A masters in FinTech teaches vital skills that could help you enter or advance in the world of finance.

FinTech is where the worlds of finance and technology intersect. A masters in this discipline can help you grow as a financial technology professional as you develop specialized technical and analytical skills.

Editorial Listing ShortCode:

Modern financial services continue to change and grow with the development and improvement of technological tools. As a fintech professional, you could play a role in the way individuals, businesses, and organizations manage their finances.

Online Masters in FinTech Programs

A financial technology masters degree exposes students to the technologies that shape the ways in which finances are managed. With the financial landscape constantly evolving, financial technology professionals are in demand in a range of industries.

Financial technology is defined as the technology that automates and improves the use of common financial services. Organizations use fintech as a means of improving the management of their financial processes, services, and decision-making.

Editorial Listing ShortCode:

Some of the modern technologies that are impacting how modern finances are managed include artificial intelligence and machine learning. These are complex systems, which require experienced professionals to develop, implement, and test them.

There are many professions that fintech graduates may consider upon graduation. Some financial technology professionals work as:

- Chief financial officer

- Portfolio manager

- Financial analyst

- Compliance expert

- Big data analyst

- App developer

- Cybersecurity expert

- Financial manager

In order for you to learn the necessary skills for this field, you’ll take classes on topics like:

- Financial management

- Financial modeling and computer applications

- Financial data analytics

- Artificial intelligence for fintech

- Fintech in decision making

- Blockchains

If you have a desire to understand the intersection between finance and technology, then a masters degree in financial technology might be right for you. A graduate program could also help you advance your qualifications for more senior or leadership positions.

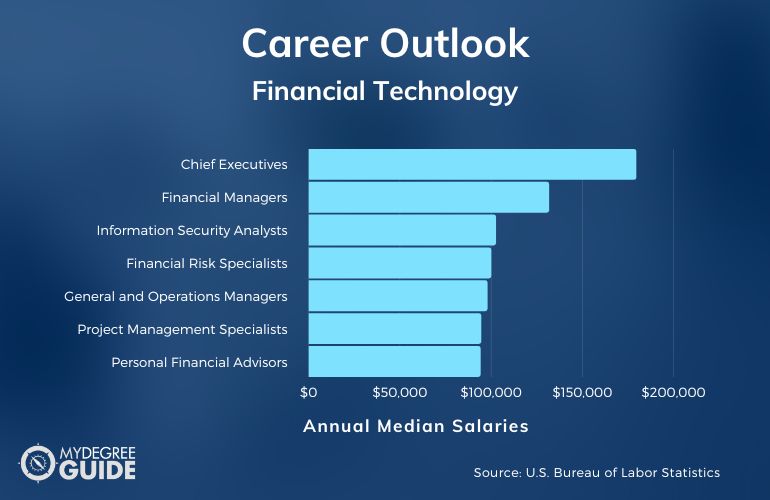

Financial Technology Careers & Salaries

There are a variety of careers associated with the field of financial technology. Fintech professionals who have the critical, analytical, and technical skills to comprehend complex financial information are in demand. The need for these professionals will continue to grow as financial organizations continue to modernize and implement more technological tools.

According to the Bureau of Labor Statistics, here are the median salaries of some career paths associated with the study of fintech.

| Careers | Annual Median Salaries |

| Chief Executives | $179,520 |

| Financial Managers | $131,710 |

| Information Security Analysts | $102,600 |

| Financial Risk Specialists | $100,000 |

| General and Operations Managers | $97,970 |

| Project Management Specialists | $94,500 |

| Personal Financial Advisors | $94,170 |

| Financial and Investment Analysts | $91,580 |

| Financial Examiners | $81,410 |

| Budget Analysts | $79,940 |

While holding a fintech degree doesn’t guarantee a certain position or salary, a masters program can help you grow your skills and professional qualifications in this field.

Editorial Listing ShortCode:

It’s common for fintech graduates to work at brokerage houses, banks, trading exchanges, and more. Financial technology professionals can also be found in a wide range of industries, including healthcare, business, and insurance.

Master of Financial Technology Curriculum & Courses

Here are some examples of courses you’re likely to encounter while pursuing a financial technology master degree:

- Strategic Financial Management: This course exposes you to the theories and analytical techniques that influence financial decision-making.

- Computational Methods in Fintech I: This course will give you a foundation in data structures.

- Fintech in Decision Making: This course introduces you to the analytics and business intelligence that is used in finance.

- Statistical Analysis of Financial Data: In this course, you are introduced to modern methods of data analysis.

- Machine Learning in Finance: You’ll learn how to apply supervised and reinforcement learning to big data problems.

- Advanced Quantitative Risk Management: In this course, you’ll take a more in-depth look at quantitative risk management.

- Cyber Security Technologies: This course teaches you about the role of network security administrators and analysts.

- Wealth Management and Robo-Advising: In this course, you’ll review the fundamentals of modern wealth management and the design of robo-advising systems.

- Mathematical Methods for Algorithmic Trading: This course teaches you about the design and implementation of modern trading strategies.

- Decentralized Financial Engineering: This course is designed to give you engineering knowledge of DeFi markets.

These only represent a few common courses. Your curriculum may be divided between core courses and elective courses. It’s beneficial to check a program’s curriculum to see if the courses interest you.

Admissions Requirements

Every master’s program has its own admissions criteria. That said, here are some general requirements that may be found across different masters in fintech programs:

- Bachelor’s degree

- Letters of recommendation

- Resume

- Official transcripts

- GRE or GMAT scores (not required by all schools)

It’s strategic to research the admissions requirements of your specific program of choice. Ensuring you fulfill the necessary criteria will not guarantee acceptance into the program, but it will be the first step in the application process.

Master’s in FinTech Degrees Accreditation

If you’re considering pursuing a masters in fintech, it’s beneficial to consider applying to an accredited institution. A school’s accreditation status can provide significant advantages, both in your studies and your career.

The status of regional accreditation is given to postsecondary institutions that have passed a set of evaluations by a formal regional accrediting agency. This status then testifies to the school’s ability to provide a high-quality education.

Editorial Listing ShortCode:

Students who graduate from an accredited institution are familiar with a rigorous curriculum, and it’s common for employers to favor these graduates in the hiring process.

Financial Aid and Scholarships

Many graduate students research a variety of financial aid opportunities to help finance their education. For many, the primary option is student loans from the federal government. While these loans require repayment after graduation, they often have lower interest rates.

You can fill out the Free Application for Federal Student Aid (FAFSA) to see if you’re eligible for government loans and other forms of need-based aid, such as work-study programs. Scholarships and grants are essentially free money awards that are given to select students who are chosen among other applicants. These opportunities can be offered by schools, professional organizations, and public or private institutions.

Some employers also offer tuition benefits to workers who want to further their education in a field that’s relevant to their work.

What Is a FinTech Masters Degree?

A financial technology (FinTech) masters degree is a graduate program that typically takes 1 to 2 years to complete. In a graduate program in FinTech, you can learn about how the worlds of technology and finance intersect. This includes studying the emerging technologies influencing finance.

Upon completion of this degree, graduates are often equipped with the knowledge and skills to enter or advance in the field of financial technology. Some may focus on developing technological tools for finance, while others may focus on utilizing these tools to improve an organization’s financial services and decision-making.

What Skills Do You Learn in Fintech?

There are many skills that you can learn in a masters in fintech program. You may learn how to implement financial technologies through the use of advanced algorithms, use data analysis to inform financial decisions, design AI systems, and more.

Fintech graduate students will take various courses to develop this knowledge. Some courses you might take include:

- Fintech in decision making

- Strategic financial management

- Computational methods in fintech

- Artificial intelligence for fintech

These represent only a small selection of the courses a graduate program in fintech may offer.

What Can You Do with a Masters in Financial Technology?

A financial technology graduate program can help you grow in your understanding of AI systems, cybersecurity, coding, financial tools, and decision-making. There is a range of fields that are in need of financial technology professionals, including healthcare, insurance, business, and more.

Potential career paths for fintech professionals include financial analyst, data analyst, app developer, entrepreneur, cybersecurity analyst, compliance expert, consultant, and AI specialist. A masters may also help you qualify for more senior or leadership roles in the field. Some financial technology professionals go on to become chief financial officers, financial managers, and project managers.

How Long Does It Take to Get a FinTech Master Degree Online?

On average, students can expect to complete an online masters in financial technology program in 2 years. Many of these programs are part-time because they’re designed for the working professional, which is why their curriculums may be shorter than other master’s programs.

Online degree in finance programs may also allow you to build your curriculum around your schedule, affecting the program’s duration. Some students take longer than 2 years to complete these programs, while others take as little as 1 year. Ultimately, your courseload will determine how long it takes you to complete the program.

Is a Master in FinTech Degree Worth It?

Yes, a master in fintech degree is worth it for many students. A masters program in fintech gives you the opportunity to develop valuable and specialized skills within the field of financial management and technology.

Editorial Listing ShortCode:

These technological financial skills are currently in demand and expected to grow within the coming years, largely due to the many technologies that are shaping the world of finance today. According to the Bureau of Labor Statistics, business, and financial occupations overall are expected to grow 7% over the next ten years, which is as fast as average. Financial managers in particular are expected to see 17% job growth.

Universities Offering Online Masters in Financial Technology Degree Programs

Methodology: The following school list is in alphabetical order. To be included, a college or university must be regionally accredited and offer degree programs online or in a hybrid format.

Duke University offers a Master of Engineering in Financial Technology program online or on campus. Potential courses include Management of High-Tech Industries, Programming for FinTech, and Asset Pricing and Risk Management. A capstone course and either a project or internship is required. The program is designed to be completed in 3 to 5 semesters.

Duke University is accredited by the Commission on Colleges of the Southern Association of Colleges and Schools.

Kennesaw State University offers a Master of Science in Digital Financial Technologies program online. The program focuses on topics such as digital payment technology, app development, fraud prevention, and data analytics and compliance. The program requires a total of 36 hours and may be completed in just 18 months.

Kennesaw State University is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

The University of Central Florida offers an online program for a Master of Science in FinTech. Potential courses include Full Stack Development for FinTech, Artificial Intelligence for FinTech, and Blockchains and Smart Distributed Contracts. The program requires the completion of 36 hours of interdisciplinary coursework and an applied capstone project.

The University of Central Florida is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

The University of Connecticut offers a Master of Science in FinTech program online or on campus. Potential courses include Introduction to Financial Models, Foundations of Fintech, Fintech Economics and Business Models, and Statistics in Business Analytics.

The program requires the completion of 36 credits through a full-time or part-time option. The curriculum typically allows customization based on interest and commonly emphasizes experiential, hands-on learning.

UConn is accredited by the New England Commission of Higher Education.

The University of Missouri–St Louis offers an MS in FinTech program online. Courses are designed to be flexible while still providing opportunities to develop real-world problem-solving skills. The program may be tailored according to interest through elective courses. The completion of 30 credit hours is required.

UMSL is accredited by the Higher Learning Commission.

Getting Your Masters in FinTech Online

A fintech graduate program is a strategic degree path for people who have an interest in both finances and technology.

If you have a bachelor’s degree in a related field, then this program could act as a natural next step toward growing your specialized skill sets and expanding your career opportunities. In this program, you’ll learn about the technologies that are shaping the way finance is managed today, but you can also learn how to use and design these technologies.

If you’re ready to take this next step in your professional journey, you could start researching accredited universities today to find the fintech program that’s right for you.