An online economics degree can potentially be the first step toward an exciting career as an economist, an analyst, or a financial professional.

In an economics program, you may learn about not only money but also the distribution of resources. It’s a fascinating subject that touches nearly every aspect of life.

Editorial Listing ShortCode:

If economics sounds like the right field of study for you, you may want to take a look at what’s involved in this college program and where a degree could take you.

Online Bachelors in Economics Degrees

Economics is a popular bachelor’s degree program for many college students. For people who are interested in numbers and finance, this can be an intriguing field. Plus, the principles learned in this program can be applied in many different sectors.

Topics covered in economics programs at the bachelor’s level often include:

- Econometrics

- Economic policies

- Financial markets

- Macroeconomics

- Measurement and modeling

- Microeconomics

- Statistics

Some economics students choose concentrations for their degrees. The availability of concentrations varies from school to school.

One concentration possibility is economic analysis, which focuses on theoretical concepts and econometric models. Another option could be public policy, which explores how economic ideas can shape policy development.

A bachelor’s degree in economics may be offered as a Bachelor of Arts (BA) or a Bachelor of Science (BS). Some colleges offer both programs so that students can choose.

Editorial Listing ShortCode:

You may have the opportunity to complete an internship during your college program. If you’re an online student, you might be able to do the internship in your local area. Even if you don’t want to commit to a full internship, you could gain valuable career insights from job-shadowing experiences.

Some graduates go on to work in banking or finance. Others join the business world in a position related to auditing, accounting, or benefits administration. Other job possibilities related to economics include personal financial advisors and actuaries.

Of course, many economics majors want to work as economists. There may be entry-level economist roles available for those with a bachelor’s degree.

More senior roles for economists are usually reserved for professionals with graduate degrees. Fortunately, you may be a prime candidate for graduate programs in economics once you’ve completed your bachelor’s in the field.

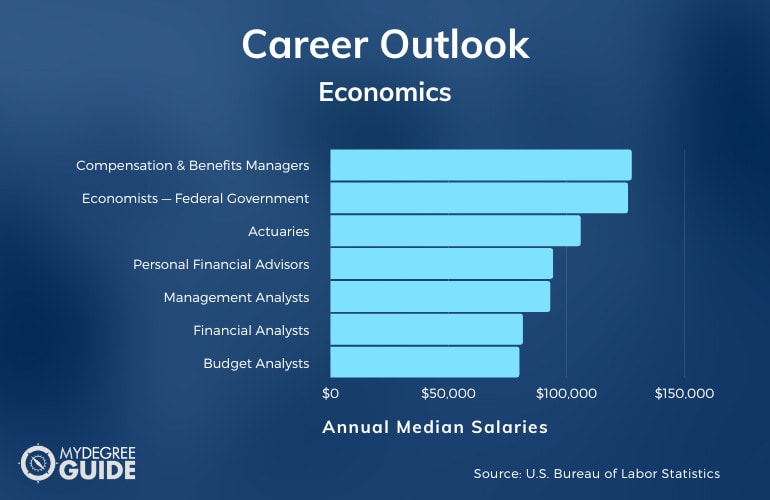

Economics Careers and Salaries

The first job that comes to mind when you think of an online bachelors degree in economics may be the role of economist. That’s a great goal, but it might not be your first position right out of college. Instead, you may first need to get more education and experience.

There are some entry-level economist positions with the federal government that only require a bachelor’s.

Fortunately, economics is a versatile field of study that can prepare you for a lot of different jobs. You may be able to do many of them with just a bachelor’s degree.

Economics majors are often analysts of one sort or another. For example, your training in numbers, statistics, and analysis could help prepare you for the responsibilities of a financial, market research, budget, management, or credit analyst position.

According to the Bureau of Labor Statistics, economists earn an average annual salary of $113,990, but that job usually requires a master’s degree.

Your bachelor’s degree could help you qualify for job opportunities like the ones listed below (BLS).

| Careers | Annual Median Salaries |

| Compensation and Benefits Managers | $131,280 |

| Actuaries | $113,990 |

| Economists | $113,940 |

| Personal Financial Advisors | $95,390 |

| Management Analysts | $95,290 |

| Financial and Investment Analysts | $95,080 |

| Budget Analysts | $82,260 |

| Credit Analysts | $78,850 |

| Accountants and Auditors | $78,000 |

| Compensation, Benefits, and Job Analysis Specialists | $67,780 |

Education requirements for the above jobs can vary by employer, but an economics bachelor degree can help qualify you in many cases.

Because of your knowledge of money and markets, you might be able to help people with their finances and investments. Some graduates work as personal financial advisors, working for firms or running their own businesses.

Some graduates work at banks. For example, they may become loan officers. Others deal with money matters for companies as accountants or auditors. Accountants can also take care of taxes and other financial matters for individuals.

Editorial Listing ShortCode:

Another related line of work is being an actuary. Becoming an actuary requires taking industry exams and becoming certified. This position involves evaluating and planning for financial risks, and actuaries often work for insurance companies.

Economics also factors into decisions that companies make about their compensation plans. Some college graduates work in the compensation and benefits departments of organizations.

Bachelor in Economics Curriculum & Courses

During an economics bachelor’s degree program, you’ll likely take a variety of courses related to money, markets, statistics, and analysis. Here are examples of common economics courses and what they typically entail:

- Analyzing Economics: You can learn how to measure economic information and create mathematical models of data.

- Computer Programming: Gaining a working knowledge of computer programming techniques can help you develop or run useful programs for performing economic analysis.

- Econometrics Foundations: In this first class on econometrics, you’ll put previously learned statistical skills to work as you evaluate economic data.

- Economic Growth and Development: You can examine case studies as you explore factors that spur financial growth and capital development.

- Economics for Public Policy: You’ll discuss ways that economic matters influence public administration and governmental decisions.

- Economics History: A history-focused course will introduce you to major thinkers, theories, and schools in the field of economics over the last several centuries.

- Global Economics: This course can cover topics like exchange rates, international trade, and financial markets.

- Introduction to Banking: You’ll get an in-depth look at financial institutions and banking activities.

- Macroeconomics: In a course on macroeconomics, you’ll focus on big-picture principles—those related to nationwide or industry-wide economic issues.

- Microeconomics: Another key branch of economics, microeconomics deals with supply and demand, taxation, pricing, and other economic matters at the individual and business levels.

These are just examples of some of the classes you may take in your economics program and the teaching they’ll involve. Specifics will vary from program to program.

Completing an economics degree online or on campus usually requires earning at least 120 credit hours.

Bachelor’s in Economics Admissions Requirements

To get into a college program, you’ll probably need to fill out an application form. That might be the Common Application or one that’s unique to the school. In addition, many colleges ask for materials like the ones listed below:

- Letters of reference from teachers or work supervisors

- Personal essay or writing sample

- School transcripts from high school and any colleges you’ve attended

- SAT or ACT test scores (not required by all colleges)

Some colleges also request resumes or interviews.

Online Economics Degree Programs Accreditation

A high-quality college experience usually starts with enrolling in a regionally accredited program.

Colleges and universities that meet set standards can become regionally accredited. They must apply and be evaluated by an independent organization. Because the evaluation process is rigorous, regionally accredited schools have demonstrated they provide quality education.

Editorial Listing ShortCode:

Other colleges put their faith in regional accreditation, too, so classes from regionally accredited schools are more likely to transfer to other schools. An accredited bachelor’s degree could also help you qualify for a graduate program.

Accreditation may even make a difference in your future employment. Hiring committees and licensing boards typically prefer college credentials that come from accredited schools.

Financial Aid and Scholarships

If you qualify, tuition help may be available for your economics online degree. You can get started by completing the Free Application for Federal Student Aid (FAFSA). Federal programs use this form to determine assistance eligibility, and some state or private programs may rely on your FAFSA results too.

Whether state or federal, government student aid often comes in the form of loans or grants. You can often wait to repay loans until after graduation. There is interest involved, but interest rates are usually lower on government loans than on private ones.

Grants are gifts of money that don’t need to be repaid as long as they are used appropriately.

Scholarships are another type of financial gift. Some students qualify for scholarships directly from their schools. Scholarship programs can also be offered by industry groups and community organizations.

Some workplaces have tuition assistance programs. You can check with your employer to see if they’ll cover part of your schooling costs each year.

Economics Professional Organizations

Students and professionals working in economics can often benefit from becoming a member of one or more industry associations. You may find that it’s worthwhile to join during your undergraduate studies and maintain your membership for years to come.

Here are some economics professional organizations:

- American Economic Association (AEA)

- National Association for Business Economics (NABE)

- National Economic Association (NEA)

Depending on your organization, your membership benefits may include continuing education opportunities, job boards, webinars, journals, newsletters, industry advocacy, online resource libraries, and more.

What Can I Do with an Economics Degree?

A bachelor degree in economics often prepares graduates for analyst jobs. The statistical skills learned in an economics program can be helpful in credit, budget, and market research analyst roles.

Economics majors often work in money-related jobs. That could include being a loan officer, a financial planner, or a compensation specialist.

Earning this degree could also help you qualify for graduate studies in the economics field. According to the Bureau of Labor Statistics, most economist jobs require at least a master’s degree.

How Long Does It Take to Get an Online Economics Bachelor’s Degree?

On-campus programs with traditional 16 week semesters usually take about 4 years to complete with a full-time course load. Some online economics programs maintain a similar schedule.

Editorial Listing ShortCode:

Other online programs speed up the process with year-round coursework. Classes are offered in accelerated formats, and each may last just 8 weeks. With a full-time schedule and a fast-track approach to a bachelor’s degree, you may have the opportunity to graduate in less time.

Transferring previous coursework or getting credit for professional experience may also shorten your time in school.

What Jobs Can You Get with an Economics Degree?

Some economics graduates become compensation and benefits specialists. They are involved in setting policies and managing programs related to how employees are paid for their work. With experience, specialists may become managers in this field.

Other economics majors pursue careers as analysts. For example, market research analysts study consumer trends and make sales projections. Management analysts look for ways that organizations can streamline their operations.

A degree in economics can also be useful for people who want to become actuaries. In addition to a degree, that job also requires industry certification. Actuaries often work for insurance companies.

What’s the Difference Between a Bachelor of Arts vs. Bachelor of Science in Economics?

Depending on your school, you may be able to get a Bachelor of Arts in Economics or a Bachelor of Science in Economics.

| BA in Economics | BS in Economics |

|

|

Although there’s usually overlap between the two programs, it can be worth exploring the differences before you decide which one to pursue.

Is an Economics Degree Worth It?

Yes, an economics degree is worth it for many professionals. Economic principles affect many areas of business and daily life, so this degree could help prepare you for jobs in many different industries. With an economics degree, you may qualify to work in marketing, human resources, banking, insurance, or other fields.

Editorial Listing ShortCode:

The number of jobs for economists is expected to increase over the next decade. The Bureau of Labor Statistics predicts 6% job growth during that time. A 7% job growth rate is projected for the business and financial sector—an area where many jobs for economics graduates can be found.

Universities Offering Online Bachelors in Economics Degree Programs

Methodology: The following school list is in alphabetical order. To be included, a college or university must be regionally accredited and offer degree programs online or in a hybrid format.

Colorado State University offers a Bachelor of Arts in Economics. The completion of 120 credit hours is required to graduate. The program is designed to allow students to complete an approved minor along with their major.

Applicants must have a GPA of 2.0 or higher and at least three mathematics credits.

Colorado State University is accredited by the Higher Learning Commission.

Florida International University offers an online program for a Bachelor of Arts in Economics. The program requires the completion of 120 credit hours to graduate.

To be eligible for the program, applicants must submit an online application and copies of their high school transcripts and SAT or ACT scores.

Florida International University is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

Oregon State University offers online programs for both a Bachelor of Arts and a Bachelor of Science in Economics. The completion of 180 quarter credit hours is required to graduate.

To be eligible for either program, applicants must submit an online application and high school transcripts. Standardized test scores are not required but accepted.

Oregon State University is accredited by the Northwest Commission on Colleges and Universities.

Pennsylvania State University offers a Bachelor of Science in Economics. The completion of 120 credit hours is required to graduate. Those interested in the program may apply online through the school’s website with copies of their official high school transcripts and ACT or SAT scores.

Pennsylvania State University is accredited by the Middle States Commission on Higher Education.

San Diego State University offers an online program for a Bachelor of Arts in Economics. It can typically be completed in 2 years and is designed for students who have already started a 4 year program.

To be eligible for the program, applicants must have 60 transferable credit hours with a GPA of 2.4 or higher.

San Diego State University is accredited by the Western Association of Schools and Colleges.

The University of Maine offers an online Bachelor of Arts in Economics program. The completion of 120 credit hours and a final capstone project is required to graduate.

Those interested in the program may apply online with copies of their official high school transcripts, a school recommendation, and an essay or personal statement.

The University of Maine is accredited by the New England Commission of Higher Education.

The University of Massachusetts—Dartmouth offers an online program for a Bachelor of Arts in Economics. The completion of 120 credit hours with a minimum GPA of 2.0 is required to graduate.

Applicants must submit an online application along with copies of their official high school transcripts, SAT or ACT test scores, and a personal statement.

The University of Massachusetts Dartmouth is accredited by the New England Association of Schools and Colleges and the Commission on Institutions of Higher Education.

The University of Utah offers a Bachelor of Science in Economics. The online program requires students to complete 48 credit hours and all other general education requirements to graduate. Those interested in the program may apply online with copies of their official high school transcripts or GED and SAT or ACT scores.

The University of Utah is accredited by the Northwest Commission on Colleges and Universities.

The University of Wisconsin—Whitewater offers an online program for a Bachelor of Business Administration in Economics. The completion of 120 credit hours and 20 hours of community service is required to graduate.

Applicants can apply through the school’s website with copies of their ACT or SAT test scores and high school transcripts.

The University of Wisconsin – Whitewater is accredited by the Higher Learning Commission.

Utah State University offers a Bachelor of Science in Economics. The completion of 120 credit hours with a GPA of 2.0 or higher is required to graduate. To be eligible for the program, applicants must apply through the school’s website and complete the prerequisite courses.

Utah State University is accredited by the Northwest Commission on Colleges and Universities.

Getting Your Bachelor of Economics Online

If you are passionate about numbers, enjoy working with data, and find financial markets interesting, then a bachelor’s degree in economics may be right for you.

In this program, you may study microeconomics, macroeconomics, econometrics, and more. Your coursework can help you gain invaluable skills in measurement, statistics, analytics, and modeling and prepare you to contribute to planning or decision-making in a variety of industries.

If you’re a busy adult, an online economics degree, whether it’s an online bachelors or an online masters in economics, could be a strategic way to fit college studies into your schedule.

You can start exploring accredited online programs today to learn more about how an economics degree might work for you.