If you want to build a solid foundation in finance and develop skills that you can apply in business and management roles, a financial management degree may be the program for you.

Professionals in this field can help organizations, individuals, and businesses analyze, interpret, and make decisions regarding their finances and improve their financial health.

Editorial Listing ShortCode:

With almost every industry needing individuals with these skills, career opportunities for graduates with finance degrees continue to grow.

Online Financial Management Degrees

A bachelors in financial management can teach you essential knowledge and skills for developing a career in the field of finance.

While the exact courses and topics will vary by program, topics covered in a bachelors in financial management frequently include:

- Financial principles

- Business law

- International finance

- Financial statement analysis

- Marketing

- Corporate finance

- Business writing

- Risk management

- Investments

- Accounting

- Estate planning

- Microeconomics

- Management foundations

- Business policy

In addition to studying topics like these, you can also develop your interpersonal and communication skills. These skills are essential for finance professionals since they frequently collaborate with and advise others.

Editorial Listing ShortCode:

Finance professionals also utilize critical thinking, problem-solving, and analysis skills as they apply financial theory and principles to provide solutions to real-world challenges. You can also develop your management and leadership skills. Graduates may pursue careers in numerous industries, and some go on to earn advanced degrees in finance.

Many students can complete their bachelor degree in 4 years or less and then directly pursue finance careers. As you gain experience in the field, you can also earn various financial certifications to increase your knowledge, demonstrate your credibility, and help you stand out to employers.

Career opportunities can be found in businesses of all sizes, government organizations, investment firms, banks, and insurance companies, among many others. Professionals with a combination of education and real-world experience can also offer their services as consultants to individuals and organizations.

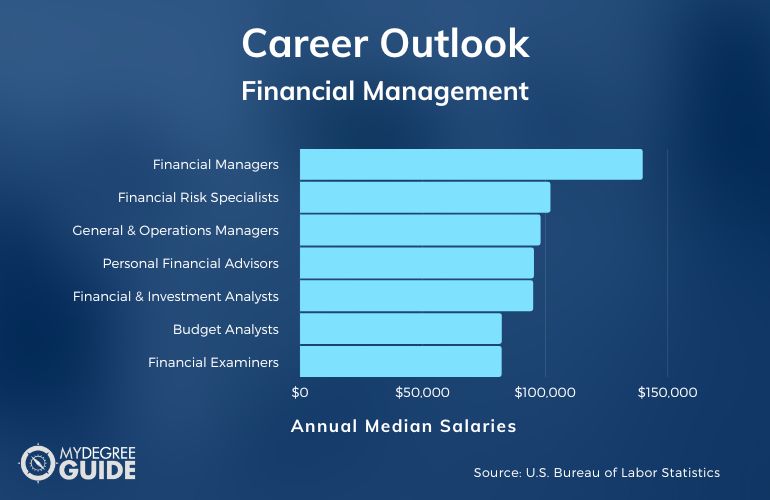

Financial Management Careers & Salaries

Every industry needs financial professionals to help manage, analyze, and plan their finances as well as communicate what is needed for strong financial health.

Most finance careers require at least a bachelor’s degree in finance or a related field. Graduates may find career opportunities as financial analysts, planners, or consultants for individuals and corporations.

According to the Bureau of Labor Statistics, here are the median salaries of careers related to finance and financial management.

| Careers | Annual Median Salaries |

| Financial Managers | $139,790 |

| Financial Risk Specialists | $102,120 |

| General and Operations Managers | $98,100 |

| Personal Financial Advisors | $95,390 |

| Financial and Investment Analysts | $95,080 |

| Budget Analysts | $82,260 |

| Financial Examiners | $82,210 |

| Accountants and Auditors | $78,000 |

| Securities, Commodities, and Financial Services Sales Agents | $67,480 |

| Loan Officers | $65,740 |

Many graduates work toward various management positions, including credit, cash, asset and liability, international finance, financial risk, and branch management. Banking also offers career opportunities. Some graduates may find work as bank officers, credit counselors, and loan officers.

Editorial Listing ShortCode:

Related careers that financial professionals may pursue include portfolio managers, bond brokers, venture capitalists, stockbrokers, traders, and treasurers. Careers in the finance field tend to pay higher than average salaries, and you can potentially increase your earning potential with additional certifications or degrees.

Bachelor of Financial Management Curriculum & Courses

Coursework will vary by school, but listed below are some common courses you may take as part of your finance management degree:

- Principles of Finance: This course introduces fundamental finance concepts, including financial statement analysis, risk measurement, investments, and corporate finance.

- Investments: You’ll examine investment markets, planning, information, and transactions, including risk and return measures, mutual funds, and tax planning.

- Financial Accounting: This course focuses on how an organization’s financial statements relate to performance and examines elements of financial statements.

- Estate Planning: This course introduces the principles of estate planning, including joint ownership of property, life insurance, and charitable dispositions.

- Business Law: This course examines legal challenges in business, focusing on employment law, legal procedure, business organization, and torts.

- Financial Planning: This course is an introduction to the key principles of financial planning, including money management, the financial planning process, and income tax planning.

- Principles of Management: This course provides you with a foundation in management skills needed for leading, planning, and organizing in a management role.

- Introduction to Microeconomics: You’ll be introduced to economic concepts, including supply, demand, and how economic factors shape decisions.

- Marketing: This course examines key marketing concepts, including marketing goods versus services, pricing strategies, and analysis and identification of target markets.

- Managerial Accounting: You’ll learn to examine accounting information from a management perspective, with topics including cost analysis and profit planning.

In addition to the finance degree courses listed above, most programs require the completion of general education courses and give you the choice of some electives.

Admissions Requirements

While admissions requirements will vary by school and program, here are some common requirements for admission to a financial management bachelors program:

- High school diploma or GED equivalent

- Official high school transcripts

- Online application and potential application fee

- SAT or ACT scores (not required by all schools)

In addition, online programs want to ensure that you can meet the school’s technical requirements for online courses. It’s beneficial to look up the specific admissions requirements for each prospective school.

Accreditation

As you look into programs for a financial manager degree, it’s beneficial to see whether a school holds regional accreditation. The regional accreditation process consists of a regional accrediting body evaluating a school’s services and verifying whether they meet educational standards.

If you transfer schools or pursue advanced degrees, many schools will only accept credits or degrees from regionally accredited institutions. The accreditation status of your school could also potentially affect your employment opportunities, especially in a rigorous field like finance. Employers tend to look more favorably on degrees from accredited schools.

Editorial Listing ShortCode:

You can visit the US Department of Education’s website to learn more about accreditation.

Financial Management Licensure and Certifications

In addition to earning a degree, there are various professional certifications you can earn to demonstrate your skills, knowledge, and credibility. Here examples of some certifications in the field:

- Chartered Financial Analyst (CFA): The CFA is for professionals with a combination of education and work experience.

- Certified Government Financial Manager (CGFM): The CGFM is for financial managers working at all levels of government.

- Certified Cash Managers (CCM): This credential is for experienced financial managers with at least 2 years of professional experience.

Certifications and licenses in financial management may help expand your career opportunities and validate your education, experience, and commitment to professional development.

Financial Aid and Scholarships

As you explore your options for earning a bachelors in financial management, you can also see if you qualify for various financial aid and scholarship opportunities.

Scholarships may be available through numerous sources, including directly through prospective schools and various public and private institutions. You can also explore government loans and grants, including the Pell Grant, which is designed specifically for undergraduate students. You can also look into work-study programs, which enable you to work part-time to pay for your program.

To learn more about financial aid opportunities that may help with the upfront costs of your program, you can visit the Federal Student Aid website.

What Is a Financial Management Degree?

A financial management degree is a program that covers the knowledge and skills needed to effectively manage finances for individuals and organizations of all sizes.

You can gain in-depth knowledge in finance and take courses on topics like estate planning, risk management, investments, and capital markets. Graduates can use the financial principles, theories, and knowledge gained to help others manage their finances, improve their financial health, and make strategic financial decisions.

A finance degree helps prepare students for careers in numerous industries. They might pursue roles as financial planners, venture capitalists, hedge fund managers, and financial risk managers.

Is Financial Management Hard?

Whether or not you’ll consider a finance management degree hard will likely depend on your strengths, skills, and what you consider difficult.

Financial managers typically have strong communication and problem-solving skills and are strategic thinkers. Financial managers also need comprehensive knowledge of the finance industry, so a degree program will cover topics like business law, microeconomics, and financial accounting.

In addition, a financial management program can help you develop technical skills to access financial reports and data as well as analytical skills to interpret financial information and respond accordingly.

What Can You Do with a Financial Management Degree?

Graduates with a bachelors in financial management can pursue career opportunities in nearly every industry. Many graduates develop careers in banking—including commercial and investment banking—as branch managers, stockbrokers, credit counselors, and loan officers.

Other potential positions include financial planner, financial analyst, venture capitalist, hedge fund manager, and financial risk manager. Graduates may also find opportunities as consultants for individuals or corporations to help improve their financial health. Other industries that require financial professionals include government organizations at every level, real estate, healthcare, and insurance, among others.

What Does a Financial Manager Do?

Financial managers are usually responsible for maintaining the overall financial health of an organization, corporation, or individual.

While the exact responsibilities will vary by role, financial managers need to understand how to access, analyze, and communicate key information provided in financial reports. Using these financial reports, financial managers then offer advice for planning and making decisions that try to mitigate the risk of loss.

Editorial Listing ShortCode:

Depending on the position, some financial managers may focus on specific areas like budgeting, cash management, or directing investments. Finance managers constantly learn by staying updated on the latest laws, regulations, financial trends, and finance-related technology.

Is Financial Management a Good Career?

Yes, financial management is a good career for many professionals. Careers in finance tend to pay higher than average salaries and offer job security, with opportunities in almost every industry.

Many finance careers are also seeing faster than average growth over the next ten years. For example, employment for financial examiners and financial managers is expected to grow 21% and 17%, respectively (Bureau of Labor Statistics).

As long as businesses, organizations, and individuals have finances, finance professionals will continue to be needed to help people make strategic financial decisions.

How Long Does It Take to Get a Financial Management Degree Online?

The time needed to complete a financial management degree will depend on a few factors, including the program’s academic schedule and your enrollment status.

If you are enrolled full-time in a program following a traditional 16-week semester, you can typically complete your bachelors in financial management in 4 years. You may be able to finish in less than 4 years if you are enrolled year-round, including during the summer, and following an 8-week semester.

If you are enrolled in courses part-time, it will likely take longer for you to complete your financial manager degree.

What’s the Difference Between a Bachelor in Financial Management vs. Accounting?

While there is some overlap in skills and coursework for a bachelors in financial management and a bachelors in accounting, here are some key distinctions between the two.

| Bachelor in Financial Management | Bachelor in Accounting |

|

|

Accounting tends to have a narrower focus of study and application, whereas financial management can lead to a variety of career paths and areas of expertise.

What’s the Difference Between a Financial Advisor vs. Planner?

While the titles “financial advisor” and “financial planner” sound similar and are sometimes used interchangeably, they are two distinct professions with some key differences.

| Financial Advisor | Financial Planner |

|

|

Financial advisors and planners can also earn certifications in their respective fields to help distinguish their areas of expertise.

Is a Financial Management Major Worth It?

Yes, a financial management major is worth it for many students. Graduates can find career opportunities in banking, investment firms, insurance, healthcare, real estate, government organizations, and businesses of all sizes.

Editorial Listing ShortCode:

Based on data from the Bureau of Labor Statistics, job opportunities for financial managers are projected to grow 17% over the next ten years, which is much faster than average. Professionals with a bachelors in financial management also have a strong foundation in finance if they decide to pursue advanced degrees.

Universities Offering Online Bachelors in Financial Management Degree Programs

Methodology: The following school list is in alphabetical order. To be included, a college or university must be regionally accredited and offer degree programs online or in a hybrid format.

Arizona State University offers a Bachelor of Arts in Business – Financial Planning that can be earned online. The program requires the completion of forty 7.5 week classes. The curriculum is designed to prepare students for the Certified Financial Planner exam. Potential courses include Uses of Accounting Information I and II, Fundamentals of Finance, and Business Law and Ethics for Managers.

Arizona State University is accredited by the Higher Learning Commission.

Berkeley College offers a Bachelor of Business Administration in Financial Services. The program provides internship opportunities and hands-on instruction using current industry software. Courses are available both online and in-person. Graduates of the program may take the Certified Financial Planner exam.

Berkeley College is accredited by the Middle States Commission on Higher Education.

Eastern New Mexico University offers a Bachelor of Applied Arts and Sciences in Personal Financial Planning. This is a degree completion program intended for students who have already completed at least 30 credit hours of college coursework. Graduates are eligible to sit for the Certified Financial Planner examination.

Eastern New Mexico University is accredited by the Higher Learning Commission.

Florida State University offers a BS in Financial Planning. The program is available fully online and designed to teach skills in investing, portfolio management, risk management, and more. Courses are taught by professors with real-world experience in the field.

Florida State University is accredited by the Commission on Colleges of the Southern Association of Colleges and Schools.

Franklin University offers a BS in Financial Management that can be earned 100% online. The program offers 6 and 12 week classes. Potential courses include Introduction to Microeconomics, Principles of Management, and Business Law. The program’s instructors have worked as financial management professionals. The curriculum is highly customizable to suit personal career goals.

Franklin University is accredited by the Higher Learning Commission.

George Mason University offers a Bachelor of Science in Business with a Financial Planning and Wealth Management concentration. This is a CFP board registered program that provides instruction in areas such as tax management, retirement planning, and asset valuation. Students in the program may join the Financial Planning Student Chapter to engage with local employers.

George Mason University is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

Grand Canyon University offers a Bachelor of Science in Finance with an emphasis in Financial Planning. The curriculum teaches a Christian worldview, emphasizing conscious capitalism and putting clients’ needs first. Online courses are 8 weeks long, and on-campus courses are 15 weeks long.

GCU is accredited by the Higher Learning Commission.

Husson University offers a fully online Bachelor of Science in Financial Planning. Husson’s online courses are designed to be immersive and experiential, and online students have access to networking opportunities, career services, mental health support, and tutoring. There are multiple start dates offered every year.

Husson University is accredited by the New England Commission of Higher Education.

Kansas State University offers a Bachelor’s in Financial Planning that can be earned 100% online. Graduates are eligible to sit for both the Certified Financial Planner exam and the Accredited Financial Counselor exam. Past students have had a high pass rate on the CFP exam.

Kansas State University is accredited by the Higher Learning Commission.

Liberty University offers a BSBA in Financial Planning. Courses are 100% online, and each one is 8 weeks long. On average, the program can be completed in 3.5 years. Liberty is committed to training champions for Christ. The curriculum is designed from a biblical worldview and seeks to teach how to provide quality work while maintaining ethical standards.

Liberty University is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

National American University offers an online Bachelor of Business Administration with a concentration in Financial Management. Potential courses include Principles of Accounting I, II, and III, Accounting and Finance for Managers, and Legal Environment of Business. The curriculum is designed to help students develop a strategic mindset regarding financial decisions for business.

National American University is accredited by the Higher Learning Commission.

National University offers a Bachelor of Science in Financial Management. Each course is 4 weeks long, and the program can be enrolled in at any time of the year. The curriculum is designed to provide hands-on training in how to analyze data to maximize profits for a business. It also covers strategies for investments and long-term financial growth.

National University is accredited by the WASC Senior College and University Commission.

Northeastern University offers a Bachelor of Science in Finance and Accounting Management that can be earned online or on campus. The curriculum focuses on experiential learning and practical skills, such as managing budgets and maximizing investments. Prospective students can apply to begin in the fall, spring, or summer.

Northeastern University is accredited by the New England Commission of Higher Education.

Northwest Missouri State University offers an online program for a BS in Finance – Financial Management. The curriculum is designed to provide experiential learning opportunities, teach financial and leadership skills, and develop critical thinking skills. Potential courses include Organizational Behavior and Theory, Intermediate Financial Management, and Selected Cases in Finance.

Northwest Missouri State University is accredited by the Higher Learning Commission.

Oral Roberts University offers a Bachelor of Science in Financial Management. There are six 7 week terms every year, and full-time students can potentially graduate in just 3.5 years. Classes are designed to help students balance their education with work and other commitments.

Oral Roberts University is accredited by the Higher Learning Commission.

Regent University offers a BS in Business – Financial Management that can be completed online or on campus in Virginia Beach. The program teaches the stewardship of money through a curriculum based on Christian principles and values. Potential courses include Financial Institutions, Investment and Portfolio Management, Corporate Finance, and International Finance.

Regent University is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

Southern New Hampshire University offers a BS in Financial Planning with a Finance concentration. The curriculum is designed to prepare students for the CFP exam and emphasizes sound decision-making and long-term planning for financial stability. The program’s accelerated pathway can provide the chance to get a head start on a master’s degree.

SNHU is accredited by the New England Commission of Higher Education, Inc.

The University of Colorado – Denver offers a BSBA in Financial Management. The program allows full-time and part-time enrollment, and most courses have online options. The curriculum features a required experiential learning component and seeks to provide a well-rounded education through liberal arts classes as well as business education.

The University of Colorado – Denver is accredited by the Higher Learning Commission.

The University of the Virgin Islands offers a Bachelor of Arts in Financial Planning that can be earned 100% online. The program emphasizes a real-world understanding of how to apply financial knowledge. The curriculum is designed to prepare for employment in banks, investment firms, and other financial institutions. Each course is 8 weeks long.

UVI is accredited by the Commission on Higher Education of the Middle States Association of Colleges and Schools.

Upper Iowa University offers a BS in Financial Management. Courses are taught by instructors with real-world experience, and the student-to-faculty ratio is just 12-to-1. Students typically take two courses at a time in convenient evening or online formats. Most graduates become employed or continue their education a year or less after graduating.

Upper Iowa University is accredited by the Higher Learning Commission.

Getting Your Bachelor Degree in Financial Management Online

Earning your Bachelor of Science in Financial Management can help you build foundational knowledge and skill sets that are applicable to various careers in the finance field.

After earning a degree in finance, there are also a number of professional certifications you can consider pursuing to help demonstrate your proficiency in the field. There is always a need for professionals with financial expertise, and continued growth is projected for a range of careers related to this discipline.

If you’re interested in developing your financial skills and knowledge in finance, you can start your educational journey today by exploring online financial management programs from accredited schools.