You can expand your knowledge of business practices, economics, and investments with an online finance certificate.

Finance professionals help individuals and organizations manage money and make informed financial decisions. Many people develop expertise in one area of the field, such as portfolio management or personal finance.

Editorial Listing ShortCode:

Online finance certificates often take less time to complete than a degree program, so they can help students start or advance their careers quickly.

Online Finance Certificate Programs

Colleges and universities offer finance certificates at two levels: undergraduate and graduate. An undergraduate certificate typically qualifies students for entry-level finance jobs, while a graduate certificate prepares learners for mid-level or senior positions. Your educational background and professional goals can help you identify the right path.

Select the program that most interests you to jump to that section of the guide:

Exploring your options may help you determine which academic path is right for you.

Undergraduate Certificate in Finance

An undergraduate finance certificate introduces you to fundamental financial concepts and practices. You can study basic economic theories and learn how to use these ideas to make strategic business decisions.

You’ll also learn about laws and ethical standards that regulate the finance industry. Undergraduate financial certificate programs cover a wide range of topics to help you develop diverse knowledge and skill sets. Common course topics include accounting, financial institutions, investment and portfolio management, and principles of finance.

Editorial Listing ShortCode:

Some programs also require students to participate in internships to gain hands-on experience. This certificate can help prepare students for numerous entry-level careers in business and finance. Many graduates become financial analysts and use data to monitor organizations’ current and future financial performance.

Others pursue careers as junior accountants. These professionals manage taxes for individuals and corporations. Certificate holders may also secure finance-related jobs in education, healthcare, and other industries.

Graduate Certificate in Finance

If you’ve already earned a bachelor’s degree, you can enroll in an online graduate certificate program in finance. This certificate allows you to gain advanced financial expertise and skills.

Some programs offer concentrations in one area of the field, like financial technology and international finance. Graduate certificate programs cover more complex methods and theories. Coursework could cover advanced financial management, cost accounting, portfolio management, real estate market analysis, and security valuation.

Editorial Listing ShortCode:

A graduate certificate in finance can help qualify you for mid-level and management jobs. Some current professionals work as hedge fund managers and oversee individual clients’ investment portfolios. Others become senior auditors and check financial data and documents for accuracy.

Graduates can also pursue careers as senior financial analysts. These professionals oversee teams of finance workers and develop financial models for organizations. Some graduates can advance to top finance careers, like chief financial officer and chief executive officer.

Finance Careers & Salaries

Every industry needs skilled professionals to manage finances, mitigate risk, and grow assets. As a result, graduates with online finance certificates can qualify for a broad range of careers in many sectors.

Graduates often secure positions with financial institutions like banks, credit unions, and investment firms. For example, banks hire financial specialists to work as credit analysts. These professionals review loan applications and perform risk assessments.

Similarly, finance graduates can work as fund managers or portfolio managers for investment firms. These experts make strategic investment decisions for corporations or private clients. Businesses also hire finance professionals to manage resources and increase revenue.

Corporate accountants generate financial reports and ensure compliance with tax regulations. Additionally, some graduates work in human resources departments as benefits managers. These specialists select and administer employee health insurance plans, pensions, and other benefits programs.

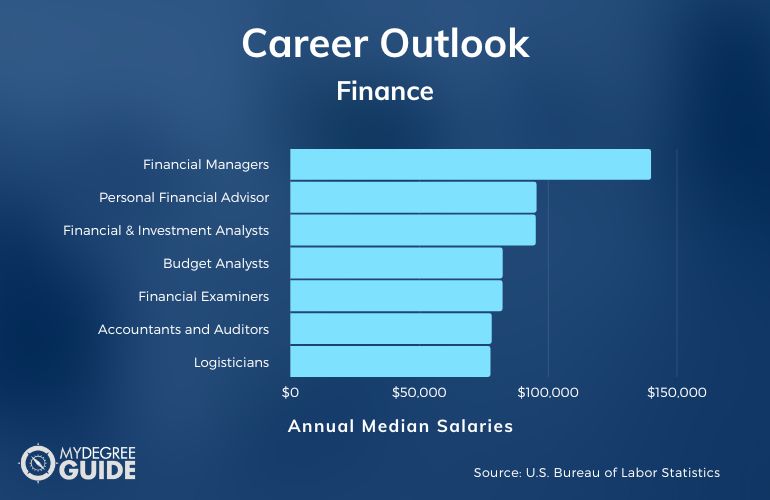

According to the Bureau of Labor Statistics, here are the median salaries of several jobs where a finance certificate could be an asset.

| Careers | Annual Median Salaries |

| Financial Managers | $139,790 |

| Personal Financial Advisors | $95,390 |

| Financial and Investment Analysts | $95,080 |

| Budget Analysts | $82,260 |

| Financial Examiners | $82,210 |

| Accountants and Auditors | $78,000 |

| Logisticians | $77,520 |

| Insurance Underwriters | $76,230 |

| Loan Officers | $65,740 |

| Tax Examiners, Collectors, and Revenue Agents | $57,950 |

Many finance graduates apply their knowledge and math skills in the insurance industry. Some work as actuaries and use data to calculate rates, while others become underwriters and evaluate applications for insurance.

Other sectors that hire graduates with online finance certificates include entertainment, healthcare, higher education, marketing, non-profit, real estate, retail, and transportation. The Bureau of Labor Statistics projects that the demand for business and financial occupations will increase by 7% over the next decade.

Editorial Listing ShortCode:

Some careers will grow at much faster rates. For example, the employment of logisticians will likely increase by 28% during this period, and 11% job growth is expected for management analysts.

Finance Certificate Curriculum & Courses

Graduate finance certification programs generally offer more advanced classes than undergraduate programs, but both levels can cover similar topics. Here are a few common courses you may take:

- Applied Managerial Finance: You’ll study methods used to secure and manage business financing, such as capital budgeting and corporate financial analysis.

- Corporate Financial Strategy: You’ll explore techniques and strategies influencing corporations’ financial policies, such as dividends and venture capital.

- Ethics in Finance: You’ll analyze ethical standards in the financial industry, study contemporary ethical issues, and learn how to apply ethics when making business decisions.

- Financial Accounting: This course teaches you how to examine and produce complex financial statements.

- Financial Markets and Institutions: You’ll learn about the structure and role of capital markets and financial institutions in the United States and study the regulations that govern them.

- Financial Securities Analysis: You’ll use data analysis and quantitative research to evaluate investment decisions, make financial recommendations, and manage portfolios.

- Fundamentals of Investing: This class introduces you to foundational investment principles and practices, including managing risk and timing purchases.

- International Finance: You’ll examine the differences between domestic and international businesses and learn about policies governing international trade.

- Introduction to Risk Management and Financial Derivatives: This course covers risks faced by corporations and strategies to control them, like insurance and government policies.

- Investment Portfolio Management: You’ll explore approaches and theories to investment management, such as asset allocation, benchmarking, and fixed-income analysis.

You may also have the opportunity to gain hands-on experience by completing an internship with a corporation or financial institution.

Admissions Requirements

The admissions criteria for online financial certificate programs vary depending on the program level and school requirements. Here are a few materials you may be asked to submit when you apply:

- Standardized test scores (only some schools require them)

- Letters of recommendation

- Personal statement

- Resume

Graduate finance certification programs also require students to hold a bachelor’s degree. Some programs prefer applicants with a finance-related degree, while others accept students from all majors. An undergraduate certificate program only requires applicants to have a high school education. You can contact a school’s admissions staff to learn more about a particular program’s requirements.

Accreditation

It’s beneficial to consider each school’s accreditation status when comparing online certificates in finance. Accredited colleges and universities provide a quality education in line with professional standards developed by outside organizations.

Accredited financial certificate programs typically offer more resources than unaccredited programs. They often provide access to top library databases, professional development opportunities, and support services like math tutoring. Also, graduates from accredited schools may have a competitive advantage in the job market because employers tend to view these schools as more prestigious.

Editorial Listing ShortCode:

The US Department of Education’s website provides more information about accreditation.

Financial Aid and Scholarships

Students who enroll in finance certificate programs online are required to pay for tuition, books, and other educational expenses. You can see if you qualify for financial aid to help reduce the upfront costs of your certificate.

The federal government offers a few types of financial assistance for students who meet specific eligibility requirements. Some people qualify for Pell Grants, Federal Supplemental Educational Opportunity Grants, and other grants. You don’t have to repay federal grants under most circumstances. Additionally, the federal work-study program pays students to work part-time for their college or university.

You can submit the Free Application for Federal Student Aid (FAFSA) to find out if you’re eligible to receive federal financial assistance. Your current employer may offer a tuition reimbursement program for employees who want to continue their education. Also, some colleges and universities offer grants and scholarships for students who pursue finance certificates.

What Is a Certificate in Finance?

A certificate in finance is an academic, non-degree program that allows students to study financial concepts, practices, and skills.

Undergraduate financial certificate programs focus on core financial methods and theories. You can study topics like budgeting, credit analysis, ethics in finance, and investment management. This certificate can help prepare you for an entry-level job in finance or help you advance an existing career.

Graduate certificates in finance explore advanced concepts in finance. Common course topics include global financial policy, managerial finance, and risk management. These graduate programs are designed for students who want to advance their professional careers in finance, insurance, and other sectors.

What Can You Do with a Finance Certificate?

Current professionals with online certificates in finance follow many career paths. Some graduates become personal financial advisors and work with individuals and families. They help clients make strategic decisions about their budgets, investments, and retirement plans.

People who earn finance certificates may also pursue careers as financial analysts or managers. These experts oversee an organization’s financial activities and develop plans to increase profits. A finance certificate can help you grow your qualifications without having to earn another degree. Management positions often require work experience as well.

How Long Does It Take to Get an Online Certificate in Finance?

Certificates generally take less time to complete than degrees because they don’t have general education or thesis requirements.

Most finance certificate programs online require students to take 12 to 21 credit hours. If you enroll full-time, you may be able to complete your certificate program in as little as 1 year. Many students enroll in financial certificate programs part-time.

Editorial Listing ShortCode:

Part-time students may finish their certificate in 1.5 years to 2 years, depending on the program. This option can provide maximum flexibility and allow you to complete your certificate at a slower pace.

What’s the Difference Between a Graduate Certificate in Finance vs. Accounting?

Accounting and finance both focus on managing money, but there are many differences between these graduate certificate programs.

| Graduate Certificate in Finance Online | Graduate Certificate in Accounting Online |

|

|

A certificate in finance can generally open more diverse career opportunities than an accounting certificate.

What’s the Difference Between a Finance Certificate vs. Certification?

Certificates and certifications may sound similar, but they have different meanings in the financial industry.

| Finance Certificates | Finance Certifications |

|

|

Both credentials could help you advance your career, but finance certificates typically provide a more comprehensive education than professional certifications.

Is a Finance Certificate Worth It?

Yes, a finance certificate is worth it for many students. This credential allows you to expand your financial knowledge and develop skills that may transfer easily between roles. For example, you can strengthen your collaboration, leadership, and mathematics skills as you complete class assignments.

Editorial Listing ShortCode:

The Bureau of Labor Statistics predicts business and finance jobs will increase by 7% over the next ten years. As a result, graduates may have many opportunities to start or advance their careers. Many certificate holders work for financial institutions like banks and investment firms. Others become entrepreneurs or consultants. Various industries like education and healthcare also hire finance professionals.

Universities Offering Online Certificates in Finance Programs

Methodology: The following school list is in alphabetical order. To be included, a college or university must be regionally accredited and offer degree programs online or in a hybrid format.

Ball State University offers a Graduate Certificate in Finance. The program requires the completion of 12 credits, or 4 courses. Potential courses include Investment Management, Global Financial Policy, Risk Management and Insurance, and Fundamentals of Accounting. All credits earned in the program may be counted toward an MBA in finance.

Ball State is accredited by the Higher Learning Commission.

Belhaven University offers an online Graduate Certificate in Finance. This flexible program consists of six 7 week courses. The curriculum is designed to help students develop critical thinking skills that can help them make financial business decisions. Potential courses include Introduction to Graduate Education, Business Principles I, Financial Analysis, Financial Markets, Investments, and Contemporary Issues in Finance.

Belhaven University is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

Boston University offers an International Finance Graduate Certificate that can be completed online, on campus, or in a blended format. On average, this 16 credit program takes 9 months to complete. Potential courses include Case Studies in Current Corporate Financial Topics, Investment Analysis and Portfolio Management, and Multinational Finance and Trade.

Boston University is accredited by the New England Commission of Higher Education.

Colorado State University’s online Applied Finance Graduate Certificate requires the completion of 11 credits. The program focuses on topics like portfolio management, corporate risk management, and security valuation under the guidance of expert faculty. Elective options are also available. Applicants can choose to enroll in fall or spring semesters.

Colorado State is accredited by the Higher Learning Commission.

Cornell University offers an online Financial Management Certificate. Potential courses include Mastering the Time Value of Money, Making Capital Investment Decisions, and Risk and Return. Each course is 2 weeks long, and the full program can usually be completed in 3 months.

Cornell University is accredited by the Middle States Commission on Higher Education.

Harvard University’s online extension school offers a Corporate Finance Graduate Certificate program. Classes are designed to be flexible while providing interactive weekly discussions and one-on-one support. It’s common for students to work full-time while pursuing the certificate, and it typically takes 1.5 years to finish.

Harvard University is accredited by the New England Commission of Higher Education.

Ohio University offers a fully online Graduate Certificate in Finance program that requires the completion of 12 credit hours, or 4 complete courses. Potential courses include Managerial Finance, Financial Markets and Institutions, Investments, and Advanced Corporate Finance. The courses are 7 weeks long and asynchronous and may be taken one at a time. The program’s instructors maintain virtual office hours.

Ohio University is accredited by the Higher Learning Commission.

Southern New Hampshire University offers an online program for a Certificate in Finance. This 21 credit program can potentially be completed in just 6 months. There are no set class meeting times, and coursework is accessible around-the-clock. Potential courses include Cost Accounting, Corporate Financial Management, and Short-Term Financial Management.

SNHU is accredited by the New England Commission of Higher Education, Inc.

The University of California – Berkeley offers a certificate program in finance through its online extension school. The program requires the completion of 15 semester units. Potential courses include Introduction to Risk Management and Financial Derivatives, Corporate Financial Analysis and Modeling, and Intermediate Corporate Finance. Elective options are also available.

The University of California – Berkeley is accredited by the WASC Senior College and University Commission.

The University of California – Los Angeles offers a 5 course Finance Certificate. The certificate program is available online or in person. With full-time enrollment, the program typically takes 6 months to complete, and 1 year with part-time enrollment. Potential courses include Applied Managerial Finance, Advanced Applications of Managerial Finance, and Financial Statement Analysis.

UCLA is accredited by the WASC Senior College and University Commission.

The University of North Carolina – Chapel Hill offers a fully online Graduate Certificate in Finance. This 4 course program typically takes 6 to 18 months to complete. Courses may include Finance, Financial Accounting, Financial Statement Analysis, and Corporate Financial Strategy. All courses are taught by professors who also teach in UNC’s MBA program.

The University of North Carolina at Chapel Hill is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

The University of St. Francis offers an online Finance Graduate Certificate. The curriculum emphasizes the development of critical thinking skills through the analysis of real-world case studies and the skills needed to make data-driven business decisions. Credits earned in the program may be applied toward a master’s degree from USF.

The University of Saint Francis is accredited by the Higher Learning Commission.

The University of West Florida offers a Finance Certificate that can be earned 100% online. The program requires the completion of 12 credit hours of 15 week courses and can commonly be completed in 4 to 12 months. It offers the opportunity to gain hands-on learning through the management of a real financial portfolio for the university.

The University of West Florida is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

William & Mary offers two options for online finance certificates, one in Investment Management and one in Corporate Finance. Each program can typically be completed in 7 to 8 months and has no residency or on-campus requirements. Credits earned in the program may be counted toward William & Mary’s online Master of Science in Finance.

William & Mary is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

Wilmington University offers a Graduate Certificate in Finance that can be completed in flexible online and traditional classroom formats. Classes start every 8 weeks and are taught by industry experts. Potential courses include Financial Management, Corporate Taxation, and Investments.

Wilmington University is accredited by the Middle States Commission on Higher Education.

Getting Your Finance Certificate Online

Financial certificate programs teach students about financial institutions, practices, and theories. Certificate programs are shorter than degree programs, and they focus on core concepts and skills that may help graduates secure entry-level or mid-level finance jobs.

Many students enroll in certificate programs because they want to switch careers or explore a new field. Online finance certificates can also serve as stepping stones to graduate degrees or advanced careers in finance.

If you want to enrich your understanding of finance and grow your professional qualifications, you can start researching online finance certificate programs from accredited schools today.