If you’re looking to develop an in-demand skill set for the insurance and financial industries, then a risk management degree could be a strategic choice.

Risk management professionals analyze data and recommend ways for organizations to protect themselves from financial loss. Job opportunities for risk management graduates could include being an insurance underwriter, a loss prevention specialist, or an actuary.

Editorial Listing ShortCode:

If you’re intrigued by those possibilities, then you might want to consider earning a bachelor’s degree in risk management.

Online Risk Management Degrees

Risk management is a booming profession. Insurance companies, financial institutions, and a variety of businesses are turning to risk management professionals. Organizations count on these experts to help them guard against loss, formulate reliable plans, and maximize their profits.

You might be a good candidate for risk management studies if you’re detail-oriented. It could also be helpful to like working with numbers. Other common characteristics of risk management professionals include being a strong communicator, having an analytical mind, and enjoying brainstorming solutions for complex problems.

During your risk management bachelors degree online program, you’ll likely study:

- Business regulations

- Communication

- Decision making

- Economics

- Employee benefits

- Finance

- Insurance

- Management principles

- Risk analysis

- Statistics

Risk management studies are often part of business administration programs. In business administration programs, you’d likely take quite a few business courses. For example, you might study accounting, marketing, and information technology. Then, for your concentration, you’d have several risk management classes.

Editorial Listing ShortCode:

During your studies, you may evaluate case studies. By digging into situations that real businesses have experienced, you can learn more about how to make risk management decisions. At some colleges, the coursework is designed to help prepare you for industry certifications. For example, your classes may count toward the educational requirements for the status of chartered property casualty underwriter (CPCU).

Internships are vital for many risk management students. By interning with real-world organizations, you can learn from people who are currently working in the field. You can also develop invaluable industry connections. Sometimes, internships can lead to promising job opportunities after graduation.

Some risk management graduates pursue careers in insurance and work as underwriters, sales agents, or adjusters. Insurance companies need actuaries, too. People with this degree may also work as financial risk analysts or financial planners. Your future goals could even include management roles in finance or loss prevention.

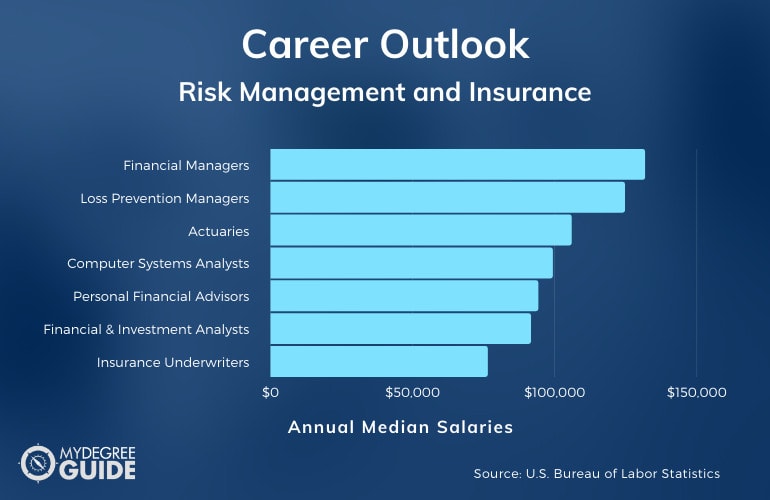

Risk Management and Insurance Careers & Salaries

Risk management is an in-demand skill. People with training in risk management are especially needed in the insurance industry.

Some risk management graduates become insurance sales representatives. They help individuals or businesses purchase the insurance policies that will best meet their needs. Others pursue roles in insurance underwriting. Claims adjusters may also have an education in risk management. Another option is to be an appraiser for an auto insurance company.

Actuaries play another key role in the insurance industry. Because actuaries evaluate data to determine the likelihood of certain events to occur—and how companies can plan accordingly—this can be a fitting career for risk management professionals.

Several types of financial analyst jobs—such as financial risk specialist, financial risk analyst, and ratings analyst—are especially good fits for risk management graduates. According to the Bureau of Labor Statistics, business and financial occupations pay a median annual salary of $76,570.

| Careers | Annual Median Salaries |

| Financial Managers | $131,710 |

| Loss Prevention Managers (Included in Managers, All Other) | $124,650 |

| Actuaries | $105,900 |

| Computer Systems Analysts | $99,270 |

| Personal Financial Advisors | $94,170 |

| Financial and Investment Analysts | $91,580 |

| Insurance Underwriters | $76,390 |

| Claims Adjusters, Examiners, and Investigators | $65,080 |

| Auto Damage Insurance Appraisers | $62,680 |

| Insurance Sales Agents | $49,840 |

Bureau of Labor Statistics data is based on national averages and may not reflect your personal earnings. Loss prevention is another career track to consider. That job involves taking steps to reduce a company’s instances of theft, damage, or other loss. Professionals may enter the field as specialists and later become managers.

Risk management departments use software systems to organize and analyze data. Graduates in this field who also have IT training might have opportunities as systems analysts. Employers often appreciate job candidates who understand not only the technology side of things but also the unique needs of the risk management industry.

Editorial Listing ShortCode:

Understanding risk can also help graduates become personal financial advisors. People in that role help their clients anticipate their financial needs and plan accordingly. They do a lot of work with investments. Professionals in various financial roles may eventually become promoted to managerial positions. There are many types of financial managers, including risk managers, credit managers, and insurance managers.

Bachelor’s in Risk Management Curriculum & Courses

Your risk management studies may be a standalone program or a subset of the college’s business degree. Either way, the curriculum could have classes similar to the ones listed below.

- Benefit Packages: You may study insurance plans, pension plans, and other perks that companies offer to attract and retain talented employees.

- Business Communication: You’ll learn how to communicate key information to stakeholders in your organization and how to use the necessary data to back up your messages.

- Corporate Finance Studies: As you study managerial finance and capital, you’ll probably discuss financial statements, resource management, and strategic planning.

- Financial Investments: This class might cover financial markets, investment vehicles, and portfolio management.

- Health Insurance: You’ll study the role and structure of health policies, the legal regulations surrounding them, and how you can help clients choose the right coverage.

- Insurance Principles: An introductory class on insurance basics will set the foundation for your studies.

- Organizational Structure: To be an effective leader, it’s necessary to understand how teams function, how decisions are made, how ideas are communicated, and how change is affected.

- Property Insurance: This course covers insurance policies for buildings, vehicles, and other types of property.

- Risk Management Concepts: Early in your studies, you’ll learn how organizations identify risks and develop mitigation strategies.

- Statistics: A statistics course can help you understand data sets, probability, correlation, variance, and other related topics.

To graduate from college with a degree in financial risk management, you’ll typically earn around 120 credits.

How to Choose an Online Bachelor’s in Risk Management Program

You may know that you want to pursue a risk management major, but how can you narrow down the selection of programs? Factors like the ones listed here might help you identify your top choices.

- Accreditation. First of all, it’s beneficial to look at a college’s accreditation status. The most reputable degrees come from schools with regional accreditation.

- Cost and financial aid. Tuition amounts vary greatly, but the financial aid packages you may receive can also differ from one place to another. If you apply to multiple schools, you may want to compare the offers you receive to figure out the financial commitment that each one would require.

- Curriculum focus. If you want a broader business foundation, you can choose a business program with a risk management concentration. For deeper studies in risk management, you might select a standalone degree program.

- Industry certifications. Some schools specify that they prepare students to earn professional credentials, which could help you get established in this industry.

- Internship opportunities. Your college may have connections to high-profile organizations where you could complete an internship and network with others in this field.

- Online options. You might want a school with traditional semesters or accelerated ones. Another common difference is that some online management degree programs have students come to virtual class at specified times, and others offer more flexible scheduling.

It’s helpful to remember that being at a top-ranked college means little if the school isn’t a good fit for you. You’ll likely have the best experience if you choose a school that aligns with your learning style, goals, and personal preferences.

Bachelor of Risk Management Admissions Requirements

Colleges want to know whether you’re academically and personally ready to handle their programs, and the application process is designed to showcase your strengths and abilities. To get into a risk management program, you might need to submit the following:

- Personal essay

- Letters of reference

- Minimum SAT or ACT scores (not required at all schools)

- Transcripts (often with a GPA of 2.5 or higher)

Some schools admit students with GPAs under 2.0, while other colleges set their GPA admissions standards at 3.0 or even higher.

Accreditation

Regional accreditation is a key element to look for when you are shopping for a college. You can think of accreditation as a seal of approval. Schools only receive regional accreditation if they meet established quality standards. So, accreditation enhances a college’s reputation. To transfer credits between schools or to get into a graduate program, you’re often required to have attended an accredited school.

Editorial Listing ShortCode:

Accreditation can even make a difference in the workforce. Many employers prefer candidates who hold a degree from an accredited institution. Some professional certification programs also require applicants to have received an accredited education.

Risk Management Licensure and Certifications

The Risk and Insurance Management Society (RIMS) offers a credential that’s designed especially for people in the risk management field. Known as Certified Risk Management Professional (RIMS-CRMP), this designation may help you secure positions in leadership.

The Project Management Institute (PMI) also has a program for risk professionals. It’s called Risk Management Professional (PMI-RMP), and the credential is designed for people currently in the field who want to advance their careers.

For a career in insurance sales or underwriting, you may want to look into the Chartered Property Casualty Underwriter (CPCU) designation. It’s administered by RIMS, and you can choose a commercial lines or personal lines concentration.

Financial Aid and Scholarships

State and federal government programs can help qualifying students pay for college. As you get ready to enroll in a risk management program, you can also fill out the Free Application for Federal Student Aid (FAFSA). Your need-based financial aid offers will depend on the information in that document.

Many college students qualify for low-interest government loan programs. Depending on your situation, you might also be eligible for grants that won’t need to be repaid. Scholarships are another form of assistance that isn’t paid back. Some scholarships may be administered by your school. You could also explore other aid opportunities from private scholarship funds or your employer.

What Is a Risk Management Degree?

A risk management degree is a bachelor-level college program that can help prepare you to work in the financial sector or the insurance industry. You can learn to assess and evaluate risks—especially financial risks—to companies or other organizations. In addition, you can study how to make business plans that reduce those risks or ease their financial burden.

Course topics in a risk management program often include business finance principles, risk profile analyses, and an introduction to insurance. As you complete your program, you may do in-depth studies on several types of insurance, including health and property policies.

Is Risk Management a Business Degree?

Yes, risk management programs are often offered by college business departments. The field of risk management has close ties to the financial and insurance sectors. Many corporations rely on risk management principles to maximize their profits. It makes a lot of sense, then, for risk management to fall under the school of business.

In fact, risk management is often a concentration option for a business administration bachelors degree program. Students in this type of program take an extensive core of business courses and then specialize with a handful of classes on risk management topics.

What Does Risk Management Do?

As the name suggests, people in the risk management field pay attention to risks. In particular, they usually focus on financial risks. They evaluate the likelihood that certain events will occur and then make plans for responding to those potential events.

Editorial Listing ShortCode:

Risk management is closely tied to the insurance field, as insurance companies make plans based on the chance of certain events happening to their clients. Businesses and individuals also purchase insurance to mitigate the risk of facing large expenses.

What Can You Do with a Risk Management Degree?

With a degree in risk management, you could pursue a career in the insurance business. Depending on their area of interest, some insurance professionals sell policies or appraise property damage.

Other graduates with this degree choose finance careers. You could consider working in financial analysis—particularly as a financial risk analyst—or financial planning. Loss prevention manager is another potential role for professionals in this field. The Bureau of Labor Statistics classifies that job in the category of “all other managers,” which boasts a median annual salary of $124,650.

Is Risk Management a Good Major?

Yes, risk management is a good major for many undergraduate students. Financial and investment analysts, such as financial risk specialists, usually earn between $57,900 and $166,560 annually (Bureau of Labor Statistics). Financial analysts in the insurance industry have a median annual salary of $93,870.

Professionals in the insurance field often claim that it’s a beneficial career path for achieving work-life balance. Many insurance roles involve reliable office hours and the ability to leave the job behind when you go home for the day.

How Long Does It Take to Get a Bachelor’s Degree in Risk Management Online?

Most risk management bachelor’s degree programs take between 4 years to complete with full-time study. On a college campus, you’re pretty likely to spend 4 years in school. Online, though, you may have a somewhat shorter program.

Year-round terms that last 6 weeks to 8 weeks help many full-time students finish online programs more quickly than traditional ones. This is the case whether it’s an online undergraduate risk management degree or an online masters in compliance, for example.

Also, some colleges offer 4+1 risk management programs. With that arrangement, you might be able to finish both a risk management bachelor’s degree and a masters in risk management degree in just 5 years.

What’s the Difference Between a Bachelor in Risk Management vs. Safety Management Degree?

Is a degree in risk management right for you, or would you be better suited for a career in safety management? To help you decide, let’s check out the differences between these degree programs.

| Safety Management | Risk Management |

|

|

These two fields are mutually beneficial to one another.

Is a Degree in Risk Management Worth It?

Yes, a degree in risk management is worth it for many students. For one thing, this degree could help you become an actuary, and there’s a huge demand for actuaries right now.

Editorial Listing ShortCode:

The Bureau of Labor Statistics predicts 24% job growth for this position over the next decade. Plus, being an actuary isn’t the only in-demand job option. The category of financial managers, which includes risk managers, is expected to see a 17% growth rate. Overall, unemployment for risk management graduates is low.

Universities Offering Online Bachelors in Risk Management Degree Program

Methodology: The following school list is in alphabetical order. To be included, a college or university must be regionally accredited and offer degree programs online or in a hybrid format.

Bay Path University offers a BS in Cybersecurity: Risk Management. Coursework includes Fundamentals of Information Assurance, Computer Networks and Network Security, Programming Languages, Cyber Strategy, and more. Students in the program are required to complete a capstone to graduate.

Bay Path University is accredited by the New England Commission of Higher Education.

Eastern Kentucky University offers a Bachelor of Business Administration – Risk Management. The program is 100% online and focuses on real-world applications. Online students have access to career services and tutoring. Coursework includes Principles of Risk and Insurance, Fundamentals of Life and Health Insurance, and Commercial Property Risk Management and Insurance.

Eastern Kentucky University is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

Grand Canyon University offers an online program for a Bachelor of Science in Risk Management. Coursework includes Business Statistics, Management Accounting, Fundamentals of Business Finance, Global Risk Management Practices, and more. The program is also available on campus. GCU teaches from a Christian worldview.

Grand Canyon University is accredited by the Higher Learning Commission.

Indiana State University offers a BS in Insurance and Risk Management both on campus and online. Online students are not required to make any campus visits. Students take courses such as Business Information Tools, Commercial Property Risk Management and Insurance, Principles of Accounting I and II, and more.

Indiana State University is accredited by the Higher Learning Commission.

Johnson & Wales University offers a Bachelor of Science in Business Administration – Enterprise and Risk Management. Classes are 8 or 16 weeks long and 100% online. The average class size is just 15 students. Online students participate in live discussions and can learn at their own pace.

JWU is accredited by the New England Commission of Higher Education.

Ohio Dominican University offers a Bachelor’s in Risk Management and Insurance. Students can participate in professional internships through the school’s industry partnerships. Courses include Fundamentals of Risk Management and Insurance, Enterprise Risk Management, Operations and Management of Insurance Companies, and more.

Ohio Dominican University is accredited by the Higher Learning Commission.

The University of Central Arkansas offers a Bachelor of Business Administration in Insurance and Risk Management. The program is available entirely online. It currently has a 100% job placement rate. Graduates often become claims adjusters, underwriters, financial planners, and more. Internships are available to help students gain work experience.

The University of Central Arkansas is accredited by the Higher Learning Commission.

The University of Colorado—Denver offers a BSBA in Risk Management and Insurance. Students can attend full-time or part-time, and some classes are available online. The program also offers opportunities for networking, internships, and study abroad. Coursework includes Operations Management, Business Problem Solving, Corporate Risk Management, and more.

The University of Colorado – Denver is accredited by the Higher Learning Commission of the North Central Association of Colleges and Schools.

The University of Houston—Downtown offers a BBA in Insurance and Risk Management. The degree can be completed online or on campus. UHD’s online courses are flexible but highly interactive. Graduates from the program often pursue jobs as insurance appraisers, underwriters, auditors, and other related careers.

The University of Houston – Downtown is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

The University of Louisiana—Monroe offers an online program for a BBA in Risk Management and Insurance. Courses may be 4, 8, or 16 weeks long, with each course covering the same material as a full-length semester. Coursework includes Social and Health Insurance, Insurance Operations, Insurance Law, Commercial Liability Insurance, Surplus Lines and Reinsurance, and more.

The University of Louisiana Monroe is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

Getting Your Bachelors in Risk Management Degree Online

A bachelors in risk management can help prepare you to enter this highly in-demand field. Insurance companies, financial institutions, and corporations are on the lookout for college graduates with expertise in risk management.

Your responsibilities in this field might include evaluating the risks that people or organizations face and developing plans in response. If you want to attend college online, you can receive a quality education and earn a credible risk management degree through accredited online programs.

You can get started today by exploring your options for online risk management studies.