Whether you’re the go-to accounting expert for your employer or have just begun to consider accounting as a profession, an MBA in Accounting could be the credential to help build your career.

Online accounting MBA programs not only teach students about vital accounting concepts but also introduce them to key business administration subjects. As a result, graduates of these programs are often qualified for a variety of employment opportunities.

Editorial Listing ShortCode:

Before deciding whether to pursue an MBA in Accounting, let’s take a look at what you’ll learn and how it might apply to your professional aspirations.

Online MBA in Accounting Programs

A Master of Business Administration (MBA) in Accounting program takes a multi-disciplinary approach that incorporates elements of business administration with advanced accounting skills. It is a popular degree for students interested in working in accounting, finance, and management.

Although each college features a unique course of study, MBA in Accounting online programs frequently include these subjects:

- Tax laws

- Financial reporting methods

- Leadership skills

- Principles of finance

- Accounting concepts

- Financial analysis

- Auditing strategies

- Risk management

- Statistics

Students also typically develop communication and research skills, and some complete thesis projects focused on a particular area of interest. These programs also typically include the courses that are required for students to sit for the Certified Public Accounting (CPA) exam.

Editorial Listing ShortCode:

Graduates of accounting MBA programs have many skills that are extremely appealing to employers, including critical thinking, problem solving, and financial analysis. These are some of the types of organizations that hire accounting professionals:

- Retail businesses

- Investment firms

- Non-profits

- Government agencies

- Healthcare facilities

- Colleges and universities

Many accounting MBA students take on roles as accountants, auditors, and analysts with these employers. Others work independently as financial advisors or consultants who offer their services to separate clients rather than working exclusively for a single organization.

If you enjoy teaching and accounting, an MBA in Accounting may strengthen your candidacy for a position as a postsecondary educator. Colleges and universities employ MBA graduates to share their knowledge and skills with the next generation of business and accounting students.

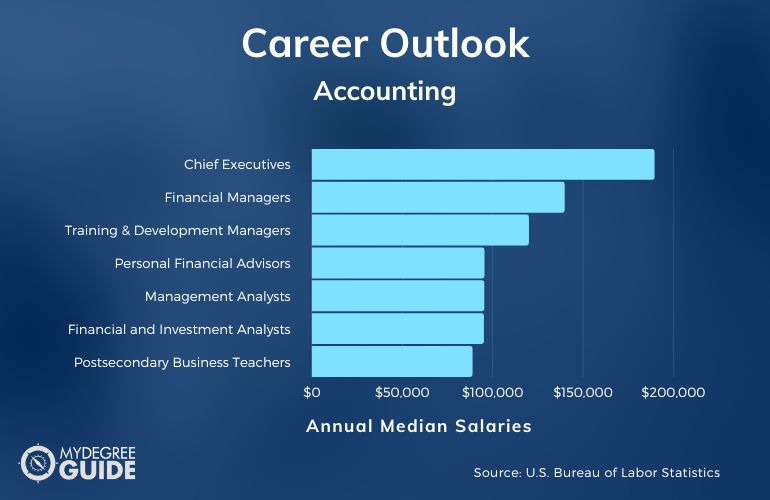

Accounting Careers & Salaries

An online MBA with accounting concentration is an excellent foundation for many career paths. It provides you with a broad understanding of business as well as knowledge of accounting methods and theories.

Financial advising, management, analysis, and education are all potential areas of employment for graduates of accounting MBA programs. If you’re currently working in one of these fields, an MBA may also help you move upward within your organization.

According to the Bureau of Labor Statistics, these are the median wages of some popular jobs for graduates of accounting MBA programs online or on campus.

| Careers | Annual Median Salaries |

| Chief Executives | $189,520 |

| Financial Managers | $139,790 |

| Training and Development Managers | $120,000 |

| Personal Financial Advisors | $95,390 |

| Management Analysts | $95,290 |

| Financial and Investment Analysts | $95,080 |

| Postsecondary Business Teachers | $88,790 |

| Budget Analysts | $82,260 |

| Accountants and Auditors | $78,000 |

| Tax Examiners and Collectors | $57,950 |

Accounting and business occupations are expected to experience steady or accelerated growth over the next ten years. According to the Bureau of Labor Statistics, the projected growth rate for accountants and auditors is as fast as average at 6%.

Editorial Listing ShortCode:

Other related occupations are likely to experience even stronger growth. For instance, financial managers have a projected growth rate of 17%, which is much faster than the average for all occupations.

Accounting MBA Online Curriculum & Courses

MBA degrees in accounting generally educate students in the areas of business and accounting theories and principles. Some courses that are commonly required during these programs include:

- Accounting Principles and Practices: This class provides an overview of essential concepts of financial accounting, including the accounting cycle, income determination, and financial reporting.

- Advanced Financial Accounting: In this course, you’ll learn about the theoretical and practical issues related to accounting for businesses and non-business organizations.

- Auditing Concepts: Students taking this course explore management information systems and the role of technology in accurate and efficient accounting and auditing processes.

- Audit Analytics: During this class, you can become familiar with the use of analytics in the audit process, with an emphasis on the use of statistics and the interpretation of results.

- Income Taxation: Taxes are crucial for both individuals and businesses, and this course help you understand subjects such as federal tax law, income realization, and tax accounting methods.

- Corporate Income Taxes: This course expands on your knowledge of income taxation and applies it to corporate settings.

- Governmental Accounting and Auditing: This class focuses on the principles of fund accounting in government units, including the Governmental Accounting Standards Board.

- Managerial and Cost Accounting: Students in this course learn about the generation and utilization of cost data for managerial control and product costing.

- Fraud Detection through Data Analytics: In this class, you’re exposed to various indicators of fraud and the use of data analytics to improve detection methods.

- International Accounting: Students with an interest in global business can benefit from this course, which encompasses accounting practices for companies that participate in global markets.

You may also be required to take classes focused on core business skills, such as communications and ethics.

Accounting MBA Admissions Requirements

In most cases, students applying to MBA programs must have completed or be close to completing a bachelor’s degree in a relevant field. Other common admissions requirements include:

- Official transcripts from any colleges or universities that you previously attended

- Recent GRE or GMAT scores, if required

- Resumé listing your professional and academic accomplishments

- Recommendations from instructors and supervisors who can describe your strengths

- Essay explaining why you’re interested in the program and how it aligns with your goals

Some schools also require students to participate in interviews and pay an application fee.

Accreditation

Before investing your time and money into a college, it’s strategic to ensure that it’s a quality program. Regional accreditation is critical because it indicates that a college has met the highest possible standards in terms of faculty and curriculum.

Regional accrediting organizations only accredit institutions that undergo a thorough evaluation and prove that they’re presenting up-to-date information. As a result, many employers prefer job candidates with degrees from regionally accredited colleges.

Editorial Listing ShortCode:

In addition, if you change schools before graduating or decide to pursue a doctorate, regional accreditation increases the likelihood that your previous credits will transfer.

Financial Aid and Scholarships

Various forms of financial aid can help reduce your out-of-pocket costs for an MBA program. You can begin your search for aid by submitting a FAFSA to determine whether you’re eligible for federal loans, grants, or work studies. Your state government may also offer separate aid programs, particularly if you plan to enroll as an in-state student.

Scholarships are another potential avenue for funding. You can search an online database or speak to a financial aid representative at your selected college to learn about scholarship programs designed for your major or circumstances.

Many working professionals pursue MBAs to advance their careers, and their employers are often willing to help fund their degrees as a form of professional development. If you’re currently working, you could inquire about the possibility of receiving tuition reimbursement or assistance.

What Is an MBA in Accounting?

An MBA in Accounting is a graduate degree that includes key business skills, such as leadership and management styles, as well as accounting concepts and practices.

During an accounting MBA program, students take courses in subjects like auditing, international business, taxes, and analytics. They also learn about fundamental economic and financial reporting skills. Some MBA programs with a focus on accounting give students the opportunity to receive real-world experience through internships or practicums. They may also include a major research project or thesis prior to graduation.

Should I Get an MBA in Accounting?

Whether you should pursue an MBA in Accounting depends on your goals and interests. For many students, earning an MBA is a worthwhile challenge because it helps them advance in their current organization or transition into new roles with different employers.

An accounting MBA is applicable to many different careers, including working as an accountant, financial manager, or chief financial officer. These positions typically offer competitive salaries and benefits. For example, according to the Bureau of Labor Statistics, the median salary for accountants and auditors is $78,000, which is substantially higher earnings than the median of $46,300 for all occupations.

What Can You Do with an MBA in Accounting?

Graduates of MBA in Accounting programs embark on a number of rewarding career paths. Many students in these programs plan to become accountants and auditors, while others move into management positions as top executives or financial managers.

Other potential career paths include working as an analyst or advisor. You may also qualify for a position as a business educator in a college or university. Some professionals work as financial analysts, management analysts, or budget analysts. Financial advisors may either work for companies or primarily advise individuals on their finances.

How Long Does It Take to Get an MBA in Accounting Online?

Most accounting MBA programs require a minimum of 30 to 36 credit hours, much like an MBA in Operations Management online. This generally translates to 2 years of study for a full-time student enrolled in a traditional program. Some programs are accelerated, allowing students to attend on a year-round schedule and graduate within 1 year or less.

Editorial Listing ShortCode:

MBA students who work or who have other obligations, such as caretaking responsibilities, may enroll on a part-time status. Enrollment for the best part time MBA programs could add flexibility but also extend the amount of time it takes to finish the degree. A thesis or internship requirement can also lengthen the program timeframe.

What’s the Difference Between an MBA vs. Masters in Accounting?

An MBA in Accounting and a masters in accounting may sound nearly identical, but they differ in significant ways, including:

- Program scope. An MBA program covers a range of business subjects, whereas a master’s in accounting explores accounting in great depth.

- CPA preparation. Both programs qualify students to sit for the CPA exam, but a master’s in accounting may cover more of the exam material.

- Career paths. In comparison to an accounting masters program, an MBA prepares students for a larger variety of business careers.

When choosing a degree path, it’s helpful to consider your career goals and whether you’re interested in business operations.

What’s the Difference Between an MBA in Finance vs. Accounting?

An MBA in Finance and an MBA in Accounting address overlapping topics, but these factors set them apart:

- Program focus. An MBA in Accounting concentrates on financial reporting and taxes, while a finance program focuses on investing and financial accountability.

- Outcomes. Unlike an accounting MBA, a finance degree does not typically prepare students to take the CPA exam.

- Career paths. Graduates of accounting programs are more likely to become accountants, whereas finance graduates may become financial analysts or advisors.

Some colleges offer an MBA in Accounting and Finance that covers both topics and helps students develop a broader skill set.

Is an MBA in Accounting Worth It?

Yes, an MBA in Accounting is worth it for many students. With a combination of business administration and accounting courses, this degree may help you qualify for an array of careers, ranging from budget analysis to financial management.

Editorial Listing ShortCode:

Accounting is generally a consistent and steady field of employment because individuals and businesses will always seek professional expertise about taxes and financial reporting. This is reflected in data from the Bureau of Labor Statistics, which shows that many occupations related to accounting will experience faster than average growth. This includes personal financial advisors (15% job growth), management analysts (11%), and financial analysts (9%).

Universities Offering Online MBA in Accounting Degree Programs

Methodology: The following school list is in alphabetical order. To be included, a college or university must be regionally accredited and offer degree programs online or in a hybrid format.

Cedarville University offers an MBA in Accounting that can be earned online. Many of the courses are 7 weeks long.

The accounting concentration courses are 16 weeks long and may be synchronous or asynchronous. The program is cohort-based and teaches business principles from a biblical perspective. Potential courses in the curriculum include Accounting for Business Executives, Executive Financial Management, and Strategic Marketing Planning.

Cedarville University is accredited by the Higher Learning Commission.

Eastern Washington University offers a fully online Master of Business Administration with an Accounting concentration. The program requires the completion of 44 credit hours and can potentially be finished in just 10 months. Potential courses include Quantitative Analysis in Business, Data Driven Decision Making, and Financial Statement Analysis.

Eastern Washington University is accredited by the Northwest Commission on Colleges and Universities.

Emporia State University offers an MBA with an Accounting concentration that can be completed online. The program’s 33 credit hours can potentially be completed in 1 year. Courses are 7 weeks long and taught by faculty with real-world experience. Potential courses include Advanced Financial Management, Accounting Theory, Managerial Economics, and Marketing Management.

Emporia State University is accredited by the Higher Learning Commission.

Fitchburg State University offers a Master of Business Administration in Accounting that can be earned 100% online. The program requires the completion of 30 credit hours. Potential courses in the curriculum include Organizational Behavior and Development, Taxation for Managers, Management Information Systems, and Corporate Finance. It can potentially be finished in 1 year.

Fitchburg State University is accredited by the New England Commission of Higher Education.

Florida Atlantic University’s Master of Business Administration in Accounting is designed to teach managerial skills alongside accounting. Courses are available online and on campus, and there are numerous elective options to choose from. The program is intended for those who already hold a bachelor’s degree in either accounting or taxation.

FAU is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

Grand Canyon University offers an online MBA with an emphasis in Accounting. The program teaches from a Christian perspective and a view of business as a ministry. It requires the completion of 54 credits of 8 week courses. Since the curriculum is designed to teach management and accounting skills, graduates may pursue diverse career paths.

GCU is accredited by the Higher Learning Commission.

Lamar University’s online Master of Business Administration in Accounting is designed to develop practical skills and leadership expertise. The program requires the completion of 30 credit hours and can potentially be completed in 1 year. It offers multiple start dates every year to provide flexibility. Potential courses include Managerial Accounting, Financial Management, and International Business.

Lamar University is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

Liberty University offers a Master of Business Administration in Accounting 100% online. The program requires the completion of 45 credit hours and takes on average of 2 years to finish. Courses use a convenient 8 week format and potentially include Accounting for Decision Making, Managerial Finance, and Tax Research and Jurisprudence.

Liberty University is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

Louisiana State University offers an online Master of Business Administration with an Accounting concentration. The program’s 30 required credit hours can potentially be completed in just 10 months. The curriculum is designed to prepare for the CPA exam. Potential courses include Managerial Use of Accounting Data, Economic Analysis for Management, and Financial Management.

Louisiana State University is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

Pittsburg State University offers a Master of Business Administration in Accounting 100% online. The program requires the completion of 30 credit hours, which can potentially be finished in just 1 year. The curriculum is designed to prepare for the Uniform CPA Examination. There are multiple start dates offered every year to provide flexibility for working professionals.

Pittsburg State University is accredited by the Higher Learning Commission of the North Central Association of Colleges and Schools.

Southeastern Oklahoma State University offers a fully online Master of Business Administration with a concentration in Accounting. This 36 credit program consists of courses like Data Analysis for Managers, Forensic Accounting for Managers, and Accounting and Taxation Research. It can potentially be finished in just 12 months.

Southeastern Oklahoma State University is accredited by the Higher Learning Commission.

Southern New Hampshire University’s online MBA in Accounting can potentially be completed in 1 year. Online courses at SNHU are designed to be engaging without having set class meeting times. Potential courses include Financial Reporting I and II, Measuring Success in an Organization, and Tax Factor in Business Decisions.

SNHU is accredited by the New England Commission of Higher Education.

St. Cloud State University offers an online MBA with a concentration in Accounting. The curriculum is designed to teach how to provide leadership by applying economic data to make business decisions. This 30 credit hour program can potentially be completed in 10 months. Graduates often pursue work as budget analysts, accounting managers, or in similar positions.

St. Cloud State University is accredited by the Higher Learning Commission.

Syracuse University offers an online MBA with an Accounting specialization. This 36 credit program consists of courses like Taxes and Business Strategy, Advanced Topics in Auditing, and Financial Statement Analysis. The curriculum is designed to develop critical thinking skills and a strong sense of ethics in the business and accounting professions.

Syracuse University is accredited by the Middle States Commission on Higher Education.

Texas A&M University – Corpus Christi offers a fully online Master of Business Administration with a concentration in Accounting. The program requires the completion of 36 credit hours and can usually be completed in 1 to 2 years. Potential courses include Taxes and Business Strategy, Advanced Auditing and Assurance Services, and Forensic Accounting.

Texas A&M University-Corpus Christi is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

The University of Maryland offers an online Master of Business Administration with a specialization in Accounting. While providing flexibility and convenience, the program follows the same curriculum that is used on campus and courses are taught by the same faculty members. The curriculum is designed to develop leadership skills and teach how to make data-informed decisions.

The University of Maryland is accredited by the Middle States Commission on Higher Education.

The University of Southern Indiana offers an MBA with a concentration in Accounting that can be completed entirely online. The program requires the completion of 30 credit hours and can potentially be completed in just 11 months. Potential courses include Accounting for Decision Making and Control, Information Systems and Technology, and Managerial Economics.

The University of Southern Indiana is accredited by the Higher Learning Commission of the North Central Association of Colleges and Schools.

The University of Texas-Permian Basin offers an online MBA with a CPA Track. The program requires the completion of 33 to 42 credits and can potentially be finished in just 4 semesters. All courses are taught by the same professors who teach on campus. The program’s rolling admissions process allows prospective students to apply at any time.

The University of Texas-Permian Basin is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

The University of West Florida offers an online Master of Business Administration with an emphasis in Accounting. The program requires the completion of 36 credit hours and can potentially be finished in 16 months. The curriculum is designed to prepare for the CPA exam. There are multiple start dates offered every year to help accommodate working professionals.

The University of West Florida is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

William Paterson University offers a fully online Master of Business Administration with a concentration in Accounting that is designed to prepare for the CPA exam. A background in accounting is not needed to choose this concentration. The program requires the completion of 30 credit hours and can potentially be finished in just 1 year.

William Paterson University is accredited by the Middle States Commission on Higher Education.

Getting Your MBA Degree in Accounting Online

If you have an eye for detail, love crunching numbers, and are fascinated by the world of finance, an MBA in Accounting might be the academic path for you.

This graduate-level program teaches you about key accounting subjects, such as taxes, audits, and fraud. It also enables you to develop advanced leadership, problem-solving, and business operations skills. After graduating, you may be well-positioned to work as an analyst, accountant, auditor, or postsecondary educator. Some professionals advance into management roles with higher salaries and greater responsibilities.

You could move one step closer to achieving your academic and professional goals by researching accredited schools that offer MBA in Accounting programs online.