Explore MBA in Finance online programs. Compare schools and see the career outlook for an MBA Finance degree.

An MBA Finance degree online can help you become an expert in derivatives, securities, and portfolios and potentially earn a yearly salary of $50,000-$184,000 (Bureau of Labor Statistics.

Editorial Listing ShortCode:

Taking online business classes can help give you the freedom to get a finance education in a way that suits your schedule. With an online MBA in Finance, you can work toward becoming the financial leader that businesses need.

What MBA in Finance Specializations Are Available?

Finance is an extensive field with many different branches and areas of specialty. Whether you have a BA vs BS Finance or another business degree, you may want to become an expert in one particular aspect of finance by pursuing a degree concentration.

Click on the area you’re interested in to jump to that part of the page.

- Cashflow Performance

- Capital Markets

- Economics

- Financial Statement Analysis

- Future Markets

- International Finance

- Investments

- Personal Finances

- Real Estate

Each concentration can help prepare you for a related but different career path with nuanced job opportunities. You could also enroll in a general Finance program to gain a broad overview of the field.

Cash Flow Performance

Where does an organization’s cash come from, and where does it go? Experts in cash flow performance are prepared to perform in-depth analyses so they can answer those questions.

A cash flow performance concentration for your finance degree can help you gain the necessary expertise to enter into this field.

In this program, you may review the skills necessary for preparing and reading cash flow statements. More importantly, you can learn to analyze the data and draw conclusions from it. Those skills can better equip you to forecast future cash flow trends.

Editorial Listing ShortCode:

After completing your program, you may want to pursue Certified Treasury Professional status.Your training in cash flow performance can help prepare you to work for a company as their cash manager. Related positions in which you may be able to apply your expertise include treasury analyst, project controller, pricing specialist, or credit manager.

Capital Markets

Does the world of buying and selling stocks and bonds fascinate you, or have you always wanted to be involved in securities trading? If so, you might be a great fit for a program focused on capital markets.

This may be a top choice for those with a desire to go into portfolio management or commercial banking.

For this program, you may take classes like Portfolio Theory, Trading Strategies, Emerging Markets, and Advanced Financial Modeling. You may study bond markets, annuities, real estate, and equilibrium pricing as well.

Editorial Listing ShortCode:

After completing your finance MBA, you may want to prepare for the Chartered Financial Analyst certification program.

This may be a good degree option for those who want to go into commercial or investment banking. You might also apply your skills as an equity analyst or a compliance manager.Other options include becoming a private wealth manager, a hedging analyst, a portfolio manager, or a risk analyst.

Economics

Although economics is sometimes a theoretical discipline, an MBA program can help you learn to apply economic theories to real-world business situations.

Having a keen understanding of economics can help you understand why markets behave the way they do, and it can also better equip you to make informed business decisions.

In this program, you will likely explore both microeconomics and macroeconomics. You can get opportunities to discover ways that economic policies and conditions can affect business and how that necessitates different corporate strategies in different areas of the world.

Editorial Listing ShortCode:

This program may also help you hone your statistical skills. The curriculum may include Economics-based Business Decisions, Global Monetary Policy, and Economic Analysis.

This degree may help you become an economist or a data scientist. If you want to work in a corporate setting, you could consider pursuing a career as a financial analyst or an economic forecaster. Potential employment settings include government, insurance, banking, and manufacturing.

Financial Statement Analysis

Finance professionals spend a good deal of time working with financial statements. If you want to get the most out of these documents, it can be smart to gain expert-level knowledge about analyzing the data they contain.

With a financial statement analysis specialization, your likely topics of study will be balance sheets and income statements. Strong math skills can help you calculate various ratios that are used for analyzing business performance; these include leverage ratios and liquidity ratios.

These calculations can help you evaluate how well a company is performing over time and how it compares to competitors.

Editorial Listing ShortCode:

Your statement-analysis skills may be used within a company to analyze how various departments are performing and serve as a guide for future business decisions.

Alternatively, you might be employed by an outside company to make determinations about issuing credit or investing in a product. Look for job titles like financial analyst or credit analyst.

Future Markets

Whether you’re interested in currencies or commodities, if you have a knack for futures, then consider how you could hone your skills with a concentration in future markets. This specialization can help you gain expert knowledge about working with index futures.

The courses for this concentration typically cover topics like derivatives, hedging, price risk, and arbitrage. You may study the ins and outs of futures contracts and become an expert on both short-term and long-term interest rate futures.

Editorial Listing ShortCode:

Learning to use options calculators is a valuable skill that you can likely gain from this program, and you may also become familiar with various options-pricing models.

As an expert in this area, you might be able to land a position as a securities operations specialist, a commodities and derivatives process specialist, or an execution specialist. You might also work for a government regulatory agency like the Commodity Futures Trading Commission.

International Finance

The global economy has a strong effect on business happenings at home. Even if you maintain only domestic operations, you’ll probably still feel the influence of international policies.

If your organization has associates, partners, or office locations worldwide, then a specialization in international finance may be even more critical to your everyday activities.

Likely courses for this program include Cross-cultural Business Relationships, Global Marketing, and Foreign Currency Systems.

Editorial Listing ShortCode:

The classes can help prepare you to offer management services for teams that span the globe, navigate economic policies in various countries, and formulate strategies for worldwide growth.

You may analyze case studies from real-world businesses, and there may also be opportunities for overseas practicums or internships.Your studies may prepare you to hold a finance position in a foreign country or with a company that has a global reach. Those in logistics and imports and exports may find this degree especially useful.

Investments

Managing investment portfolios is a serious responsibility. Providing quality financial services requires a keen understanding of markets, financial institutions, and forecasts.

To gain the education that can help you rise to the top in this field, consider a specialization in investments or investment management.

Common topics of study in this program are statistics, fiscal policy, central banks, and portfolio analysis. The discussion of how ethics should play a role in investment management will probably be an important focus in your studies as well.

Editorial Listing ShortCode:

You may have opportunities for hands-on practice with financial databases, or you may get to manage a real portfolio as part of your studies. The classes may set you on the path to obtaining Chartered Financial Analyst certification.

Those interested in pursuing careers as investment bankers or wealth managers may want to consider this degree. Your studies may also help you get a job as a controller, an acquisitions manager, or a treasury director.

Personal Finances

Although many finance students work with large corporations or government agencies, you might be more interested in helping individuals and families get their money in order. A concentration in personal finances can help you achieve that goal.

Your studies can help you obtain the tools needed to help others make wise decisions about setting money aside for retirement, making investments, and navigating tax issues.

Editorial Listing ShortCode:

This program can help you learn to work with those who have only a little cash to invest and to provide estate management services for those with a great deal of wealth. To demonstrate your expertise in this field, you may want to pursue Certified Financial Planner credentials after completing your program.

Some financial advisors go into business for themselves. Others take jobs with financial planning firms. You might be a financial planner who works with a variety of clients, or you might focus solely on managing the portfolio of just one well-to-do client.

Real Estate

Dealing with residential properties may have provided a good start for your real estate career, but commercial real estate is likely to present fresh challenges and complications.

A finance MBA with a real estate specialization can help you gain the know-how you need for a career in commercial real estate.

You’re likely to start your degree program with an introductory class that provides an overview of commercial real estate.

Editorial Listing ShortCode:

After that, you may study the markets involved in commercial transactions, the loans that make significant purchases possible, and the concept of real estate as an investment. You may also learn to evaluate the real estate market and appraise commercial properties.

After completing your MBA, you may want to become a commercial real estate broker. This degree can also prepare you for a career in mortgage lending, urban planning, global housing, or real estate taxation.

Courses for MBA in Finance Programs

In any MBA program, you’ll likely take a core set of business classes that are useful to leaders throughout the business world. The concepts taught in those classes can be applied in settings from accounting to human resources to management.

For a degree that focuses on finance, you may also take concentration-specific courses. In those classes, you can get opportunities to learn from experts in the world of finance and develop detailed knowledge about financial theories, formulas, and skills.

Your list of business and finance classes may resemble the sample curriculum below.

Business Analytics: This course is designed to give an overview of the ways that analytics professionals are using data to inform business decisions. You’ll likely study big data, statistical modeling, and database tools.

Econometrics: Your class in econometrics can help you learn how to apply your analytics skills in finance settings. You may practice using Stata and explore topics like linear and nonlinear regression.

Global Finance: This part of your master’s program can expose you to the benefits and complications of doing business with people from around the world. You may discuss economic policy, currency, imports, exports, and international markets.

Markets and Financial Institutions: Taking this class can help you become more familiar with the banking and insurance industries as well as the concepts of capital and secondary markets.

Organizational Leadership: This class can help you learn how to provide effective direction for teams and companies through your study of organizational strategy, ethical leadership, and group behavior.

Wealth Management: This class can help you learn about portfolio management and estate planning for the wealthy. Topics may include bonds, equities, taxation, and trusts.

You may wrap up your studies with a capstone experience or a culminating project. These final requirements vary among schools, but you may prepare a thesis, consult on a real-world business problem, or complete an internship.

What MBA Finance Jobs Could You Get?

Finance professionals possess valuable skills that are in demand by all sorts of organizations. With your online finance MBA, you can seek employment with an organization that aligns with your goals, values, and interests, or you can go into business for yourself.

Financial Institution

If your passion for studying finance stems from a desire to be directly connected to the markets, then you may want to work for a financial institution. For example, you could pursue work as a sales agent who deals with the buying and selling of securities and commodities.

You might perform risk management for an insurance company, head up a commercial banking department, evaluate whether to issue credit or loans or work as a hedge fund manager.

Government

The government needs finance professionals as well. Those who work in taxation often have a finance background; for example, you might be a tax examiner or a tax collector.

Another option would be to work for a regulatory agency like the U.S. Securities and Exchange Commission (SEC). You might also work as a budget analyst for a government organization. Government finance jobs are available at the national, state, and local levels.

Businesses and Organizations

Organizations that aren’t primarily focused on finance still need the services of finance experts. The finance department is a significant sector of many large corporations. There are people who deal with taxation and legal compliance.

Others serve as financial analysts who look through the data to make recommendations about business decisions, budget analysts who oversee spending, or purchasing agents who deal with pricing and procurement contracts.

Financial managers may supervise many of these tasks, and chief financial officers carry the ultimate responsibility for an organization’s finances.

Healthcare organizations, school systems, and nonprofit groups need this sort of financial expertise as well. If you care deeply about the mission of a particular group, you can contribute to the effort by providing strong financial leadership.

Wealth Management

By managing an organization’s funds or investments, you can help ensure that they’ll have plenty of money with which to keep doing their work. You might also serve as a financial consultant who helps organizations get their finances in line.

Assisting others in managing money is another important role that finance professionals can play. As a wealth manager or a private banker, you could provide portfolio and estate-planning services for the ultra-rich.

Less well-to-do families need financial guidance as well; as a personal financial advisor, you can provide help with investments, insurance, retirement planning, and taxation issues. These jobs can be done as a member of a financial services firm, or you could work independently.

Academia

As an expert in this field, you can also provide academic leadership for others. You might become an economic researcher or a data scientist who develops new insights into trends, patterns, and forecasts.

Up-and-coming finance students need college professors who will help them learn about business and finance. With a master’s degree, you could potentially teach courses at community colleges and some four-year schools, and earning a doctorate might help you advance in academia.

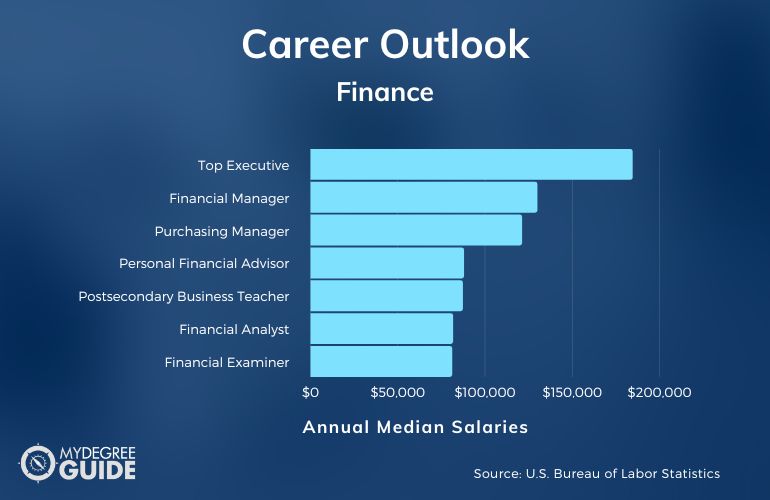

MBA in Finance Salary

How much can you earn after completing your MBA program with a finance concentration? The answer will depend on the type of job you decide to pursue. The following table highlights the outlook for various finance careers, according to the Bureau of Labor Statistics.

| Career Category | Example Titles | Median Annual Salary | Job Outlook Over the Next 10 Years |

| Top Executive | Chief Financial Officer | $184,460 | 4% growth |

| Financial Manager | Controller, Credit Manager, Risk Manager | $129,890 | 15% growth |

| Purchasing Manager | Buyer, Procurement Manager, Materials Manager | $121,110 | 7% decline |

| Personal Financial Advisor | Wealth Manager, Private Banker | $87,850 | 4% growth |

| Postsecondary Business Teacher | Professor | $87,200 | 9% growth |

| Financial Analyst | Risk Analyst, Portfolio Manager | $81,590 | 5% growth |

| Financial Examiner | Consumer Compliance Examiner | $81,090 | 7% growth |

| Budget Analyst | Senior Budget Analyst | $76,540 | 3% growth |

| Insurance Underwriter | Commercial Lines Underwriter, Life Insurance Administrator | $70,020 | 6% decline |

| Loan Officer | Mortgage Loan Officer, Loan Underwriter, Commercial Loan Officer | $63,270 | 3% growth |

| Sales Agent | Broker, Financial Services Sales Agent, Investment Banker | $62,270 | 4% growth |

| Tax Officer | Tax Examiner, Tax Collector, Revenue Agent | $54,890 | 4% decline |

| Real Estate Professional | Real Estate Agent, Real Estate Broker, Commercial Broker | $50,730 | 2% growth |

Average salaries are based on a broad sample of professionals from across the country. Salaries vary with experience and location. To see an even larger average annual salary, try pursuing a PhD in finance online.

Professional Organizations for those with an Advanced Finance Degree

Professional associations provide opportunities to network with others in your field or find promising new jobs. Membership in these organizations may give you access to classes, certification programs, publications, discounts, or online libraries.

You may have opportunities to learn from other finance professionals through online forums, annual conferences, or local chapter meetings.

American Association of Finance & Accounting

The mission of the American Association of Finance & Accounting (AAFA) is to connect finance professionals to job openings in the field. Individuals who are looking for jobs are invited to submit resumes that can be directed toward corporate recruiters.

Companies rely on AAFA’s services to help them identify screened, qualified candidates for their positions.

The organization works with a number of affiliates with a presence in local markets. Staffing organizations and recruitment firms can become AAFA members for the opportunity to help match candidates to open positions.

The Association of Accountants and Financial Professionals in Business

The Institute of Management Accountants (IMA) is also referred to as the Association of Accountants and Financial Professionals in Business. Membership in this group is open to financial managers, accountants, finance school faculty members, and finance students.

Benefits of membership include access to continuing education classes, tools for career assessment, access to industry publications, and opportunities to network with other professionals through social media. You can also engage with one of IMA’s many local chapters.

IMA administers the Certified Management Accountant (CMA) and Certified in Strategy and Competitive Analysis (CSCA) programs. CMA candidates automatically receive IMA membership.

Association for Financial Professionals

The Association for Financial Professionals (AFP) primarily focuses its efforts on professionals who work in corporate finance and treasury positions. The organization holds a large annual conference that is attended by people from around the world.

Even if you can’t attend the conference or other group meetings, you can still benefit from membership. The group offers opportunities for online discussion and learning.

Listening to the Conversations podcast can give you new ideas and knowledge. You can also read publications, get tips for advancing your career, and use online finance tools.

AFP administers two professional certifications: Certified Treasury Professional and Certified Corporate FP&A Professional.

Association of MBAs

The Association of MBAs (AMBA) is an exclusive group. Membership is limited to those who are currently enrolled in or have graduated from a graduate business program that has been accredited by the group.

If you don’t qualify for AMBA membership, you may still be able to join the separate community that is available for professionals who work at business schools.

As a member, you’ll get special access to the Ambition website. You can read book reviews and get discounts on new books. In addition, you can attend seminars, participate in webinars, view job postings, and use career-development tools.

Financial Planning Association

The Financial Planning Association (FPA) offers help and advocacy for Certified Financial Planners and those who support them, such as finance professors. Individual financial planners or finance students may qualify also for membership even if they don’t yet have CFP status.

By joining FPA, you will receive access to events like the FPA Annual Conference and the FPA Retreat. You can benefit from the group’s policy efforts and can join in FPA Advocacy Day activities.

Other perks include podcasts, social media communities, and publications; you may want to make your voice heard by contributing to these FPA outlets.

National Association of Women MBAs

For many years, the National Association of Women MBAs (NAWMBA) served to represent female MBA holders. The national group dissolved in 2019, but some universities still maintain local chapters.

These groups operate independently, so each offers different benefits. There may be social events so you can network with others in the business program, or you may receive information about upcoming workshops and seminars of interest to MBA students.

Although the national NAWMBA group has ceased operations, you can still visit the organization’s Career Center website. You can find job-hunting tips as well as information on current openings for business professionals.

National Black MBA Association

The National Black MBA Association (NBMBAA) exists to encourage and support African American business professionals, but people of any ethnic or racial background are welcome to join.

Students are invited to participate in the group as well, and some schools are part of the Collegiate Partnership Program.

In addition to an annual conference, the organization runs programs like the Black Think symposium, the Scale-Up Pitch Challenge, and the Leaders of Tomorrow mentoring service.

As a member, you can access webinars and discounted certification programs. You can also participate in local activities through your city’s chapter.

Prospanica

Originally known as the National Society of Hispanic MBAs, Prospanica now bills themselves as “The Association of Hispanic Professionals.”

Membership in this group can help you continue to grow as a business leader. You may be able to earn a scholarship, enroll in discounted certification programs, or participate in workshops or the annual conference.

You’ll receive copies of the newsletter, and you’ll be able to take advantage of exclusive savings offers. To help you connect with others in your local area, the group has chapters in cities and universities across the country.

Certification and Licensure Following a Finance Master’s Degree

To advance your standing among fellow MBA holders and further your career opportunities, consider pursuing professional certifications. Through certification programs, you can expand your knowledge and demonstrate your proficiency in a particular area.

- Certified Financial Planner: The CFP designation is for those who want to show their commitment to helping people make reliable financial plans. Not only does being a CFP demonstrate that you have the know-how to help people work through their money problems, but it also signifies that you subscribe to a trustworthy code of professional ethics. CFP Board manages this program.

- Certified Public Accountant: Becoming a CPA can be a worthwhile goal for professionals in the accounting, taxation, and auditing industries. Regulations on CPA licensure vary from state to state. No matter where you live, though, you’ll have to pass the Uniform CPA Examination if you want to qualify for this credential. The test is administered by the American Institute of CPAs (AICPA).

- Chartered Financial Analyst: As you prepare for your CFA certification, you’ll need to study topics like assets and portfolio management. Holding this credential serves as proof that you are an investment expert whom others can trust with their money. Earning it usually takes about four years because it requires passing three separate tests. CFA Institute runs this certification program.

Gaining these credentials will require you to pass rigorous exams. Before beginning, you’ll need at least a bachelor’s degree. On top of the education you’ve already gained, you’ll probably need to commit a significant block of time to test prep.

Accreditation for an Online Finance MBA Degree

Industry organizations provide programmatic accreditation to select business programs. Choosing a school with this type of accreditation ensures that you can learn from a curriculum that meets or exceeds industry standards.

There are multiple organizations that accredit business schools.

- Association to Advance Collegiate Schools of Business: Business programs at over 800 schools around the world have received accreditation from AACSB International. Colleges that hold AACSB’s main accreditation can also apply for the organization’s accounting-specific accreditation.

- The Accreditation Council for Business Schools and Programs: ACBSP accredits business programs at the associate’s, bachelor’s and graduate levels. Schools can pursue just the main business program certification, or they can seek to add on the accounting certification as well.

- The International Assembly for Collegiate Business Education: IACBE relies on program outcomes to determine whether to approve applicants for accredited status. The organization’s main focus is on schools’ business programs, but a select few colleges have received accounting accreditation as well.

This type of accreditation is worthwhile since potential employers should appreciate knowing that you attended an accredited school.

Even more important, though, is regional accreditation. You should consider colleges that are officially recognized by one of the country’s regional accreditors.

Credits from regionally accredited schools are more likely to be able to transfer to other schools, and federal financial aid can’t be applied toward the tuition at unaccredited schools.

Financial Aid for an MBA in Finance Online

MBA programs often cost tens of thousands of dollars. If you’re worried about how to fund your graduate education, it’s time to start thinking about financial aid. Compiling a well-rounded assistance package can help you afford to go back to school.

The first thing that you should do to learn about your financial aid options is to fill out and submit the Free Application for Federal Student Aid (FAFSA).

The federal government uses this information to determine which of their programs can benefit you. Other organizations may rely on your FAFSA data as well.

Federal assistance programs you may be able to use include:

- Grants

- Low-interest loans

- Work-study

Your state government may offer similar programs, and you may be able to take advantage of both federal and state aid.

To make school as affordable as possible, don’t rely only on government assistance. You can also look for financial aid from private sources.

Private aid may include:

- Employer tuition assistance

- Fellowships

- Scholarships

- Non-government loans

- University payment plans.

Fellowships and scholarships may be awarded by your college, a national organization, or a group in your community.

Can You Get an MBA in Finance?

Yes, you can get an MBA in Finance. An on-campus or an online MBA degree program can help increase your business know-how and help you gain marketable skills. To learn more about one particular aspect of business, you can select a specialty for your degree. Finance is a common one.

Common topics of study in an online MBA in Finance program are securities, derivatives, risk management, and financial institutions. Other topics may include portfolio management and financial planning.

You can select a more specific specialization for your degree if you’d like to become an expert in a certain branch of finance. Options may include economics or financial statement analysis.

Are There Any Online MBA Finance No GMAT Programs?

Yes, much like with MBA in supply chain management online programs, there are online MBA Finance no GMAT programs. The GMAT is a standardized test that tries to assess your readiness for graduate-level business programs, but not all schools rely on these exam results as part of the admissions process.

To save yourself the time and effort of test prep, look for no-GMAT finance schools instead. Some colleges rely on other admissions criteria to formulate their decisions. For these schools, you may be asked to submit essays, letters of reference, or resumes.

Other colleges grant GMAT waivers to select applicants. You may qualify for a waiver based on your past GPA or your work experience.

Are There Any Cheap Online MBA in Finance Degrees?

Yes, just as you may find low-cost MBA in healthcare management online programs, for example, there are also some cheap online MBA in Finance degrees available. The cost of an MBA can vary significantly from school to school. For the lowest tuition rates, look for an online program from a public university in your state. These schools typically offer reduced rates for in-state students.

Since most schools charge by the credit hour, you may spend less money if you select a school where completing the MBA program requires a low number of credit hours. Financial aid can help make your schooling more affordable. Grants and scholarships can be particularly beneficial.

What Jobs Can You Get with an MBA in Finance?

Finance professionals work in nearly every sector. As a financial manager, a budget analyst, or a purchasing manager, you might work for a large corporation or a smaller business. Hospitals, schools, religious groups, and community organizations need these same types of services as well.

Your degree can also help prepare you to work for a bank, a finance firm, an insurance company, or a government taxation agency. Options in these financial sectors include underwriter, credit analyst, revenue agent, loan officer, or stockbroker. Additional job options include commercial real estate agent or college finance professor.

How Much Does an MBA in Finance Make?

MBA salaries are largely determined by the position you hold. For example, loan officers make an average annual salary of $63,270, financial analysts earn an average of $81,590 each year, and financial managers may earn $129,890.

Salaries also vary based on years in the field and geographic location. The bottom 10% of financial managers earn $66,480 or less each year. The top quarter of earners make more than $173,920.

The highest-paying regions for this job category are metropolitan areas in New York, New Jersey, Delaware, District of Columbia, and Connecticut, according to the Bureau of Labor Statistics.

Which Country is Best for MBA in Finance?

If you’re planning to work in American companies, you might find that a business school in the U.S. is the best option for you. Plus, the U.S. has some of the world’s top business schools, and a domestic university may have connections to excellent opportunities for internships or mentoring in your local area.

Even still, there are benefits to studying through an overseas school. Overseas schools can expose you to different cultures and ways of thinking, which can prove useful in international business situations. Tuition rates are sometimes lower as well. Consider business schools in France, Singapore, or the United Kingdom.

List of Schools Offering an MBA in Finance Online

Methodology: The following school list is in alphabetical order. To be included, a college or university must be regionally accredited and offer degree programs online or in a hybrid format.

American University was chartered by an Act of Congress in 1893 and opened its doors to students in 1914.

The Kogod School of Business delivers the University’s online MBA program. It currently ranks No. 14 for best online finance MBA in the country by U.S. News & World Report in terms of career outcomes, academic rigor, and technological infrastructure.

- MBA in Finance

American University is accredited by the Middle States Association of Colleges and Secondary Schools.

Arizona State University, or ASU, is one of the largest universities in the United States by enrollment.

The school’s online MBA program offers students the chance to earn their degrees within 24 months. It focuses on developing leadership skills, together with advanced business strategies, finance, supply chain management, and marketing.

- MBA in Finance

Arizona State University is accredited by the Higher Learning Commission.

Arkansas State University was founded in 1909 and is currently the second-largest University in Arkansas by enrollment.

The school’s online MBA program aims to develop business skills for working professionals. It offers an excellent MBA program for students who want more flexibility in earning their degrees.

- MBA in Finance

Arkansas State University is accredited by The Higher Learning Commission.

Azusa Pacific University was founded in 1899 and currently has seven locations across Southern California.

Their online MBA program offers comprehensive classes with ultimate flexibility to students who want to earn a high-quality degree with minimal on-campus obligations. APU is known for its online courses, with excellent interaction between students and professors.

- MBA in Finance

APU is accredited by the WASC Senior College and University Commission.

Ball State University started accepting students in 1917. Its headquarters is in Muncie, Indiana, with two satellite facilities in Indianapolis and Fishers.

The University’s MBA program offers classes that deliver practical experiences applicable to the digital and global economy. The online program focuses on business strategies and ethics and leadership skills.

- MBA in Finance

BSU is accredited by Higher Learning Commission.

Benedictine University was founded in 1887 as St. Procopius College.

Their online MBA program is designed to teach students how to analyze and interpret financial inputs, allowing them to be more effective in managerial finance and assessment. It also focuses on evaluating an organization’s investments and portfolio.

- MBA in Finance

Benedictine University is regionally accredited by the Higher Learning Commission.

Colorado Technical University started accepting students in 1965. It has undergraduate, graduate, and doctoral degrees in business, management, and technology. Approximately 92% of students in CTU take online programs, including business administration.

With a concentration in finance and business administration principles, students can learn applicable business practices. The classes in their online MBA program focus on developing critical and analytical thinking.

- MBA in Finance

Colorado Technical University is regionally accredited by the Higher Learning Commission.

Dallas Baptist University or DBU opened its doors to students in 1898 as Decatur Baptist College. It now has campuses in Dallas, Plano, and Hurst.

Their MBA program offers a concentration in finance, aiming to develop a deeper understanding of financial management and investment strategies. Students of DBU’s MBA program are required to complete at least 36 credit hours.

- MBA in Finance

Dallas Baptist University is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

East Carolina University or ECU was founded in 1907 and is now the fourth-largest University in North Carolina. All academic facilities of the University are located on six properties, with an overseas campus in Italy.

The University’s College of Business has been AACSB-accredited since 1967. Only 5% of all business schools in the world have received this accreditation.

- MBA in Finance

East Carolina University is accredited by the Commission on Colleges of the Southern Association of Colleges and Schools.

Florida Institute of Technology or Florida Tech is a research university in Melbourne, Florida. It started accepting students in 1958 as Brevard Engineering College.

FIT’s innovative online MBA program allows students to access rigorous classes and faculty-monitored forums from anywhere. Its accreditation ensures a high-quality MBA education for every student.

- MBA in Accounting and Finance

- MBA in Finance

Florida Tech is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

Golden Gate University was founded in 1901 and has gained its popularity through its Law School and Business School.

Their MBA program combines the core skills needed for businesses of today, together with effective communication, team building, leadership, and executive presentation. Students can learn from instructors who have hands-on experience with the most successful businesses in San Francisco.

- MBA in Finance

Golden Gate University is accredited by the Western Association of Schools and Colleges.

Johnson & Wales University was founded in 1914 and became one of the most popular career-oriented universities in Rhode Island.

JWU’s online MBA program focuses on developing the students’ strategic, creative, and critical thinking skills. Students can receive lessons from successful industry leaders, making them competitive in an ever-changing business environment.

- MBA in Finance

JWU is accredited by the New England Commission of Higher Education.

The Marist Brothers founded Marist College in 1905. It was accredited by the state of New York in 1929 to offer more degrees to students, including a comprehensive MBA program.

The curriculum focuses on developing business leaders, decision-makers, and analytical thinkers. It is a combination of traditional MBA classes and current strategies for modern businesses.

- MBA in Finance Management

Marist College is accredited by the Middle States Commission on Higher Education.

Mississippi College is the oldest educational institution in Mississippi. Founded in 1826, the school currently has 5,000 enrolled students in different courses, including an online MBA program.

It is the only program in the state that allows students to earn their degrees without any on-campus obligation within one year.

- MBA in Finance

Mississippi College is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

North Carolina State University was founded in 1887 as a land-grant college and is now the largest University in the Carolinas. The university offers professional and online MBA programs, which have the same options as concentrations.

However, students need fewer credit hours to complete and have the chance to work closely with faculty and practice teamwork with other students.

- MBA in Financial Management

North Carolina State University is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

Nova Southeastern University consists of 18 colleges and schools with over 150 programs, including an MBA. NSU currently has 20,793 students enrolled in its system.

Their MBA with a major in finance develops students’ skills in business administration and topics on finance. The combination of knowledge and expertise makes students equipped in the economics of businesses.

- MBA in Finance

NSU is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

In 1898, Northeastern University opened its doors to students in Boston, Massachusetts. The University currently has 18,000 undergraduate and 8,000 graduate students enrolled in its system.

NU’s D’Amore-McKim School of Business delivers the MBA program. It gives students the opportunities to improve their business knowledge, and have the flexibility to pick their area of interest from eight in-demand concentrations.

- MBA in Finance

Northeastern University is accredited by the New England Commission of Higher Education.

Norwich University started accepting enrollees in 1819 at Norwich, Vermont. Since then, the University has produced some of the industry leaders in business, management, and finance.

Their MBA program is a dynamic hands-on curriculum that develops specialization in different fields of business. The program also promotes networking opportunities for students to get a headstart in building their connections.

- MBA in Finance

Norwich University is accredited by the New England Commission of Higher Education.

The Congress of the Confederation chartered Ohio University in 1787 and started accepting students in 1809. The University offers an online MBA program with a concentration in finance.

This degree is designed to help students learn the dynamics of the financial market, together with portfolio management and corporate finance. Fortune ranked the university’s MBA as the third most valuable in the United States.

- MBA in Finance

Ohio University is accredited by the Higher Learning Commission.

In 1998, the Pennsylvania State University launched the Penn State World Campus. It is an online campus with more than 150 online degrees and programs, including an MBA.

The program is led by the Smeal College of Business, ensuring that students receive world-class education through flexible schedules that fit the lifestyle and needs of every student.

- MBA in Finance

Penn State World Campus is accredited by the Middle States Commission on Higher Education.

George Pepperdine founded the Pepperdine University in 1937 in Malibu, California. It is now offering courses in seven facilities in California, one in Washington, and six international campuses.

Their MBA program from Graziadio Business School is currently the 73rd best part-time MBA program by U.S. News & World Report. It focuses on teaching students the strategies, technologies, and leadership that students need in a globalized marketplace.

- MBA in Finance

Pepperdine is accredited by the Western Association of Schools and Colleges – Senior College and University Commission.

Eight different schools build the Quinnipiac University, which includes the School of Business and Engineering, School of Health Sciences, and School of Law.

Their online MBA program offers the flexibility that matches the fast-paced business environment. It allows working professionals to solidify their chosen career path with minimal on-campus obligations, and without compromises in the quality of education.

- MBA in Finance

Quinnipiac University is accredited by the New England Commission of Higher Education.

Pat Robertson founded Regent University in 1977 as Christian Broadcasting Network University.

Regent University’s MBA with a concentration in Finance & Investing aims to prepare students in a competitive financial industry, with rigorous lessons for wealth management, and investment portfolio. It is among the best online MBA programs in the country by The Princeton Review.

- MBA in Finance & Investing

Regent University is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

Regis University started accepting students in 1877 in Denver, Colorado. It has five schools, including the Anderson College of Business.

Their MBA program focuses on helping students understand the core concepts of business, finance, and leadership. It aims to provide flexible education to working professionals who want to further their education in business and management.

- Professional MBA in Finance

Regis University is accredited by The Higher Learning Commission.

Saint Francis University was founded in 1847 on a 600-acre land in Loretto, Pennsylvania.

SFU’s Shields School of Business offers an MBA program with a concentration in finance that is designed to help students build a career path in a competitive financial market. Students have opportunities to learn skills that are useful in different fields, such as banking, real estate, financial planning, and portfolio management.

- MBA in Finance

Saint Francis University is accredited regionally by the Middle States Commission on Higher Education.

Saint Joseph’s University started accepting students in 1851 as Saint Joseph’s College. The University’s MBA program aims to develop students’ leadership skills, team building, management, and practical business knowledge.

It focuses on creating business leaders that have exceptional strategic and ethical business practices. This degree also aims to help working professionals build deeper foundations in different business-related skills.

- MBA in Finance

Saint Joseph’s University accreditation has been awarded by the Middle States Association of Colleges and Schools.

Samford University, formerly known as Howard College, started accepting enrollees in 1841. It is one of the oldest educational institutions in the United States.

The Brock School of Business delivers the University’s MBA program. It focuses on creating successful managers and business leaders in a competitive business environment.

- MBA in Finance

Samford University is accredited by the Commission on Colleges of the Southern Association of Colleges and Schools Commission on Colleges.

Southern New Hampshire University traces its roots back in 1932. Its headquarters sits between Manchester and Hooksett, New Hampshire.

SNHU became famous for its open enrollment policy, requiring students only to have a high school diploma, making it one of the fastest-growing universities in the United States. Their MBA with a concentration in finance combines long-term and short-term financial analysis.

- MBA in Finance

Southern New Hampshire University is accredited by the New England Commission of Higher Education.

St. Thomas Aquinas College is a liberal arts college in Sparkill, New York. It offers 35 majors across three schools: Business, Education, and Arts and Sciences.

The MBA program that they offer is for working professionals who want to pursue a degree in business management. Students can choose from the on-campus or online program to earn their MBA from STAC.

- MBA in Finance

St. Thomas Aquinas College is accredited by the Middle States Commission on Higher Education.

Stevens Institute of Technology was incorporated in 1870 and is now the oldest technological school in the United States.

Stevens’ MBA program focuses on providing education to working professionals and making sure that it aligns with their career goals. It combines tech-centric management courses and flexible classes that let students earn their MBA by exploring different disciplines.

- MBA in Finance

Stevens Institute of Technology is accredited by the Middle States Commission on Higher Education.

Syracuse University was initially in Lima, New York until the management moved it to Syracuse, New York in 1870.

The Martin J. Whitman School of Management develops and delivers the online MBA program. It focuses on developing core skills for business and finance, including investments, risk management, corporate finance, international finance, quantitative finance, and real estate.

- MBA in Finance

Syracuse University is accredited by the Middle States Commission on Higher Education.

Touro University Worldwide is an international institution based in New York. It currently has 30 schools in four countries and has 18,000 students enrolled in the system.

The university’s online MBA program gives students complete control over the place and pace of their education. With minimal on-campus obligations, working professionals can earn their degree in MBA with great flexibility.

- MBA in Finance

Touro University Worldwide is accredited by the WASC Senior College and University Commission.

The University of Colorado in Colorado Springs, or UCCS, was founded in 1965 and is one of the four universities in the University of Colorado system.

The MBA program offered by the University has evening classes that also gives students access to online courses since 1996. Their years of experience with online MBA ensures quality education recognized by employers worldwide.

- MBA in Finance

UCCS is accredited by the Higher Learning Commission.

The University of Colorado – Denver is one of the most important research institutions in Colorado. It receives more than $375 million in research grants every year.

The professors who handle on-campus lessons are the same professors who deliver the University’s online MBA program. Full-time professionals can also enjoy the flexibility of hybrid and online classes.

- MBA in Finance

CU Denver is accredited by Higher Learning Commission.

The University of Dallas started accepting students in 1956 and produced the sixth-highest percentage of students who participated in international programs.

The university’s MBA program offers a concentration in finance, which focuses on providing a deeper understanding of global markets, corporate finance, and portfolio management. The classes use state-of-the-art equipment to ensure quality education.

- MBA in Finance

The University of Dallas is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

The University of Delaware, or colloquially Delaware, is the largest in Delaware with four satellite campuses throughout the state.

The Alfred Lerner College of Business and Economics handles and delivers the university’s online MBA program. It aims to provide education to working professionals by offering great flexibility and advanced knowledge in their career path through concentrated coursework.

- MBA in Finance

The University of Delaware is accredited by the Middle States Commission on Higher Education.

The University of Kansas is a research university headquartered in Lawrence, Kansas. It has several satellite campuses and educational centers across the state.

The university’s school of business offers a unique approach to education to keep the students engaged. Students will take one class at a time for eight weeks, allowing them to immerse themselves with specific subjects.

- MBA in Finance

The University of Kansas is accredited by the Higher Learning Commission.

The University of La Verne started accepting students in 1891 and currently has different colleges, including the College of Business & Public Management.

The university’s MBA program has a unique approach in teaching by offering separate coursework for experienced professionals. This class ensures proper education for professionals who have at least three years of experience.

- MBAX in Finance

The University of La Verne is accredited by the Senior College Commission of the Western Association of Schools and Colleges.

The University of Maryland in College Park is a research university founded in 1856. It is the flagship of the University of Maryland system.

The Robert H. Smith School of Business designs and delivers the university’s online MBA program. It focuses on developing exceptional leadership, analysis, decision-making, and communication skills in a globally competitive market.

- MBA in Finance

University of Maryland is accredited by the Middle States Commission on Higher Education.

The University of Massachusetts Amherst, or UMass Amherst, is a land-grant university founded in 1863. It is a member of the Five College Consortium, with 1,300 faculty and at least 30,000 students.

The university’s Isenberg Online MBA focuses on providing working professionals with hybrid education from on-campus lessons and online platforms.

- MBA in Finance

The University of Massachusetts Amherst is accredited by the New England Commission of Higher Education.

The University of Massachusetts Global has over 25 campuses in California and Washington. The school’s MBA program is customizable, allowing students to take courses that match their career goals while ensuring high-quality education for working professionals.

It offers a concentration on accounting, strategic business management, entrepreneurship, international business marketing, data analysis, and organizational leadership.

- MBA in Finance

The University of Massachusetts Global is accredited by the WSCUC Senior College and University Commission.

The University of Miami, or UMiami, is a research university in Coral Gables, Florida. It was founded in 1925 and currently has 12 separate colleges with research facilities in southern Miami-Dade County.

UOnline’s Professional MBA program focuses on teaching students who want to gain a deeper understanding of a business’ core concepts without enrolling in a full-time, on-campus program.

- MBA in Finance

The University of Miami is accredited by the Commission on Colleges of the Southern Association of Colleges and Schools.

The University of Nebraska–Lincoln is a research university in Lincoln, Nebraska. It was founded in 1869 and is currently the oldest and largest in the University of Nebraska system.

The MBA program lets students earn their degrees within 18 months. Working professionals can earn their degree within three years, and students can stretch their course for up to 10 years.

- MBA in Finance

The University of Nebraska-Lincoln is accredited by the Higher Learning Commission.

The University of North Carolina in Chapel Hill is a research university founded in 1789. It is one of the oldest universities in the United States.

The university’s MBA program focuses on providing an excellent foundation in the competitive financial sector, with a concentration in capital markets, tax, mergers and acquisitions, and financial reporting.

- MBA in Finance

UNC – Chapel Hill is accredited by Southern Association of Colleges and Schools Commission on Colleges.

The University of North Texas is a research university founded in 1890. It is a part of the University of North Texas System, together with universities in Dallas and Fort Worth.

The university’s online MBA program includes business analytics, finance, business management, marketing, business studies, and strategic management. These classes aim to help students stand out in global trade and corporate finance.

- MBA in Finance

The University of North Texas is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

The University of Saint Mary started accepting students in 1863. It was initially a school for women but is now a coeducational institution.

The school offers an MBA with a concentration in finance, which is designed to help students develop core strengths in corporate investments and assets. It has an accelerated finance degree curriculum, giving students the opportunity to earn their degrees in 1 year.

- MBA in Finance

The University of Saint Mary is fully accredited by Higher Learning Commission.

The University of Wisconsin – Whitewater, or UW – Whitewater, is part of the University of Wisconsin system. It has 1,400 faculty members and receives enrollment from students in 40 states and 30 countries.

The university’s MBA provides emphasis in corporate financial management, financial planning, and investments. The state-of-the-art investment tools provide theoretical developments for a better learning experience.

- MBA in Finance

University of Wisconsin-Whitewater is accredited by Higher Learning Commission.

Villanova University is a research university in Radnor Township, Pennsylvania. It was founded in 1842 and is currently one of the oldest universities in the state.

The university’s online MBA program focuses on technological advancements in business and global trade. The professors handling on-campus classes also manage online programs, giving flexibility without compromise in the quality of learning.

- MBA in Finance

Villanova University is accredited by the Middle States Association Commission on Higher Education.

Washington State University, or colloquially Wazzu, is a research university in Pullman, Washington. It was founded in 1890 and is one of the oldest land-grant universities in the American West.

The university offers an online MBA program that aims to create confident business leaders. It gives students the advantage of a robust curriculum, with emphasis on global business and entrepreneurship.

- MBA in Finance

Washington State University is accredited by the Northwest Commission on Colleges and Universities.

Wright State University is a research university in Fairborn, Ohio. It was named after the aviation pioneers, the Wright brothers, and became an independent institution in 1967.

The school’s MBA program is designed to help students stand out in a globally competitive financial market. The program also provides multiple flexible scheduling options, allowing professionals to earn their degrees comfortably.

- MBA in Finance

Wright State University is accredited by the Higher Learning Commission.

Is an MBA in Finance Worth It?

Yes, an MBA in Finance is worth it for many students. The Bureau of Labor Statistics is projecting 5% job growth in business and financial occupations over the next 10 years. Common careers in this field include chief financial officer, financial manager, financial analyst, and loan officer.

Finance is a dynamic field with many opportunities for employment and advancement.

If you enjoy thinking about money and economics, analyzing data, and solving problems, then a finance concentration for your MBA may be suited for you.

Prepare for the next phase of your education and career by researching online MBA schools. Send applications to the ones with the finance specializations, curriculum, faculty, and format that appeal to you.

In an MBA in Finance program, you can get opportunities to advance your knowledge under the guidance of experienced business experts.