tax forms.

- Financial Accounting: This is an introductory course on financial accounting that can help you become familiar with various financial reports and measurement principles.

- Financial Analysis: The benefit of financial reports is the data that they can provide, and this course can help you learn to identify that information.

- Financial Reports: This class can give you the opportunity to examine real-world financial reports as you study the accounting cycle.

- Forensic Accounting: This branch of accounting involves analyzing financial documents for evidence of fraud.

- Intermediate Accounting: Most certificate programs include one or more of these courses in which you can study the basics of the accounting field, including many types of financial records.

- Management Accounting: This class focuses on how to use accounting information to make wise business decisions.

There will probably be several required core classes, and you may get to select some electives as well.

How to Choose an Online Accounting Certificate Program

Accounting certificates can be earned on college campuses or online. If you’re interested in an online format, the following considerations can help you pick the right school for you:

- Accreditation. By selecting a college with regional accreditation, you’ll boost the chances of your coursework being recognized by employers or other schools.

- Credits and curriculum. Accounting programs are often fairly similar in what they teach, but it can still be worthwhile to review how many classes are required and what topics will be covered.

- Intended students. Your previous college experience will determine whether you should choose a program for students without degrees or a post-baccalaureate program. Some schools’ programs work for either group.

- Online format. If you’re interested in the speedy nature of earning a certificate, then you might appreciate colleges that have year-round terms, each lasting only a month or two. For those who need flexibility, asynchronous courses can be beneficial.

- Transfer options. It can be strategic to have the option to transfer your coursework into a degree program. Some colleges specify that the certificate credits can be applied toward their accounting degrees.

Different students have different goals and preferences, so picking the right school is often a personal decision.

Admissions Requirements

Just like you would for a degree program, you’ll send in an application before beginning an accounting certificate program. The school may require you to submit the following when you apply:

- Application form

- Scores from the ACT or SAT (only required at some schools)

- Transcripts from high school and any college courses

- Writing sample or statement of purpose

For some programs, you may be required to take prerequisite college courses before enrollment. Certain programs may even require you to hold a bachelor’s degree.

Online Accounting Certificate Programs Accreditation

When you decide to earn a certificate in accounting, it’s strategic to choose to study at a regionally accredited school. That way, you can count on getting a top-quality education.

Accredited classes are more likely to count for transfer credit. That could be helpful if you want to pursue a bachelor’s degree someday. Accredited coursework may also count toward the CPA exam’s educational requirements.

Editorial Listing ShortCode:

Hiring committees often place more faith in regionally accredited classes. It could be beneficial to list an accredited school on your resume.

Financial Aid and Scholarships

Earning an accounting certificate is usually more affordable than getting a full college degree. Even still, you may want to explore your financial aid options. If you qualify, the Free Application for Federal Student Aid (FAFSA) could help you secure financial assistance from federal programs as well as state ones.

Many students qualify to take out loans to help pay for college classes. Government loans are sometimes more affordable than private ones because their interest rates are lower. Some students can receive government grant money too.

You can also look into different scholarship opportunities to help pay for school. Some scholarships are available directly through a college’s financial aid office. Others come from outside organizations, such as industry associations or philanthropic groups.

Some employers also want their workers to further their education. As a result, workplaces may offer tuition help.

What Can You Do with an Accounting Certificate?

Earning a certificate in accounting can help you qualify to work in various business or finance roles. Many get their starts as clerks or assistants. In such positions, you could be responsible for keeping records, sending invoices, tracking payments, or helping clients.

Being a tax preparer is another potential job for graduates. You might be especially busy during tax season as you help people submit their state and federal returns. In some cases, a certificate might qualify you to work as an accountant, especially if you have work experience or a bachelor’s degree in another field.

How Long Does It Take to Get an Online Accounting Certificate?

Accounting certificate programs vary in how many credit hours they require. For that reason, their lengths can vary too. They typically last between 10 and 18 months, though. Many programs take right around 1 year to complete.

Whether you go to school online or on campus can make a difference in the length of your studies. Online colleges often use accelerated schedules that feature shorter class terms. As a result, students may finish an online program in less time than it would take to do on-campus studies.

Can I Become an Accountant without a Degree?

It is possible to get a job in the accounting field without earning a degree. A certificate program could provide you with the introductory skills for getting started, and then you’d be able to advance your know-how on the job.

Entry-level positions that don’t typically require a degree include accounting clerks and tax preparers. Some employers prefer to hire accounting candidates with bachelor’s degrees, though. In most states, becoming a CPA requires at least a bachelor’s degree as well.

What Training Is Needed to Be an Accountant?

The typical path to becoming an accountant starts with getting a bachelor’s degree. Earning a bachelor’s can help you develop a solid accounting foundation that qualifies you for many jobs in the field as well as graduate studies or even an on-campus or an online graduate certificate in accounting.

Editorial Listing ShortCode:

Not everyone chooses that route, though. Some students earn an undergraduate accounting certificate or an associate degree instead. Those can be strategic, quicker, and lower-cost ways to gain entry-level knowledge about the accounting field.

You can also earn an accounting-specific certificate after getting a bachelor’s degree in another field.

What’s the Difference between an Accounting Certificate vs. Degree?

Should you go to college for a certificate in accounting or pursue a full degree? Knowing how these two options differ may help you decide.

| Certificate in Accounting | Bachelor’s Degree in Accounting |

|

|

A certificate is helpful for quick training in this field, but a degree program provides a more thorough and well-rounded education.

What’s the Difference between a Certificate vs. Certification in Accounting?

“Certificate” and “certification” sure sound alike, but these terms mean different things in the accounting world.

| Certificate | Certification |

|

|

While a certificate can help you launch your career, you’re more likely to pursue online accounting certifications as a working professional.

Is an Accounting Certificate Worth It?

Yes, an accounting certificate is worth it for many professionals. Accounting is a much-needed service for many individuals and businesses. A certificate program could help you quickly equip yourself with the fundamental skills needed for this field.

Editorial Listing ShortCode:

Accounting is also a growing field. The Bureau of Labor Statistics projects a 7% job growth for roles in accounting and auditing over the next ten years. For business jobs in general, the Bureau of Labor Statistics predicts an 8% growth rate.

Plus, the classes you take for a certificate may be a step toward future goals, such as a bachelor’s degree or CPA credentials.

Universities Offering Online Certificate in Accounting Programs

Methodology: The following school list is in alphabetical order. To be included, a college or university must be regionally accredited and offer degree programs online or in a hybrid format.

At the center of Colorado Christian University’s online certificate in accounting program is financial accounting in the corporate environment. The program focuses on the crafting of statements and budgets and understanding the process of the yearly tax cycle.

The degree consists of 12 credit hours, with each course lasting either 5 or 7 weeks.

Colorado Christian University is accredited by the Higher Learning Commission.

Midlands Technical College’s accounting certificate program is intended to be the ideal next step for students with an existing associate or bachelor’s degree in accounting. It also provides the option to continue on to the school’s full accounting degree once the certificate is obtained.

Full-time students can typically complete the certificate in 4 semesters, and part-time students can usually complete it in 7 semesters.

Midlands Technical College is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

Richmond Community College offers courses in everything from business ethics to financial accounting. The school is often an excellent fit for students with good communication, technical, and critical thinking skills.

The school’s accounting program consists of 66 to 69 credit hours completed over the course of two academic years. Graduates typically qualify for most entry-level accounting or finance jobs.

Richmond Community College is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

Seton Hill University offers a certificate in accounting program that is designed to be convenient for students in a variety of circumstances. Classes are held fully online and can often be finished in only 3 semesters.

Accepted students can expect to engage in coursework focused on budget management, key accounting software, and the analysis of financial statements.

Seton Hill University is accredited by the Middle States Commission on Higher Education.

The online accounting certificate program at Southern New Hampshire University is often a great fit for applicants looking to supplement their existing undergraduate or graduate degree. It is designed to give students the knowledge needed to stay current in the field and progress in their careers.

The undergraduate track consists of 18 credits, while the graduate track consists of 21 credits.

Southern New Hampshire University is accredited by the New England Commission of Higher Education.

Southwestern Community College offers a full host of certificates in accounting and finance, with either a general focus or a focus in bookkeeping, tax, or payroll. All tracks consist of five semesters, with between 9 and 16 credits per term. Graduates are typically qualified for most entry-level positions in the financial sector.

Southwestern Community College is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

The University of California—Berkeley offers an online certificate in accounting program. Because CPA requirements differ by state and shift frequently, it is designed to help students stay informed and qualified in their field.

The program can typically be completed in 2 years, though it is recommended by the school that students have an existing bachelor’s degree.

The University of California – Berkeley is accredited by the Western Association of Schools & Colleges.

Focused on the fundamentals of accounting, the University of Washington’s online certificate in accounting program is often an ideal choice for students preparing to take their CPA exams.

Students interested in the program need to complete 10 prerequisite credits. Once they are admitted to the program, the certificate consists of 26 credits that may be completed in one full-time quarter or three part-time quarters.

The University of Washington is accredited by the Northwest Commission on Colleges and Universities.

The certificate in accounting core concepts program at Wake Technical Community College can be completed through in-person, hybrid, or fully online formats. The program consists of 14 credits, with courses in writing within the discipline, managerial accounting, financial accounting, and business law.

Courses in the program are scheduled across two semesters.

Wake Technical Community College is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

Wayne Community College offers an online program for a certificate in bookkeeping and accounting that is an option for students with high school diplomas. The program covers key financial concepts and consists of 17 credits that may be spread across two semesters.

Wayne Community College is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

Getting Your Certificate in Accounting Online

Through an accounting certificate program, you can receive essential training for roles that involve financial records and reports. Because certificates require fewer courses than degrees, they can often help you break into the field more quickly.

Online programming is a strategic choice for many aspiring accounting students. With online classes from an accredited school, you can receive a quality education on a schedule that works for you. Online programs are often flexible enough to fit in alongside work and family responsibilities.

If you’re wanting to get started in the field of accounting, you can begin by exploring the many online options for accredited certificate programs.