What can you do with a finance degree? Business and finance are in-demand fields with a projected 5% growth rate, so your traditional or finance degree online prospects are strong.

There are many different opportunities to earn a finance degree such as through online programs or accelerated finance degree online programs.

Editorial Listing ShortCode:

After graduation, you may be able to get a job making around $40,000-129,000 (Bureau of Labor Statistics) or go to grad school.

What Can You Do with a Finance Degree Once You Graduate?

Your bachelor’s degree studies can help you obtain many useful career skills, but they don’t have to be the end of your academic experience. If you want to increase your knowledge, branch out into other business fields, or prepare yourself for leadership or executive positions, consider going back to school.

A master’s degree in finance may be the natural choice after earning an undergraduate degree in this area. During a master’s program, which usually takes about two years, you can study advanced topics in finance. What you can do with a master’s degree in finance varies, but you may be able to focus on a particular specialization area, such as investments or fraud.

If you’d like to pursue a slightly different track for your master’s degree program, you might be well-suited to pursue a Master of Business Administration with a concentration in finance or a different discipline. Another option is to get an accounting master’s degree.

Eventually, you might consider earning a doctoral degree in finance or a related field like economics. With a doctorate, you may pursue research or university faculty positions. A doctoral degree may also boost your chances of becoming a chief financial officer.

What Can I Do with a Finance Degree Now?

There are many choices available for entry level finance degree jobs. All sorts of organizations need finance professionals, so you can search for a position with an employer whose interests align with yours.

Many finance major jobs are with corporations. In the finance department of a business, you might take care of financial analysis, budget analysis or accounting.

In a large organization, you might be responsible for a narrow set of tasks, but a smaller company might put you over a mix of finance-related responsibilities. As you gain experience, you may be able to move into a managerial role.

Financial institutions are another good place to look for jobs. You could search for a position as a loan officer at a local or national bank. As an investment banker, you might conduct electronic trades. You may enter this type of work as a brokerage clerk.

Working in the insurance industry is another popular option for finance majors. Insurance companies need underwriters who evaluate whether policies should be issued to applicants. Although software can help with the decision-making process, you may be responsible for collecting data and making the final call.

Editorial Listing ShortCode:

The world of finance extends beyond corporations, banks, and insurance companies. Just as organizations need financial guidance, so do individuals.

If you’d rather work one-on-one with families to plan their financial futures, you can use your finance degree in that capacity. Personal financial planners may work independently or for a financial services firm.You could also hold a finance position that’s similar to the work you’d do in the corporate world but with a different type of organization. For example, charitable nonprofits need financial pros to manage their money. Other groups that may need your expertise include:

- School districts

- Universities

- Healthcare clinics

- Religious institutions

Federal, state, and local governments hire many finance majors. For example, revenue agents make sure that taxes are paid on time and correctly. Financial examiners determine whether organizations are complying with government regulations.

Finance Careers – What Is the Outlook?

The U.S. Bureau of Labor Statistics projects a 5% growth rate for business and finance jobs over the next ten years. This growth is expected to lead to 476,200 new jobs during this time.

Finance jobs that are expected to have a growth rate that’s similar to the industry average include:

- Financial examiner (7%)

- Financial analyst (5%)

- Loan officers (3%)

- Personal financial advisors (4%)

- Real estate appraiser (3%)

- Securities, commodities, and financial services sales agents (4%)

Some finance jobs are expected to experience more significant growth rates, and people with the skills to fill those positions may find themselves greatly in demand.

Financial manager is one such job; a 15% projected growth rate means that approximately 108,100 new financial management positions are expected to be added over the course of the decade. Risk managers are especially needed.

Another promising career path is becoming an actuary. Job growth in this field is expected to be around 18%.

If you’re interested in this career, make sure to take plenty of math and statistics classes during your college program. It’s also a good idea to study computer science topics, including databases and programming languages.

Despite the promising overall growth in the field of finance, some finance major jobs are expected to see a decrease in growth over the next decade. Careers for which the number of positions is expected to go down include:

- Bookkeeper (-6%)

- Insurance underwriter (-6%)

- Tax examiner (-4%)

Although having a BA in finance or a BS in finance may affect your career prospects, but fortunately, there are plenty of jobs that offer better finance degree prospects.

Finance Degree Jobs

There are quite a few different options for jobs with a finance degree. When you’re considering possible career paths, it’s smart to take into account both the job description and the potential earnings. You’ll want to look not only for a job that pays well but also one that you’ll enjoy.

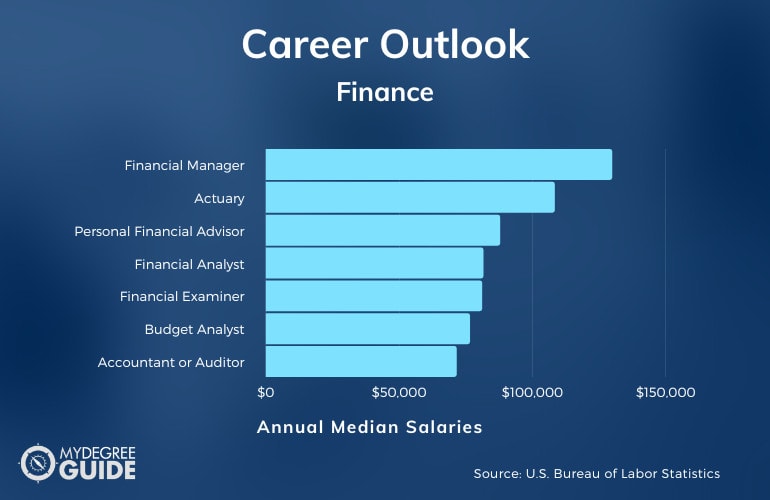

To help you figure out what to do with a finance degree, some careers, according to the Bureau of Labor Statistics, include:

| Careers | Overview | Median Annual Salary |

| Financial Manager | Oversee the financial operations of an organization | $129,890 |

| Actuary | Perform statistical analyses to evaluate risks | $108,350 |

| Personal Financial Advisor | Assist people in managing their money and making investment decisions | $87,850 |

| Financial Analyst | Help individuals or businesses decide how to invest money | $81,590 |

| Financial Examiner | Evaluate whether organizations’ financial practices comply with the law | $81,090 |

| Budget Analyst | Oversee the spending practices of an organization | $76,540 |

| Accountant or Auditor | Maintain or review financial records, including tax returns and account books | $71,550 |

| Insurance Underwriter | Determine whether insurance policies should be issued to applicants | $70,020 |

| Financial Services Sales Agent | Buy and sell commodities or securities | $62,270 |

| Loan Officer | Review loan applications to determine whether to lend money | $63,270 |

| Real Estate Appraiser | Determine the value of properties | $57,010 |

| Brokerage Clerk | Carry out clerical duties related to the buying and selling of securities | $52,750 |

| Real Estate Agent | Help others buy and sell properties or match tenants to rental units | $50,300 |

| Bookkeeping Clerk | Maintain records of the money that goes in and out of an organization | $41,230 |

Taking special-interest courses can help prepare you for one or more of these career paths.

What Are the Best Jobs for Finance Majors?

If you want to go straight from school to the workforce, what kind of jobs can do you? There are many entry level jobs for finance majors that require a four-year degree but little to no experience.

Path to Becoming a Financial Manager

Financial managers often make impressive salaries, but you need experience to land those positions. If you have your sights set on a management role, then, for right now, you’ll want to look for any job that could lead to that sort of promotion someday, such as:

- Loan officer

- Financial services sales agent

- Accountant

- Financial analyst

Each of these jobs is experiencing a growth rate of at least 3% and boasts a median salary of more than $60,000. With a 5% growth rate and a median salary of $81,590 per year (Bureau of Labor Statistics), the role of financial analyst may be the top pick among them.

How to Advance in Real Estate

A different line of work for finance majors to consider is real estate. Although a bachelor’s degree is not a must for this job, it can help you vie for competitive positions with some of the top agencies in your area. Plus, your college classes may help you prepare for the real estate licensure exam.

In real estate, advancement often comes with experience. The better you get at overseeing property sales and purchases, the more commission you’ll likely earn. The top 10% of real estate agents make over $111,800 each year (Bureau of Labor Statistics). Experience may also qualify you to take the brokerage exam and open your own agency someday.

Satisfaction of Financial Planning

Helping individuals and families create solid plans for their futures can be a personally rewarding career path.

You can start this job with a bachelor’s degree in finance, and then add certifications and education as you go. For example, obtaining Certified Financial Planner status can help you attract new clients. Over time, you may also want to become licensed to offer services like buying stocks for your clients or selling insurance.

Eventually, you may move into senior management or open your own business.

Questions Related to Earning a Finance Degree

Here are our answers to a few more questions that might be on your mind in regards to finance degrees and what you can do with them post-graduation.

What’s the Difference Between Finance and Accounting?

You can think of accounting as looking backward and finance as looking ahead. The discipline of accounting usually addresses records of financial transactions that have already occurred, while the discipline of finance deals with future financial projections.

That’s why finance majors often do jobs like underwriting, risk management, and securities trading. They can even be found doing work as assistant directors of finance or personal accountants, as well as accounting coordinators. Still, there’s a good chance that you can use your finance degree to work as an accountant or enroll in an accounting master’s program.

So if your deciding between an accounting vs finance degree, just know that they may both lead to the same careers as they deal with very similar concepts and coursework.

Can You Tell Me What to Do with a Finance Degree and No Experience?

There are numerous career paths you may pursue with a finance degree. Nearly all finance major careers begin with entry level positions. Consider looking for a job as a junior financial analyst, a loan officer, or an accountant.

To get your foot in the door, you may need to start as a bookkeeper, a brokerage clerk, or a bank teller and work your way up through the organization’s ranks.

How Much Does a Finance Major Make Out of College?

The average salary for entry level finance majors can vary greatly from one job to the next.

According to the Bureau of Labor Statistics, the average salary of the bottom 10% of financial analysts is less than $47,230 each year. The lowest paid financial examiners earn less than $43,500. Security sales agents may have an average salary that’s less than $35,320 each year. Your geographic region will influence your salary too.

Should I Get My Masters in Finance?

Pursuing a master’s degree in finance may open a variety of additional opportunities that weren’t available before:

- Obtaining better resources in finance may qualify you for higher level careers that weren’t open previously

- Higher level financial careers often include a bigger salary. Financial managers average $129,890 per year (Bureau of Labor Statistics)

- You may receive greater individual responsibilities from your current company

Pursuing a master’s degree in finance can help you develop greater knowledge in finances which can help create the ability to move up the ranks in companies quicker.

Is Finance a Good Degree?

Yes, finance is a good degree for many undergraduate students. The Bureau of Labor Statistics is projecting 5% job growth in business and financial occupations over the next 10 years.

There are so many answers to the question of what to do with a finance degree that it can make your head spin: analyst, advisor, underwriter, stockbroker, loan officer, real estate agent, and more.

In other words, a finance degree can help open the door to a world of possibilities, including plenty of entry level finance degree jobs. If you’re excited by working with numbers and like the idea of landing a profitable job with advancement opportunities, then you may want to start submitting your finance school applications.