Is college worth it in 2024? Is a college degree worth incurring student loan debt? Every week, you walk on tiptoes around your boss, hoping that this is not the week when your name lands on the dismissed list due to budget cuts and mass layoffs.

There’s gotta be a better way to do this! You’re right. Your life doesn’t have to be an endless slog from one weekend to another. You are ready for success. But what is it going to take?

Editorial Listing ShortCode:

Honestly, hard work and determination. But you are ready for it. You are the kind of person who is ready and willing to do the hard things to succeed.

So, you survey the landscape, to get an idea of what you need to do. You can switch jobs, and hope that this one is better than the last one. You can take on a side hustle like Uber to pad out your paycheck until you hopefully get that raise. Or you can invest in yourself by upgrading your high school diploma to a college degree, which can help increase your income and provide greater job security.

What’s It Going to Cost to Go to College?

Of the three options, a college education should sound like the best strategy.

But I have never seen a neon light advertising free tuition at any college, and believe me, I’ve looked! So, how much can you expect to pay to get a college degree?

Lots.

And not so much.

I hate to say this, but it all depends on where you go!

Housing costs can vary significantly from region to region and must be taken into account when you are creating a final comparison between colleges.

Editorial Listing ShortCode:

Room and board at the University of Hawaii, for instance, costs an average of $13,000 annually, while Northwestern Oklahoma provides a year of room and board for about $4,950. Even with the higher cost, you may determine that living in Hawaii is of value due to the weather and atmosphere.

But let’s say you hate sunshine and sandy beaches, so you cross the University of Hawaii off the list of potential colleges.

According to Statista, the average cost of attendance (including tuition, books, and room and board) at a four-year publicly funded in-state college is $22,180 for 1 academic year.

If you live in an area with a phenomenal state college, such as the University of Michigan (1 of the top-rated public US universities according to the QS World University Rankings®), then this is an open-shut case. But what if this isn’t the case? What are the other options for pursuing a college study and picking from a very large list of reputable colleges?

In-District College

- An in-district college is frequently referred to as a Community College. An Associate’s degree can typically be earned in 2 years and then students can go on for further studies elsewhere.

- Attending an in-district college is typically the best option in limiting your student loans as in-district college students pay an average of $3,770 (tuition costs only, no room and board) per academic year.

In-State College

- Attending an in-state college may yield significant benefits for you. You’re just a day trip away from home! Or maybe that’s a negative?

- Another potential benefit of attending an in-state college is financial savings. All those years of paying state taxes have finally benefited you as you can expect to pay on average only $26,820 per academic year.

Out-of-State Publicly Funded College

- Maybe you are looking for a taste of adventure, and an out-of-state college is the ticket for you? Attending college in another state may allow you to study in a specialty area, such as studying architecture at UCLA.

- This choice, however, is usually pricier, as college students pay an average of $43,280 to study at an out-of-state college.

Private Non-Profit Four-Year Colleges

- Private four-year colleges often yield rich cultural experiences, as they tend to attract students not only from other states but from other countries as well. In addition, private colleges tend to have smaller populations, so you are more likely to know your professors and be seen as a person, and not just a number.

- The cost of this experience, however, is usually considerable, as there is no government funding afforded to private colleges, so on average, you will pay $54,880 per year to attend a private college.

(Source: Trends in College Pricing and Student Aid, The CollegeBoard)

Is College Worth the Cost?

After analyzing the various options for obtaining a college education, you may be asking yourself if college is worth it.

Because $18,000 to $54,000 a year (The CollegeBoard) for tuition adds up quickly when you are working to make rent payments and keep food on the table.

You’ve probably also heard the horror stories of the massive student debt that college students and college graduates accumulate through the student loans they take out in order to pay for their education.

But just like a stock market investment, investing in your education is a long-term game. It will take time and yes, money to pursue a higher education. But hearing their name being announced in a room full of college graduates, walking across the stage, shaking hands with the president of the university, and receiving their diploma can be ultimately worth it for many students.

Across the board, over the course of their lifetime, the average worker with a Bachelor’s degree makes approximately $1 million more than a worker without a post-secondary degree.¹

But that’s not all.

With the changing times and our current economy, job security is vital. College graduates who hold a Bachelor’s degree earn 66% on average more than their less-educated colleagues and are also far less likely to be unemployed long-term.²

Thinking about a master’s degree (Is a master’s degree worth it?) or a doctorate degree (Highest Paying Doctorate Degrees)? Although you may have to take out extra student loans, college graduates with these degrees are typically rewarded with more lucrative careers and earnings.

Editorial Listing ShortCode:

Adding to the necessity of a college education, by next year, an estimated two-thirds of job openings will require post-secondary education or training. This means your high school education may not cut it anymore while a college education may become the best chance in earning a job. These are some jaw-dropping facts.

Don’t want to spend the next four years in college? You don’t have to! Some of the fastest degrees being offered these days are online in a wide range of fields. With a little planning and a lot of hard work, you may even be able to finish your bachelor’s in just 2 years. Many college graduates even have the option of extending their education through accelerated graduate programs.

Every semester that you are able to skip and save out on will result in reduced student loans. Ultimately, the quicker you become a college graduate, the less your student debt will be.

When you realize that you can finish college faster than you thought was possible, and not accumulate as many student loans as the average college graduate, the idea of earning a college education to increase potential lifetime earnings should be starting to sound like a very sound investment!

In addition, through potential financial aid and college scholarships, you may start to realize that the student loan debt horror stories may not be that bad after all.

Student Loan Debt

When determining if college is worth it, part of your decision may include whether or not you want to take on student loan debt to cover the cost of financing your higher education.

Currently, over 50% of young adults ranging from 17 to 34 years of age have some sort of student loan debt. Last year, the average student loan debt for college graduates topped $37,500.

So, is taking out student loans and accumulating student loan debt worth it in order to get your college degree?

Experts are divided with some pointing to the increase in earnings a degree affords, while others state that saddling college graduates with student loan debt cripples them financially.

The Bureau of Labor Statistics has determined that there is a great divide between the earnings of college graduates and those who do not have a college education. Millennials who have earned a bachelor’s degree have a median salary of about $77,920. Those who did not complete their four year, bachelor’s degree have a median salary of approximately $37,770 per year.

In addition, according to the Federal Reserve Bank of New York, the rate of return for college graduates is exceptionally high at around 14%, compared to other long-term investments such as stocks (7%) or bonds (3%). The Federal Reserve Bank of New York also states that even with the rising college tuition costs and student loans, the college wage premium remains substantial.

So, the average annual earnings for college graduates are about $20,000 more than for those who did not earn a bachelor’s degree. An increase in salary of $20,000 per year seems like a worthy investment, provided college students do not take on too much student loan debt.

Ultimately, whether it’s a worthwhile investment to take out student loans to go to college is up for you to decide. Both the experts for student loans and experts against student loans have reasonable arguments.

How Much Is a College Degree Worth?

An extra $1 million in your bank account at the end of your career may sound extremely attractive. But ask most elementary teachers if they are rolling around in their excess cash, and you will get laughed right out of town.

Because going to college and getting a degree does not necessarily set you up for success; you need to get the right degree. For a more in-depth look, check out our article on fast degrees that pay well.

Editorial Listing ShortCode:

Colleges offer a variety of majors with each having a different return on your investment, and those variables should be weighed carefully.

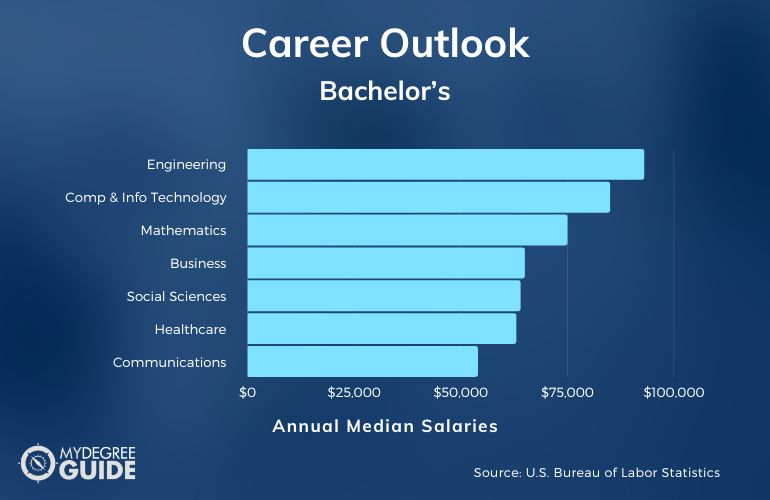

Here are some bachelor’s degree majors with their median pays, according to the U.S. Bureau of Labor Statistics:

| Bachelor’s Degree Major | Annual Median Salaries |

| Engineering | $93,000 |

| Computer and Information Technology | $85,000 |

| Mathematics | $75,000 |

| Business | $65,000 |

| Social Sciences | $64,000 |

| Healthcare | $63,000 |

| Communications | $54,000 |

| Agriculture | $52,000 |

| Liberal Arts | $50,000 |

| Education | $48,000 |

So, if you are looking to get the most bang for your literal buck, then you will probably want to consider pursuing a study in STEM (Science, Technology, Engineering, Math) rather than an arts degree.

Still curious? Here’s a list of the top 20 highest paying bachelor’s degrees if you want to dig deeper.

What Is the Long-Term Gain of a College Degree?

Perhaps you are not in the place to go to school full-time for the next 4 years. Is there any benefit to upgrading your education from high school to college, even if it only takes one or two years?

Yes.

Whether you are able to invest a little or a lot into your education, every bit counts.

Even if you are only able to take one or two courses a year, and are not able to complete a post-secondary degree, those courses will still impact your financial bottom line. Workers who have some post-secondary education without obtaining degrees make on average about $38,700 annually. This equals an additional $250,000 in lifetime earnings.

But it doesn’t have to stop there. The increase in salary usually continues as your level of education rises.

Editorial Listing ShortCode:

If you complete an Associate’s degree at your local community college, you stand to make nearly one-third more than a worker with only a high school diploma. Securing an Associate’s degree may cause your lifetime earnings to swell by $450,000 over someone who does not have a post-secondary education.

At this point, you are halfway finished a Bachelor’s Degree, and with a couple more classes under your belt, you should begin to notice that your lifetime earnings are more than worth the effort of going to college. The average lifetime earnings for someone with a Bachelor’s degree is 2.3 million dollars! This is 74% greater than the expected earnings of a worker with only a high school diploma.

(Source: Georgetown University, The College Payoff: Education, Occupations, Lifetime Earnings)

Well, What’s In it for Me Personally?

You may have weighed the argument back and forth, and it may already seem heavily weighted in favor of going to college and getting a college degree. The potential money is good, the prestige and job security are valuable, and having the experience is priceless.

But maybe you’re not just about the money. You may need to know that a degree is going to be good for you, from a holistic perspective.

Are There Any Easy College Majors?

Yes, most colleges offer majors that are generally considered to be easier than others, but it depends on your likes and dislikes.

Do you like the idea of getting a college degree, but aren’t sure which study to pursue? We totally understand. That’s why we have assembled a list of easy college majors.

Benefits of a College Degree

Before considering if going to college is worth it, you should know that a college education provides 4 essential benefits that have nothing to do with your earnings.

1. Job Satisfaction

Having a career that is personally satisfying is often the result of your own sweat equity. You’ve invested in this degree, and brought it to completion. Around 89% of people with a Bachelor’s degree attest to having a feeling of job satisfaction.

2. Increased Health

We have all seen the anti-smoking ads and are aware of the health costs of choosing to smoke cigarettes. However, a post-secondary degree takes that understanding to heart and reduces your propensity to smoke cigarettes by 15%. Take that, lung cancer!

3. Sophisticated Leisure

Perhaps due to some increased exposure to the arts while studying, if you have a Bachelor’s degree, you are more likely to read books daily and attend concerts twice a month than if you only have a high school diploma.

4. Civic Engagement

In the 1996 election, only 26% of high school graduates voted in the presidential election, compared to 42% of post-secondary graduates. These days, every vote counts, and those who have gone to college and earned a college degree are more likely to take their responsibility to heart and participate in civic elections.

(Source: University of Pennsylvania, The Benefits of Higher Education: Sex, Racial/ Ethnic, and Socioeconomic Group Differences)

What if I Decide Not to Get a College Degree?

I can understand the temptation to walk away from your dreams of a college degree. Investing years of your life and huge sums of money when you are just trying to keep one foot in front of the other can be nerve-wracking.

In addition, taking out student loans can seem intimidating and maybe risky.

But what happens if you don’t take this opportunity?

What happens if you decide to stay on with your current employer and just keep your head down and work this job till you retire?

Maybe it will work, and you won’t have to put in the effort to improve yourself. Maybe it will be good enough.

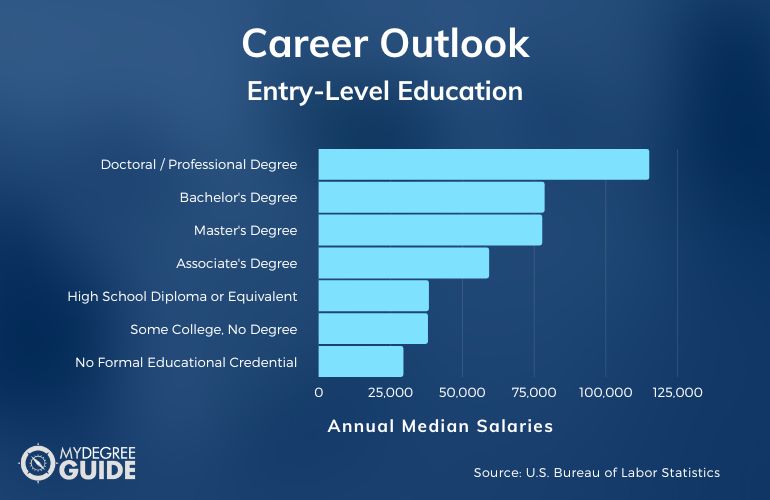

| Entry-Level Education Requirement | Annual Median Salaries |

| Doctoral / Professional Degree | $115,010 |

| Bachelor’s Degree | $78,580 |

| Master’s Degree | $77,750 |

| Associate’s Degree | $59,260 |

| High School Diploma or Equivalent | $38,290 |

| Some College, No Degree | $37,960 |

| No Formal Educational Credential | $29,420 |

Source: U.S. Bureau of Labor Statistics

But maybe it won’t work.

Whatever the case, if you’re unemployed and only have a high school diploma and an Employee of the Month certificate to open doors for the next job, it’s probably not going to work very well.

Georgetown University forecasts that this year, 65% of all jobs in the economy will require post-secondary education and training beyond high school.

That means the odds are against you in securing another job that will pay a living wage with only a high school diploma.

This might not be the “right time” when it’s easy to make the leap into a college degree. But that doesn’t mean it is the wrong choice. Waiting until everything lines up may leave you lining up in the unemployment line, wondering why you didn’t jump for it earlier.

So is college worth it?

Yes, it can be worth it. Choose to invest in you.

You’re worth it.

The opportunity lingers before you. Do you take the leap into higher education? You deserve the chance to better your future. Choose you.