A financial risk management certificate program teaches students and professionals how to manage the financial risks that affect the global economy.

The skills learned from this graduate certificate program can help you protect organizations from potential financial risks. While earning this certificate, you can study how to analyze and respond to financial risks. You can also learn about different methods for assessing risk and the modern technology that is used in the mitigation of risk.

Editorial Listing ShortCode:

Read on to learn more about this type of certificate and its benefits.

Online Financial Risk Management Certificate Programs

Organizations of all kinds are subject to the often-tumultuous fluctuations in the economy. This is why skilled financial risk managers are needed to help them stay afloat.

Graduate finance certificate programs are designed to teach you about quantitative and strategic risk management. With the specialized knowledge that this certificate provides, you might increase your marketability in the workforce, advance your current career, or even choose to pursue various fields.

Editorial Listing ShortCode:

Graduate finance certificate programs help make students experts in their field. As such, these programs are usually for students or working professionals who have already completed their bachelors or even graduate degrees in a related field.

When you pursue a financial risk management certificate, you can expect to study several high-level financial subjects. You may also have the opportunity to apply your knowledge in real-world situations.

Some of the many subjects you can expect to study while undertaking a financial risk management certificate include:

- The role of financial risk managers

- Financial analysis

- The role of credit risk managers

- Key financial ratios for analyzing credit risk

With these skills in tow, you can likely grow your qualifications for a variety of positions. Some potential positions in this field include but are not limited to:

- Underwriter

- Broker

- Risk manager

- Risk analyst

Earning a financial risk management certificate is a strategic option for many people who are looking to build on their existing knowledge of finance and risk management.

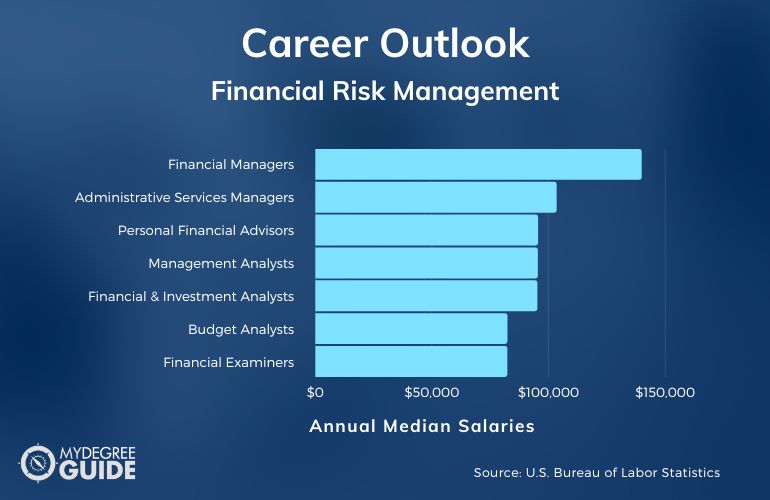

Financial Risk Management Careers & Salaries

Businesses require talented individuals who can help lead them through uncertain times. As such, they regularly invest in risk managers who can identify, assess, and mitigate financial risks to their organization.

According to the Bureau of Labor Statistics, here are some potential career paths, along with their median salaries, that are related to finance and financial risk management.

| Careers | Annual Median Salaries |

| Financial Managers | $139,790 |

| Administrative Services Managers | $103,330 |

| Personal Financial Advisors | $95,390 |

| Management Analysts | $95,290 |

| Financial and Investment Analysts | $95,080 |

| Budget Analysts | $82,260 |

| Financial Examiners | $82,210 |

| Accountants and Auditors | $78,000 |

| Insurance Underwriters | $76,230 |

| Loan Officers | $65,740 |

Graduate finance certificate programs can help you qualify for careers across business. Graduates may find themselves applying for positions in banks, finance companies, insurance companies, advisory firms, and public entities.

Editorial Listing ShortCode:

There are many factors that influence the hiring process, so no credential can guarantee a certain position or salary. That said, a financial risk management certificate can help you grow your qualifications, marketability, and career opportunities.

Financial Management Certificate Curriculum & Courses

While the specific coursework will depend on the program you take, here are some common courses you may encounter while earning a financial risk management certificate:

- Risk Management Principles and Practices: This course will teach you the fundamentals of operational, strategic, and financial risk.

- Risk Assessment and Treatment: This course explores the techniques for assessing risk and how to go about mitigating risk.

- Risk Financing: This course examines various risk financing techniques and their respective applications.

- Practical Enterprise Risk Management: In this course, you’ll gain a foundation in enterprise risk management while working alongside professionals to develop an ERM plan for a business.

- Cyber Risk Management: This course examines how non-state and state actors attack government and corporate networks through cyber attacks.

- Strategic Risk Management: In this course, you’ll examine the process of mitigating risk to a firm, known as risk management.

- Life and Health Insurance: In this course, you’ll be introduced to insurance planning concepts and policies for businesses and individuals.

- Corporate Risk Management: This course serves as an overview of risk management as it pertains to the corporate risk process.

- Credit Analysis: This course teaches you how to evaluate the repayment of asset-based loans.

- Financial Statement Analysis: In this course, you’ll study the foundational elements of accounting that are used to examine financial statements.

Your curriculum will depend on the program of your choice and any electives you take along the way.

Admissions Requirements

Here are some common admissions requirements for graduate finance certificate programs that you may come across:

- Online application and fee

- Bachelor-level courses in finance

- Minimum 3.0 GPA (if required)

- Statement of purpose

Every certificate program is different. Some financial risk management programs have fewer requirements. Certain programs only require an application, making it easy for students to enroll. It’s strategic to always review a program’s specific requirements before applying.

Accreditation

Attending a school that holds regional accreditation can offer a number of benefits. For starters, regional accreditation gives credibility to an academic institution and assures that you can receive a high-quality education.

Editorial Listing ShortCode:

Regional accrediting organizations review institutions and award accreditation to them if they’re found to be consistent in giving students a quality education. Another benefit of accreditation is that it is often attractive to employers. Employers typically have greater trust in education that comes from a reputable institution.

Financial Aid and Scholarships

Many students seek the assistance of financial aid to help them cover the upfront costs of their education. If you require assistance, there are a number of financial aid options you can explore.

You can consider applying for federal aid by filling out the Free Application for Federal Student Aid (FAFSA). This is the formal application that determines whether you’re eligible for government assistance. Common forms of government aid include student loans, grants, and work-study programs.

You can also apply for scholarship and grant opportunities that are offered by schools, private institutions, and public organizations. If you are currently working, you can also see if your employer offers tuition reimbursement or other professional development programs that encourage workers to further their education.

What Can You Do with a Certificate in Risk Management?

Graduate finance certificate programs can help you further your understanding of finance and risk management. You may graduate with key insights that allow you to protect an organization from the uncertainty they face in the economy, helping them mitigate risk.

Many graduates who possess this certificate go on to join rating agencies, finance companies, advisory firms, and more. With their newfound skills, graduate certificate holders may be prepared for careers as branch managers, financial advisors, and financial analysts, in addition to a variety of other careers.

How Long Does It Take to Get an Online Graduate Certificate in Finance?

The amount of time it takes you to complete a financial risk certificate program will depend on the program of your choice as well as your specific circumstances.

In general, these programs are designed to be completed in two to four semesters, or in 6 months to 1 year. Graduate certificate programs can offer different timeframes for completion. Some are designed to be completed part-time, while others may have accelerated tracks available.

Editorial Listing ShortCode:

You can compare the overall lengths and academic calendars of various programs to determine which ones best fit your schedule.

What’s the Difference Between a Financial Risk Management Certificate vs. Certification?

Here are some of the differences between a financial risk manager certification and a graduate certificate program.

| Financial Risk Management Certificates | Financial Risk Management Certifications |

|

|

A graduate certificate program can help you further your expertise and academic credentials in financial risk management. Holding a professional certification can demonstrate that you meet industry standards.

What’s the Difference Between an FRM vs. CFA Certification?

Financial risk manager (FRM) certifications and chartered financial analyst (CFA) certifications have a few stark differences. You can review the table below to see what separates the two.

| Financial Risk Manager (FRM) Certifications | Chartered Financial Analyst (CFA) Certifications |

|

|

Despite the similarities of these two certifications, the one that’s right for you will likely depend on your preferred interests and career goals.

Is a Certificate in Financial Risk Management Worth It?

Yes, a certificate in financial risk management is worth it for many students. Financial risk managers possess the knowledge and skills that organizations of all kinds require. Because of this, risk management certificate graduates can often pursue positions in a variety of fields.

Editorial Listing ShortCode:

Job prospects for these professionals are expected to be very positive both now and in the future. According to the Bureau of Labor Statistics, employment for financial managers is expected to grow 17% over the next ten years, which is much faster than the average for all occupations.

Universities Offering Online Financial Risk Management Graduate Certificate Programs

Methodology: The following school list is in alphabetical order. To be included, a college or university must be regionally accredited and offer degree programs online or in a hybrid format.

Boston University offers a Financial Management Graduate Certificate that can be earned online, on campus, or in a blended format. The program requires the completion of 16 credits and can typically be finished in 9 months.

The curriculum is designed to improve critical thinking skills through hands-on projects. Potential courses include Financial Markets and Institutions, Mergers and Acquisitions, and Investment Analysis and Portfolio Management.

Boston University is accredited by the New England Commission of Higher Education.

The College of Mount Saint Vincent offers a Graduate Certificate in Risk Management that can be earned online. The program requires 12 credit hours of coursework and can potentially be completed in just 8 months. Potential courses include Managing Risks and Internal Processes, Data Analytics: Enhancing Business Insight and Reporting, and Financial Statement Analysis.

The College of Mount Saint Vincent is accredited by the Middle States Commission on Higher Education.

Johns Hopkins University offers a Graduate Certificate in Financial Risk Management. The program requires the completion of four courses for a total of 12 credit hours.

Potential courses include Introduction to Financial Derivatives, Financial Risk Management and Measurement, Statistical Methods and Data Analysis, and Monte Carlo Methods. Applicants must meet the same admissions requirements as students pursuing a master’s degree.

Johns Hopkins University is accredited by the Middle States Commission on Higher Education.

At Missouri State University, a Quantitative Risk Management Graduate Certificate can be earned 100% online. The curriculum focuses on using statistics and modeling to evaluate risk and reward and make business decisions. Missouri State’s career services center offers job placement assistance.

Missouri State University is accredited by the Higher Learning Commission.

Murray State University offers an online Graduate Certificate in Corporate Finance and Budgeting intended specifically for working professionals. The program is designed to prepare students for upper-level management responsibilities. There are multiple start dates offered every year. The program requires the completion of 9 credit hours and can typically be completed in 8 to 10 months.

Murray State University is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

Robert Morris University offers an online Graduate Certificate in Risk Management. The program requires the completion of 12 credits. These credits may be applied to an MBA. Courses are 8 weeks long. Potential courses include Finance and Accounting for Decision-Making, Contemporary Topics in Risk Management, and Critical Technology Issues in Risk Management.

Robert Morris University is accredited by the Middle States Commission on Higher Education.

Stanford University offers an online Financial Analytics Graduate Certificate. The program explores how to use data and information technology to make informed business decisions and manage risk.

The program requires the completion of four courses—one from the statistics section and three from the financial analytics section or two from each section. Potential courses include Probabilistic Analysis, Financial Risk Analytics, and Investment Science.

Stanford University is accredited by the Western Association of Schools and Colleges Senior College and University Commission.

The University of Colorado – Denver offers a Risk Management and Insurance Certificate both online and on campus. Past students currently work in a wide range of industries and have had a 100% job placement rate. Credits earned in the program may also be applied to a graduate degree from the CU Denver Business School.

The University of Colorado – Denver is accredited by the Higher Learning Commission.

A Risk Management and Insurance Graduate Certificate can be earned from the University of Iowa. All four of the required courses are offered online, and two are also offered on campus if preferred. The program can potentially be completed in 18 months. Credits earned may be counted toward an MBA from Iowa.

The University of Iowa is accredited by the Higher Learning Commission.

William Paterson University offers an online International Risk Management Certificate that can potentially be completed in just 6 months.

The curriculum consists of five 7 week courses for a total of 15 credit hours. Potential courses include Financial and Economic Global Strategy, Investment Analysis, International Economics and Finance, Derivative Securities, and Risk Management.

William Paterson University is accredited by the Middle States Commission on Higher Education.

Getting Your Financial Risk Management Certificate Online

Graduate finance certificate programs let you delve deeper into the subject of risk management for organizations. This certificate program can help you hone your existing knowledge and skills so that you can grow your qualifications and expand your career opportunities.

Graduate certificate programs can be beneficial for recent bachelor graduates and experienced professionals alike. As a financial risk management professional, you may find yourself capable of fulfilling various positions. In addition, the demand for financial managers is only expected to rise in the coming years.

If you think a financial risk management certificate is right for you, then consider researching accredited institutions today!